The crypto -market experiences significant shocks with stunning 300 billion dollars in just 24 hours. This mass sale caused fears among investors, prompting analysts to study the main reasons for this sharp decrease.

Bitcoin and Ethereum sharpness

According to In the understanding of the letter of Kobelsi, the global commentator in the capital markets, the frequency of the “flash -car” in the crypto secretary increased since January. This rapid decrease in prices can occur without the main bear news, as a result of which investors are puzzled by sudden volatility.

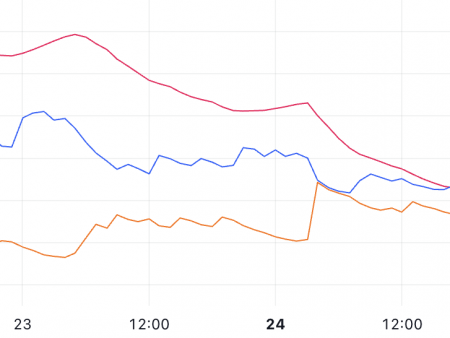

The recent recession began with Bitcoin (BTC), which initially fell below $ 95,000. Nevertheless, a sharp fall from 95,000 to 90,000 dollars just 30 minutes earlier in the morning served as an alarming challenge for traders.

Ethereum (ETH) surrendered even worse, experiencing a stunning 37% of the falls within 60 hours on February 2, despite the fact that the headings of the trade war, which have already been evaluated in the market.

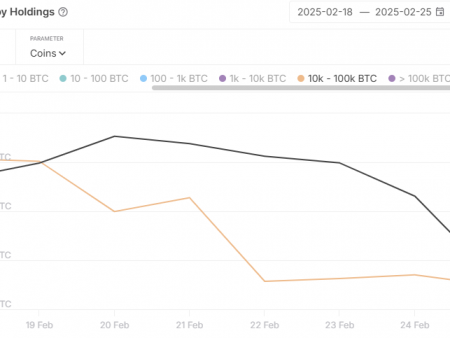

According to analysts, one of the critical factors contributing to this crypto is a radical shift in liquidity and a short position in Ethereum. In one week, short positions grew by 40%, and since November 2024 they took off by 500%.

This unprecedented level of short circuit in Wall is stroke Hedge -Funds He created a dangerous situation for Ethereum, which is currently estimated at about 300 billion dollars.

Being institutional investors are increasingly short etherium, many turn their attention to bitcoins, creating a sharp contrast in the dynamics of the market. While the retail interest in bitcoins has decreased, partly due to the surge of memes, institutional capital continues to flow into Bitcoin, aggravating the volatility in altcoins, such as Solana.

Retail trade against institutional investors against the backdrop of crypto -vlatality

Kobelsi also emphasizes that the current market environment is characterized by polarization between retail and institutional investors. How liquidity Decrease, price movements are becoming more unstable. This led to significant “air pockets”, where moods can change dramatically, which will lead to quick changes in prices.

A recent analysis of moods shows that the cryptographic market experiences its lowest levels of enthusiasm for 2024. Crypto Fear and greed indexWhich previously indicated a state of greed, now it has fallen to the level of fear of 29%. Such shifts in moods are often preceded by flash -carriers, since traders react to a change in the landscape.

In addition to the complexity of the situation, public figures, such as Eric Trump, expressed their opinion about the largest crypto acets, bitcoins and etherum. There is Trump proposed That these prices represent the possibilities of the purchase, the point of view that can affect the behavior of retail investors.

In addition, companies such as Microstrategy also influenced the dynamics of crypto -market. Despite the 45%, the fall of his shares since his peak on November 20, Microstrategy continues to accumulate bitcoin through Convertible note The proposals, strengthening its commitment to the crypto clice and potentially affect market sentiments.

To date, Ethereum has been able to restore a level of $ 2500 after a fall below 2300 US dollars on Tuesday, fixing losses of 7% in a 24-hour period.

Dall-E shown image, diagram from TradingView.com