Hedera (HBAR) was faced with an ongoing subsidence, with a brief stop last week, when Altcoin entered the consolidation period. Despite this, the general trend remains down, and traders begin to change their position.

This shift in mood, characterized by uncertainty, is a negative sign of the future price action of HBAR.

Heder is looking for a turn

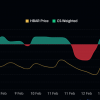

The financing level for HBAR traders is currently fluctuating, which indicates uncertainty regarding the next step of the coin. Traiders switch between short and long contracts, reflecting their indecision. This return time in mood can lead to instability in the market, while fluctuations negatively affect the price, since the market reacts to each new position.

Such frequent changes in moods from traders can be harmful to price stability. Since the market remains uncertain in relation to whether Hbar will grow or fall, fluctuations in contracts can lead to an increase in volatility, which can lead to a further decrease in the pressure on the price of HBAR.

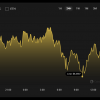

Macrom Impulse for HBAR shows the bear, especially in the analysis of key technical indicators, such as the relative force index (RSI). Currently, the RSI is on the verge of falling into the resale, which usually indicates that the asset is underestimated.

Historically, when RSI falls below 30.0, it was followed by changes in prices, which triggers recovery. This can give HBAR the opportunity to cancel its recent trend and prepare the soil to restore prices.

While the current position of the RSI involves bearish, in the past the region has often acted as a turning point. If the RSI goes to the oversupply zone, this can signal that the HBAR should be a rebound, offering the potential for purchases for investors who want to use a possible change.

HBAR price forecast: bounce

The HBAR price has decreased by 8% over the past 48 hours, violating below the consolidation that has formed over the past two weeks. Trade of $ 0.208, Altcoin has lost some support, and the further movement of the deficiency in the short term is possible. This shift in price action signals the need for a strong level of support in order to avoid further losses.

In order for the HBAR to establish recovery, the price may be required further, which is potentially lower than 0.200 US dollars to check the support level of $ 0.182. This will push the RSI into the resale, which can cause a change and pave the way to restore prices. Loading into this area often signals the end of the descending trend and the beginning of the ascending movement.

However, if HBAR manages to return $ 0.225 as an auxiliary floor, Altcoin can recover without significant losses. This will help stabilize the price and prepare the ground for movement for the next resistance of $ 0.250. Providing $ 0.225 as support would be a bull development for HBAR, which offers hope for further benefits in the near future.