OKX is one of the world’s top 10 crypto exchanges, handling over $100 billion in spot Bitcoin transactions annually. However, despite its size and seven-year history, its staff has made a rookie mistake that suggests they have only a basic understanding of the Bitcoin network and how unspent transaction outputs (UTXOs) are managed.

The exchange recently repeated the unfortunate mistake it first made in October 2023: trading against itself. Specifically, it broadcast UTXO consolidation bitcoin transactions at average fee rates, but then, incredibly, began trading against its own transactions.

Due to weak security measures when working with the Bitcoin network, OKX was forced to pay six times the fee rate than he would otherwise have paid if he had not been competing with himself.

OKX ended up bidding over 350 satoshi per virtual byte (s/vb) after an initial bid of just 53 s/vb to consolidate its UTXOs.

What are Bitcoin UTXO consolidations?

Bitcoin wallets that receive and send a lot of transactions end up with a large number of UTXOs. These are commonly known as just “bitcoins,” the unspent coins in the wallet.

Unlike account-based blockchains like Ethereum, which automatically pool assets into a single balance, each Bitcoin UTXO requires charging a separate fee per transaction so that miners include that particular UTXO in a valid block of data.

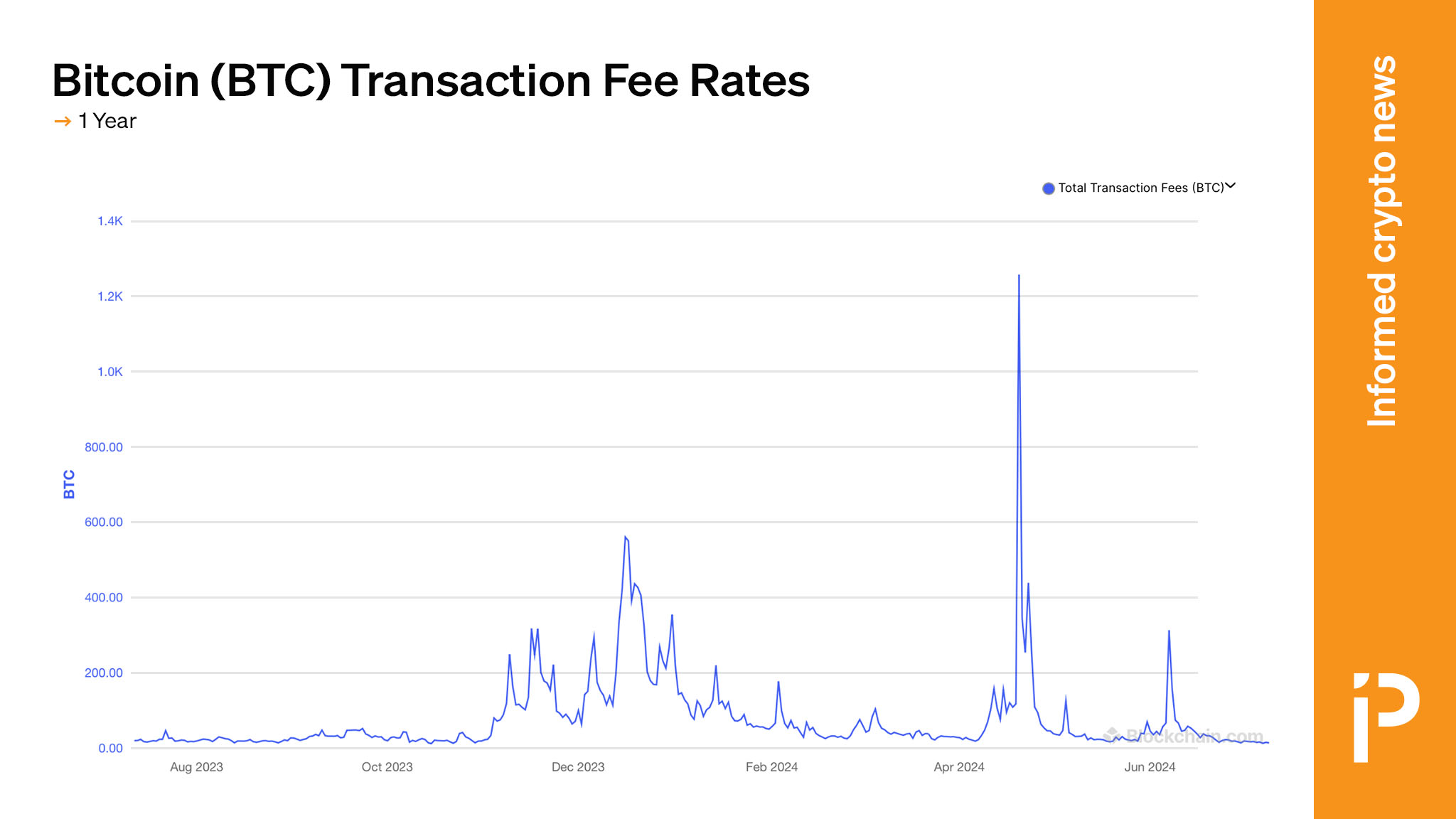

When Bitcoin transaction fees are high, large wallets tend to let their UTXO sets grow. As the months go by and fee rates drop, large wallets take the opportunity to consolidate their UTXOs.

Read more: Ordinals Break Bitcoin: Transaction Fees Exceed Rewards Due to Growing Congestion

For example, instead of paying over 1,250 bitcoins as a daily fee to store blocks of data on the bitcoin ledger on April 19, bitcoin users who waited until today could pay less than 15 for the same amount of data storage.

Being patient with UTXO consolidation certainly allows Bitcoiners to save on transaction fees – unless they insist on it, of course. bidding against yourself.

Protos reached out to OKX for comment but had not received a response at the time of publication.