This is a segment from the information bulletin of the empire. To read full publications, SubscribeField

Well, so much for the rebound after last week.

Instead, the market reacts to a completely new set of questions – those that are not related to Bybit or North Korean hackers.

The statement by President Donald Trump that the United States will proceed to 25% of the tariffs for Canada and Mexico today, they sent both traditional actions and crypto. According to BlockWorks, the total market capitalization of Crypto is currently at the level of 2.82 trillion dollars, which is 11% decreasing over the last day.

Yikes.

Bitcoin costs $ 80,000, which is far from the level of $ 90,000, which we have fun outplayed after President Trump announced the strategic reserve.

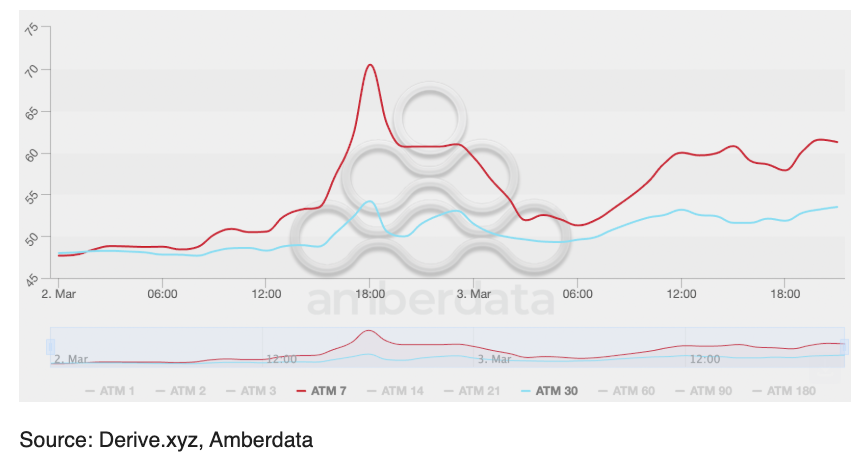

On derive.xyz, “traders demonstrate a high demand for challenges with high resolution, and 49.4% of BTC awards and 45.5% of ETH prize acquires. This indicates that traders are looking for exposure to exposure after large price fluctuations. ”

This should not be too surprising if you followed the price action. But “7-day BTC volatility increased from 47% to 70%, and 30-day volatility increased from 47% to 55%,” said Dr. Sean Dawson, head of the research department at Dervive.xyz. After the rally, the volatility temporarily settled, but since it flashed again.

Matt Mena, crypto -research strategist in 21Shares, told me: “[T]The market reaction reflects updated fears about inflationary pressure and economic uncertainty, but this sale, according to the visible, is an excessive reaction. Many investors foresaw these steps, and as futures markets are adjusted during the night, we could see stabilization in the trade in resume [this morning].

Yesterday I thought that I successfully called the PayPal “green shooting” section, but, as it turns out today, with some valid Green shoots – at least if you ask Menu.

“Despite the short-term volatility, long-term prospects for the crypto sector remain bright. It is noteworthy that Cme Solana’s futures plan to start trading on March 17, which can speed up the SEC approval time for Solana Spot ETF, ”he added.

Regardless of whether the movement around SOL ETF will revive a rally. But, based on what we are observing now, I am a skeptic.

While people like Eric Trump encourage people to buy failures, I take a slightly more cautious position. There is nothing wrong with using the advantages of lower prices, but at present there are many unknown ones – and not a single market is reacting to this.

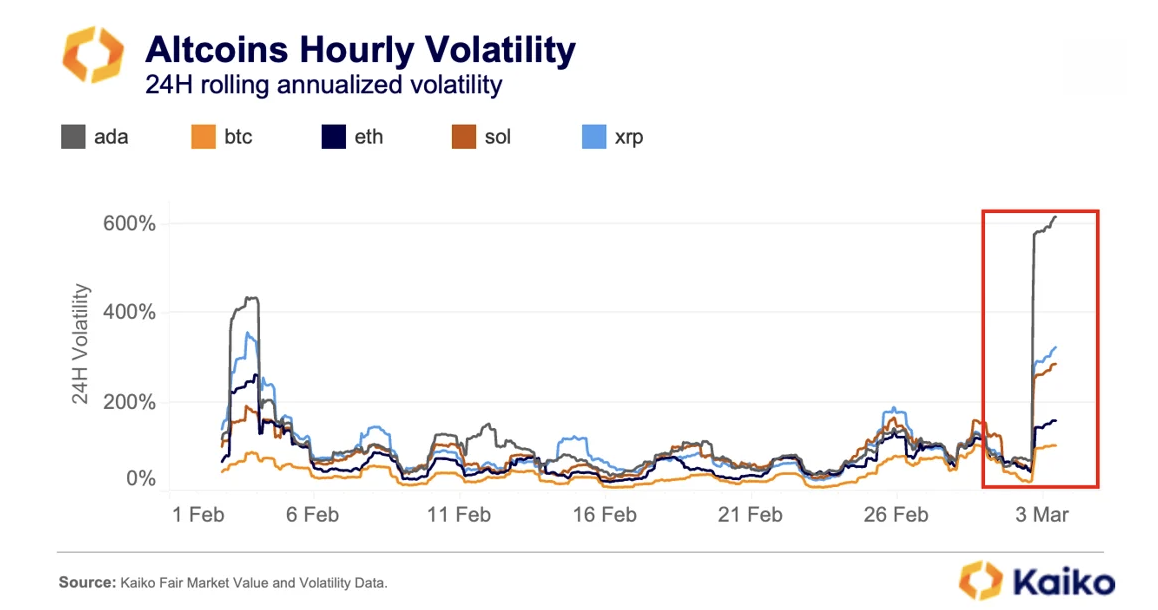

Don’t believe me? Let’s look at some Altcoin data from Kaiko.

“A year ago, the 10 best altcoins in market capitalization were 58% of the altcoin volume on American platforms and 50% on offshore exchanges. As of last week, these shares increased to 77% and 66%, respectively, ”said Kaiko.