Over the past 30 days, melania has been traded in its records, which is 70% dropped by 70%, which reflects extreme media moods. Despite the unlocking of token about $ 39 million in just a day ago, it did not have a significant impact on its price, emphasizing the lack of market attention to melania, nor positive or negative.

With its RSI, at present at 38.5 and BBTREND B -13.1, technical indicators show constant bear pulse and constant sales pressure. If the descending trend continues, melania can fall below $ 1. If he manages to restore the bull impulse, he can check the resistance at the level of $ 1.39 and potentially rise to $ 1.61.

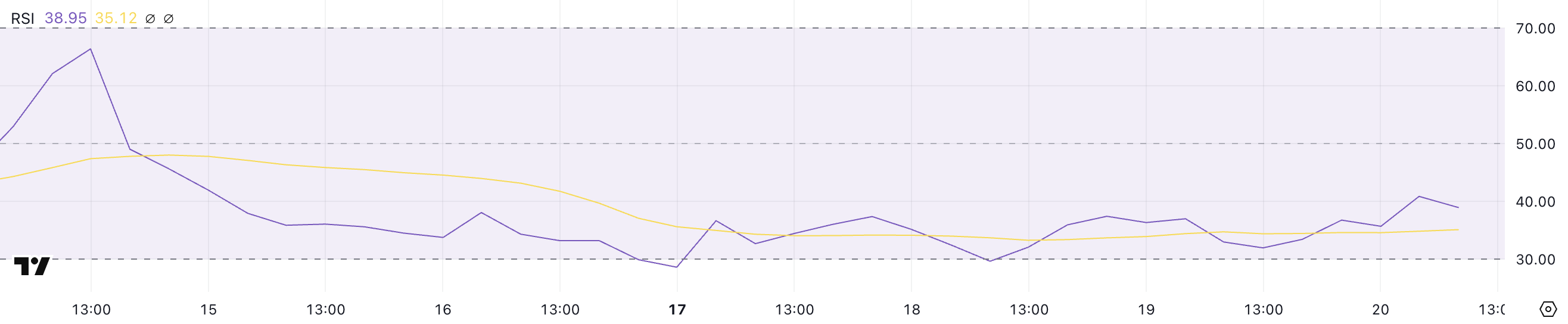

Melania RSI is currently neutral and below 50 for almost a week

Melania RSI is currently 38.5 and remains below 50 from February 14. This indicates a permanent bear. RSI below 50 suggests that the market dominates the sale with predominant bearish moods.

Melania is traded on constant minimums even more emphasizes the lack of a coin of buying interest and general negative mood. This steady low level of RSI reflects constant weakness, assuming that sellers continue to control the price action, supporting melania under pressure.

The relative force (RSI) index is an pulse oscillator, which measures the speed and change in prices. It ranges from 0 to 100. RSI below 30 indicates the terms of re -settings that can signal the possibility of purchase, since the asset may be underestimated.

Conversely, RSI above 70 implies overdone conditions, signaling the potential price correction. With his RSI to 38.5, Melania is approaching the territory of reserving, but not quite there. This level suggests that bear mood is strong, but a potential change can occur if interest arises.

However, given that it is traded at constant minimums, careful optimism is recommended, since the descending trend can continue if the support levels are not held.

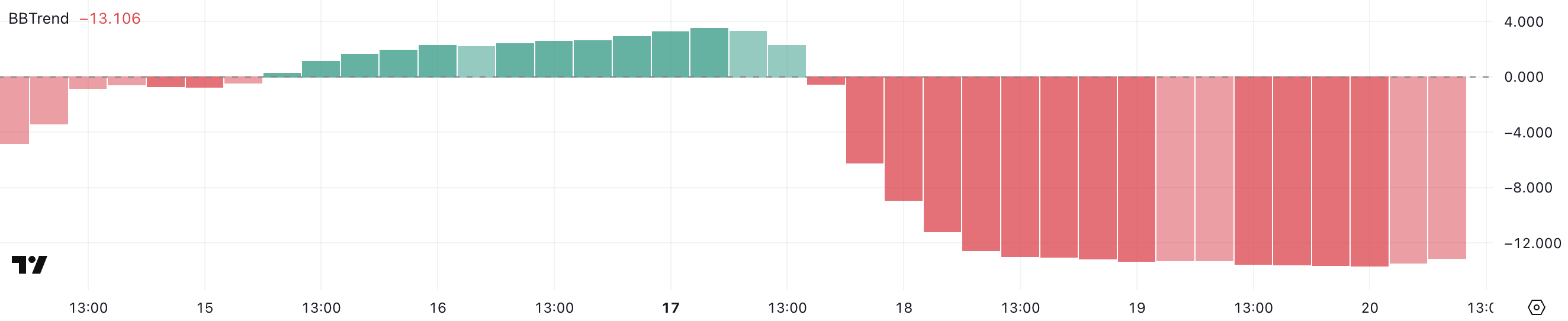

Melania bbtrend below -12 per day

The BBTREND of Melania is currently -13.1, remaining negative over the past two days and below -12 for more than a day. This indicates a strong bear pulse, since the BBTrend values below zero indicate a pressure down.

With a coin of memes that are already on constant time, this negative BBTrend involves a constant bear, signaling that a further drawback can be possible if the sale of the sale continues.

BBTREND, or BOLLINGER BAND TREND, is a technical indicator obtained from BOLLINGER lanes. He measures the distance between the price and the middle strip of Bolinger, which gives an idea of the strength and direction of the trend.

The positive values of the BBTrend indicate the ascending impulse, while negative values suggest downward pressure. The current BBTREND MELANIA -13.1 reflects a significant bear force, especially compared to its highest value of 3.5.

This extremely negative indications suggests that sales pressure reaches its peak, increasing the likelihood of further price reduction. However, if the BBTrend begins to recover, this may indicate a potential change or stabilization in price, but caution is recommended, since bear pulse remains strong.

Melania may fall below $ 1 in the near future

The Melania Meme coin with a market capitalization of $ 665 million has currently decreased by more than 90% of its record maximum. It is traded at the lowest levels, reflecting extreme bearish moods and the lack of interest of the purchase.

This significant decrease exerted significant pressure on melania, since investors remain careful against the background of the ongoing sale. The current descending trend suggests that market participants are still not daring to buy. This holds the price under pressure and the risk of further decline.

If this descending trend continues, the price of melania can potentially decrease below $ 1, which even more deepens its bear trajectory.

However, if the asset can restore the bull impulse and set the ascending trend, it can check the resistance of $ 1.39. The breakthrough of this resistance will indicate the renewed percentage of the purchase, perhaps pushed melania to $ 1.61.

Any movement outside this range looks less likely, based on current technical indicators.