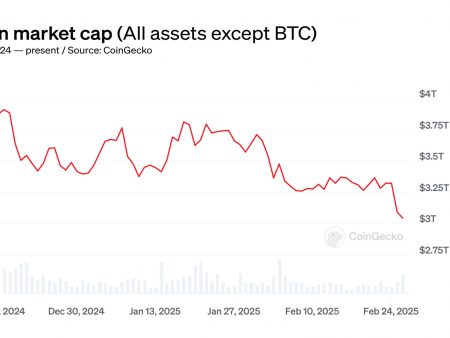

Shiba Inu (Shiba) is traded significantly below $ 0.000020 over the past month, which is experiencing 30%in February. His market capitalization is currently 8.25 billion dollars. Despite this decline, the technical indicators of Shiba show mixed signals, which implies the possibility of changing the trend.

RSI recently recovered after resold levels, and the BBTrend has become positive, which indicates a potential shift in the interests of the purchase. Nevertheless, its EMA lines remain in the bear installation, showing that the Shib is still faced with problems in establishing a strong upward trend.

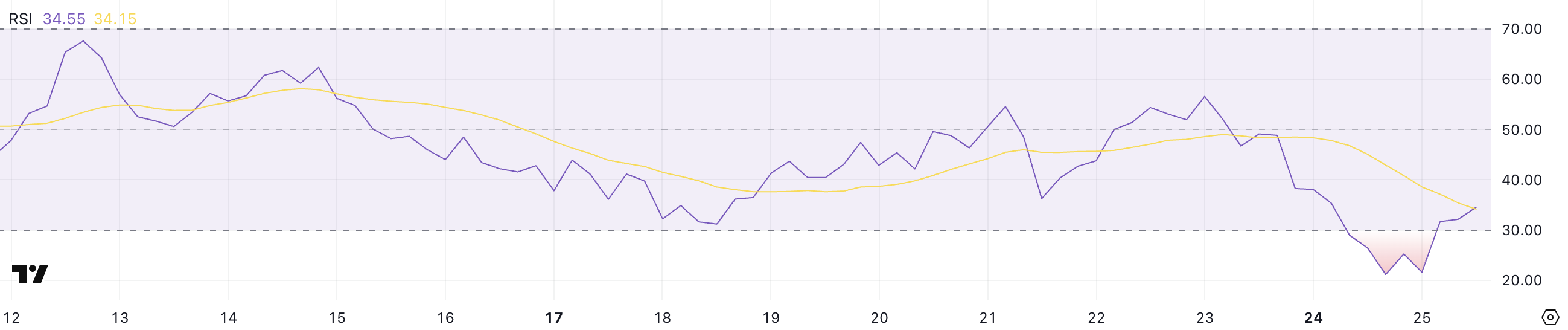

Shib RSI now neutral after reserves

RSI Shib is currently 34.5, after it dropped a few hours ago to 21.6. This notes a sharp decline from 56.5 just two days ago.

RSI, or relative force index, measure the speed and change in prices, helping traders identify overdated or resold conditions.

It ranges from 0 to 100, and the values of more than 70 indicate the conditions of bite and below 30, which indicates the re -amount of the levels. The recent fuss of Shibe into the territory of overturning notes that for the first time this happened since February 3, which indicates intensive pressure of sales.

With RSI now 34.5, the Shiba is restored from resold conditions, but remains in a fragile state. This level suggests that the sale of the impulse slows down, it may prepare the ground for a short -term rebound.

Nevertheless, the current RSI is still relatively low, which indicates that bear feelings are preserved. If the RSI continues to grow above 40, this can signal the shift to updating the interest of the purchase.

And vice versa, if it falls below 30, the schub may encounter another wave of sales pressure.

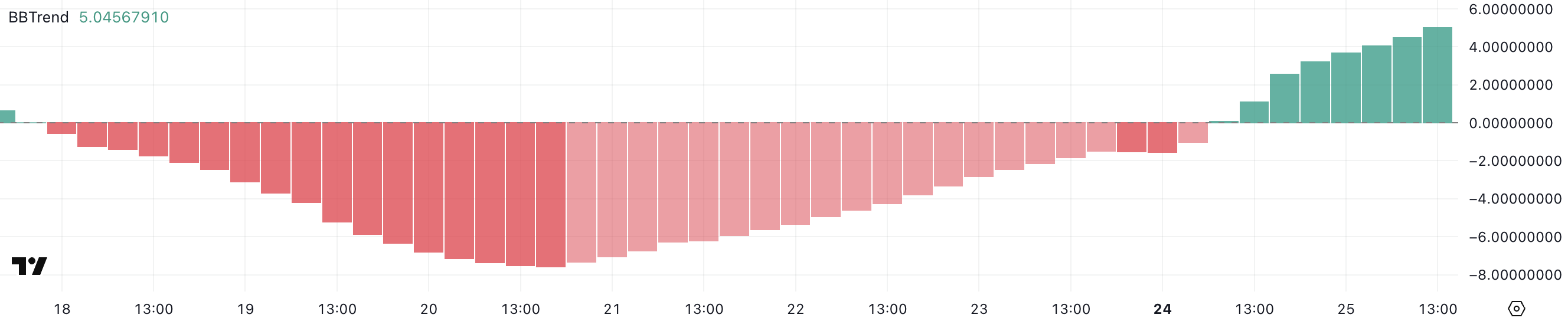

Shiba Inu Bbtrend is now positive, but not yet steadily strong

BBTREND Shiba Inu has become positive between yesterday and today, currently sitting at 5 years after growth with -1.55 only a day ago. BBTREND is an indicator obtained from the bands of Bolinger, which measures the strength and direction of the trend.

Positive values indicate a bull impulse, while negative values signal the bear pressure.

The bbtrend Shiba was negative for six days in a row, reaching a minimum -7.58 February 20. This is a low reflection of the strong pressure of the sale before this recent change.

With BBTrend now at 5, Shiba Inu demonstrates signs of an updated interest of purchase and potential bull impulse. This positive shift assumes that buyers receive control, increasing the likelihood of a short -term upward trend.

However, although a positive turn of BBTrend is encouraging, it is still at relatively low levels compared to previous rallies. If the BBTrend continues to grow, this will confirm the strengthening of bull moods.

On the other hand, if he begins to decline again, this may indicate that the purchase of an impulse disappears, which can lead to a rollback from the price.

Shiba Inu can rally 42%if the golden cross is formed

Shiba Inu Price has recently fallen below $ 0.000014 for the first time since the beginning of February, reflecting the continuation of its bear tendency. Its EMA lines are still in a bear installation, and the short-term EMA are located below long-term, which indicates a constant pressure of sales.

If this descending trend continues, Shib can check the support of $ 0.0000116, potentially decreasing below 0.000012 US dollars for the first time since August 2024. A wide separation between EMA implies a strong bear pulse, which complicates the return of customers.

However, if the Shiba manages to cancel this trend, it can check the resistance at 0.0000146 US dollars. A gap of this level can cause a rally to $ 0.000017. In addition, if this resistance surpasses, the price of Shiba Inu can continue to increase to 0.0000196 US dollars.

A strong purchase impulse can lead to the fact that the coin of the meme escaped above $ 0.00002 for the first time since the end of January.

In order for this bull script to play, the short -term EMA would have to cross the excess of long -term, confirming a change in the trend. Until then, the bear’s tuning settings suggests that the pressure down is likely to remain.