Friday is the expiration day of crypto options. Almost $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) contracts are due to be settled or renewed today. Cryptocurrency markets have been surging on the back of Trump’s talkative rally over the past few weeks, but can they keep going?

Expiring cryptocurrency options often lead to noticeable price volatility, prompting traders and investors to keep a close eye on today’s developments.

$2.72 Billion in Bitcoin and Ethereum Options Expiring

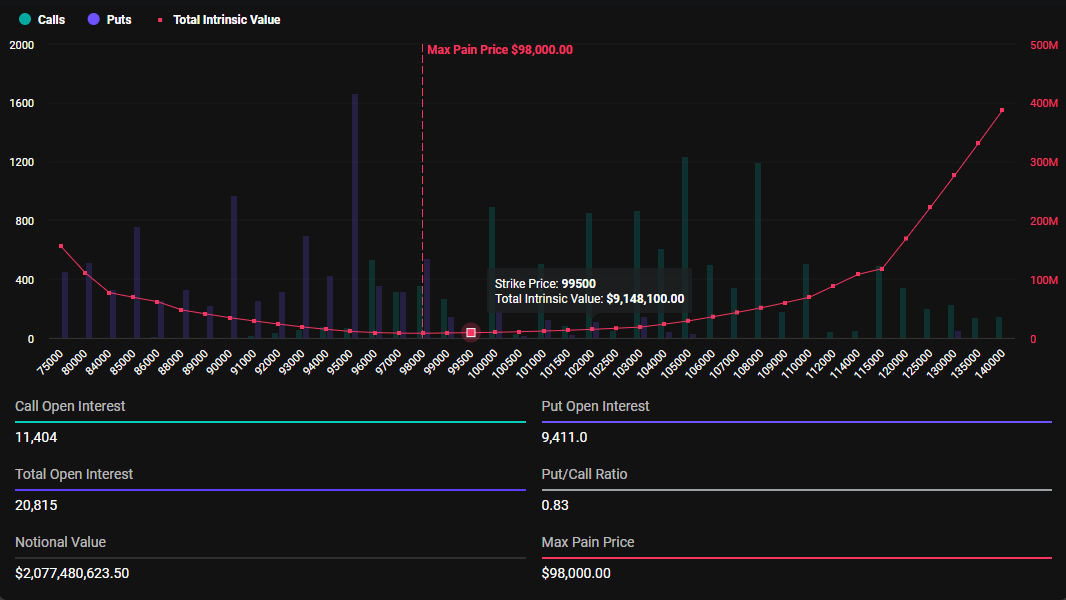

Deribit reports that 20,815 Bitcoin contracts with a face value of $2.077 billion are expiring today. The put-call ratio is 0.83, which indicates that traders continue to sell more call options (long contracts) than put options (short contracts).

The maximum pain point (the price at which the asset will cause financial loss to the greatest number of holders) is $98,000. Notably, this is slightly lower than the current spot market price of $99,758.

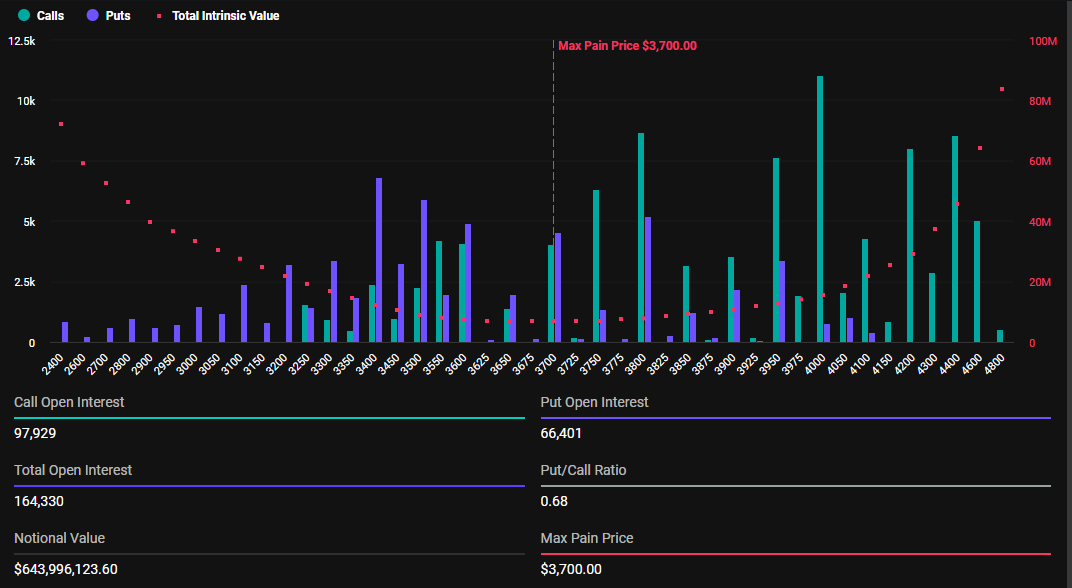

Meanwhile, 164,330 Ethereum options contracts with a face value of nearly $644 million are expiring today. The put-call ratio is 0.68, indicating that, as with Bitcoin, traders are selling more long contracts than short ones.

Greek publication Live noted that corrections have dominated the market this week, unlike last week when Bitcoin had a smaller correction and altcoins had a stronger correction. However, as Christmas and annual deliveries approach, market makers begin to change positions.

“Recent Block Call options trading accounted for a higher share, with a daily average of over 30%. In previous years, the Christmas season in Europe and the trading heat in the US will be significantly reduced. This year, the influence of US equities on cryptocurrency is increasing, and this phenomenon may be more obvious,” Grecs Live said.

This raises the question of whether there will be a Christmas rally this month as the market again finds itself in a position of greater divergence. BTC is currently hovering below $100,000 while ETH is hovering just below $4,000.

Options market data over the past two weeks shows market makers are more cautious. Amid sharp market fluctuations, there was a slight increase in the key term implied volatility (IV). Against this backdrop, Gres.live analysts say that options are currently very suitable for short-term plays.

“…the cost-effective way of buying options is still very good,” they added.

Meanwhile, these expiring options come after a turbulent week in terms of US economic data. US inflation rose to 2.7% in November, while the core consumer price index remained at 0.3%. While many expect the Fed to cut rates, persistent inflation is complicating the path to sustained monetary easing.