-

FET can take off 45%to reach $ 1.10 in the coming days

-

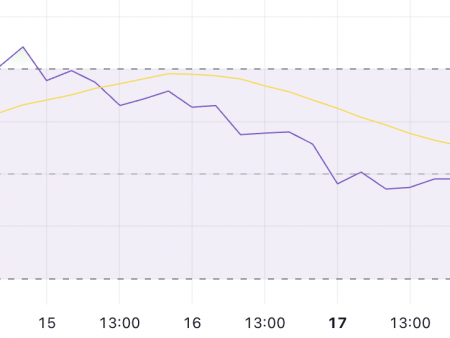

FET traders are excessively replaced at 0.731 US dollars on the lower side and $ 0.785 on the upper side.

-

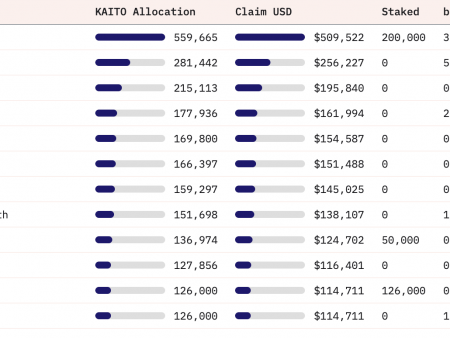

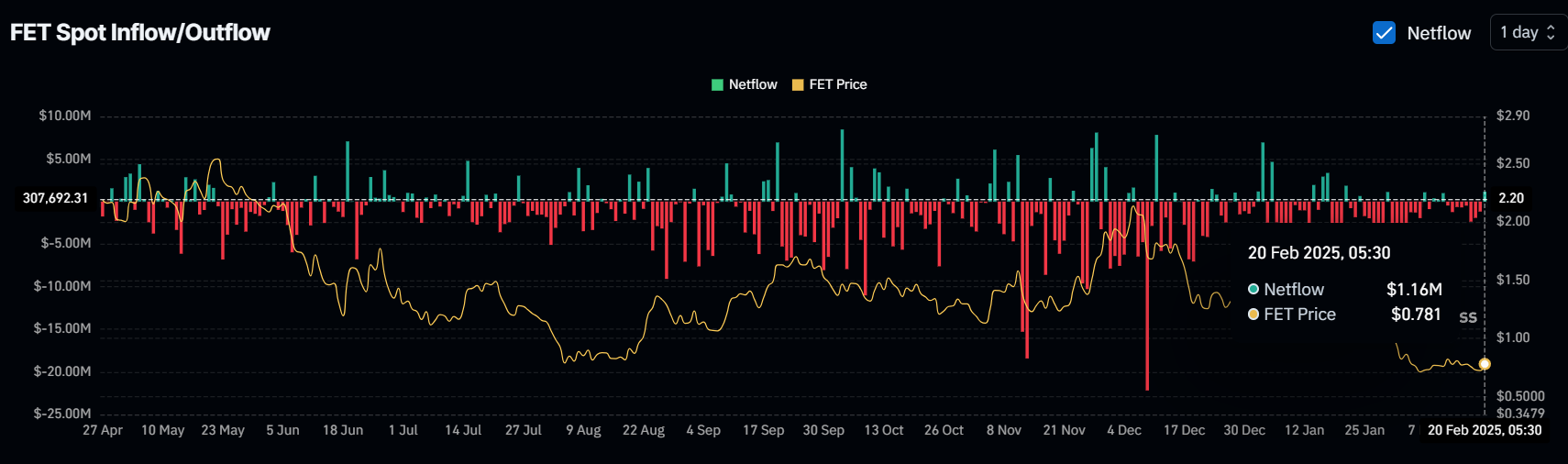

The metrics on the chain show that the exchanges have witnessed an outflow of approximately 1.50 million dollars.

After over the past two months has become a witness to a drop in prices by 65%, the alliance of artificial superinthleligence (FET) looks ready for take -off, supported by bull price effects both on weekly and in the daily time. With constant price restoration, FET tokens will attract significant attention among traders and investors, which can help the asset soon recover.

The current price is impulse

Today, February 21, 2025, FET is traded about 0.778 US dollars after over the past 24 hours has grown by more than 9.50%. Over the same period, the volume of bidding increased by 17%, which indicates a growing percentage of investors and traders compared to the previous day.

Technical analysis of FET and upcoming levels

According to the technical analysis of CoinPEDIA, FET would seem optimistic and is preparing for a significant increase in the impulse, since its technical indicators flashes bull divergence in weekly time. In addition, the FET seems to form a bull scheme of double price and is currently on the verge of the completion of its second leg.

Based on historical models, if the asset is preserved above the level of 0.70 US dollars, there is a strong probability that it can withstand 45%, reaching $ 1.0 and 165% as a whole to restore the level of $ 2.05, which FET lost in December 2024.

Investors have prospects

Despite the bull impulse, some investors unload FET, as reported in the analytical company On-Chain Coinglass. The data show that the exchanges witnessed the outflow of FET tokens of about $ 1.50 million, which suggests that some holders sold their positions.

The main levels of liquidation

Meanwhile, traders who make bets on the long side are currently dominated by the asset. During the printing, the ove -targeted levels amount to $ 0.731 on the lower side and $ 0.785 on the upper side, where traders built millions for long and short positions. The data show that traders occupy long positions in the amount of 1.03 million dollars. The United States at 0.731 US dollars and $ 270,000 at 0.785 US dollars.

When combining these metrics on the chain, it seems that some traders use current market moods, while others, moving with fear, drop the asset.