Coinbase, a leading cryptocurrency exchange in the US, recently announced the inclusion of Stader (SD) in its asset listing plan.

The announcement sent SD’s share price skyrocketing.

SD Token Price Soars Amid New Listings

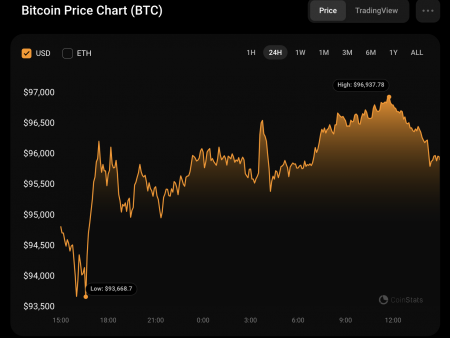

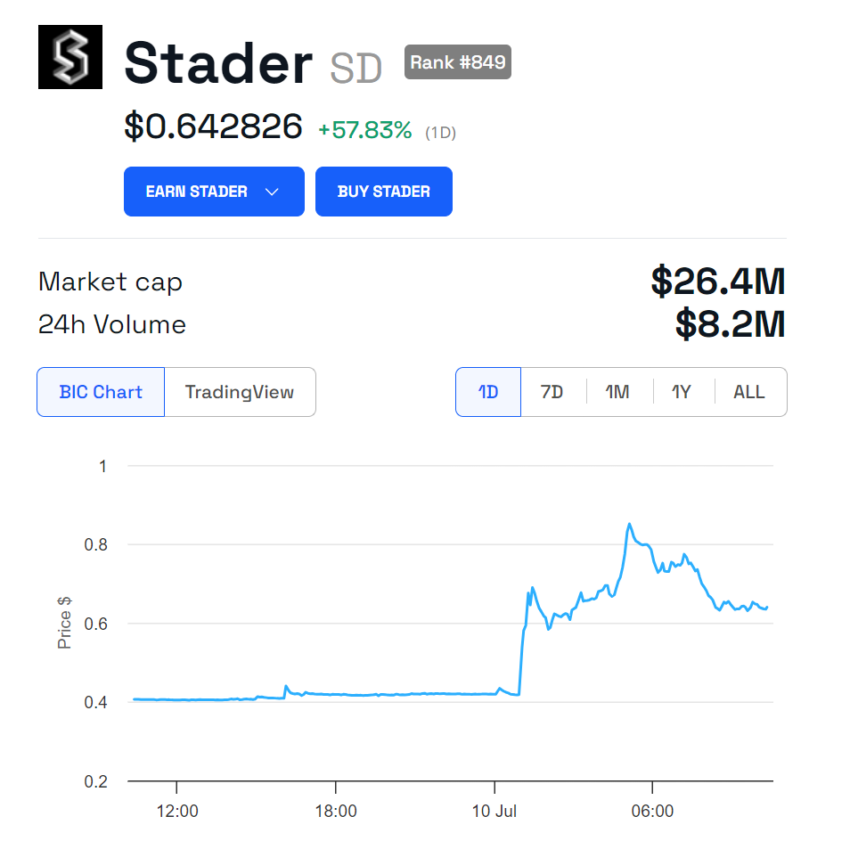

According to BeInCrypto, SD has surged nearly 104% from $0.417695 to $0.850730 in just four hours. Despite the initial surge, SD’s price has stabilized. At the time of writing, it is trading at $0.642826.

Read more: 7 Best High Yield Liquid Staking Platforms to Watch in 2024

Stader is a non-custodial, multi-chain liquid staking platform. It offers users access to some of the most lucrative decentralized finance (DeFi) opportunities on Proof-of-Stake (PoS) networks. These include Ethereum, Polygon, BNB, and Hedera.

SD, Stader’s native token, is an ERC-20 token with a maximum supply of 120 million. The token boasts several utilities, including a unique SD utility pool, liquidity mining incentives, and a governance role in the Stader protocol.

Stader differs from native Ethereum staking by reducing the capital commitment for node operators. Instead of the 32 ETH required for native staking, Stader allows node operators to support the network for just 4 ETH.

This reduced bond is complemented by liquid stakers, allowing ETHx tokens to be issued and representing the entire stake. Additionally, Stader offers users a 50% reward boost, resulting in a reward rate of over 6%, while node operators can earn up to 35% more income with 8x leverage on their ETH stake.

ETHx Restaking Launch and Chainlink Integration Take Stader’s DeFi Play to the Next Level

In December 2023, ETHx Stader became an accepted Liquid Staking Token (LST) for re-staking on EigenLayer. Starting from December 18, 2023, users can re-stake their ETHx.

They can participate either directly on EigenLayer or via Early Queue on Kelp DAO. These options are aimed at maximizing rewards for ETHx holders and improving the staking experience.

Stader also integrated Chainlink CCIP into the Ethereum and Arbitrum mainnets in June. Using CCIP’s simplified token transfer capabilities, Stader enables secure cross-chain ETHx transfers. Stader sponsors the ETHx/ETH Chainlink Price Feed on Ethereum to drive ETHx adoption in DeFi.

“We are excited to integrate Chainlink’s industry standard CCIP to help secure cross-chain ETHx transfers. By leveraging CCIP’s level 5 security and advanced risk management framework, we can help increase ETHx adoption in DeFi,” said Amitaj Gajala, co-founder of Stader Labs.

Read more: What is Crypto Staking? A Guide to Earning Passive Income

According to Token Terminal data, Stader’s current total value locked (TVL) is $474.74 million. While this is down from its yearly high of $706.84 million on March 13, Stader’s recent inclusion on Coinbase’s roadmap shows confidence in its potential, promising further growth and adoption in the crypto community.