Ethereum (ETH) scored almost 6% over the past 24 hours, which led to its price above $ 2,200 after a brief fall of about $ 2,000. This recovery occurs when investors expect potential developing events from the upcoming white house crypto.

Key indicators, such as RSI and DMI, suggest that Ethereum is at a key point, with a bear impulse, weakening, but not completely disappeared. If bull pressure continues to increase, ETH can overcome key levels of resistance, potentially aiming at $ 3,000 in the coming weeks.

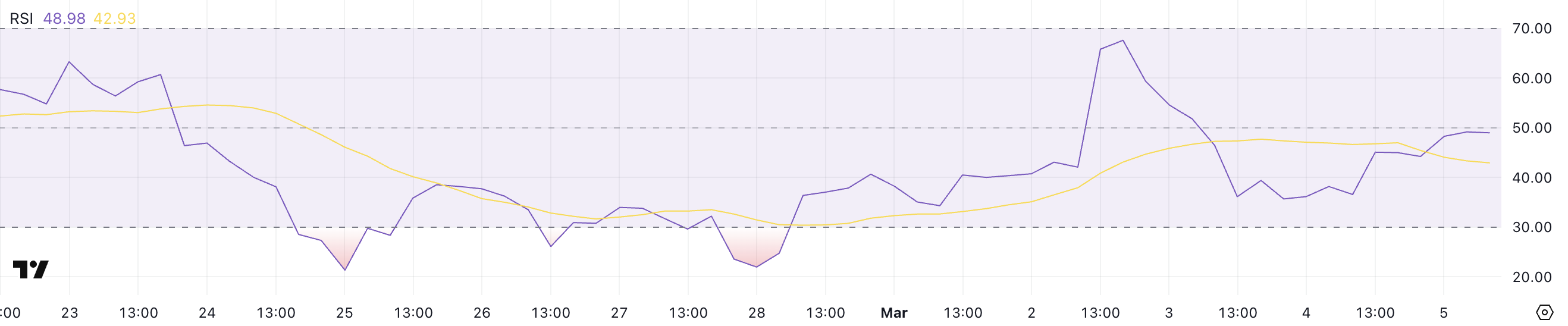

Ethereum RSI Neutral, but yesterday

The relative force index of Ethereum (RSI) is currently 48.9, which reflects a neutral position after significant fluctuations in recent days.

Two days ago, the RSI reached 67.6, approaching the territory of the bought -up, before yesterday fell to 36.1, signaling a short period of stronger sales pressure.

The current RSI level of about 50 indicates that Ethereum is not a strong processing and is not resold, positioning it at a key point of excess, where the next move can determine the short -term direction.

RSI, or relative force, is an indicator of an impulse that measures the speed and value of price changes to determine whether the asset is bought or resold.

As a rule, the RSI values above 70 indicate the conditions of rejection, which indicates a potential refusal, while the values below 30 conditions are resold, often leading to a rebound. With ETH RSI now at 48.9, it offers a more balanced market, where neither buyers nor sellers have a clear upper part.

If the RSI starts to rise again, this may indicate an updated bull impulse, pushing Ethereum to higher levels. However, if it decreases further, this can signal the increase in bear pressure, which leads to a potential repeated test in lower support zones.

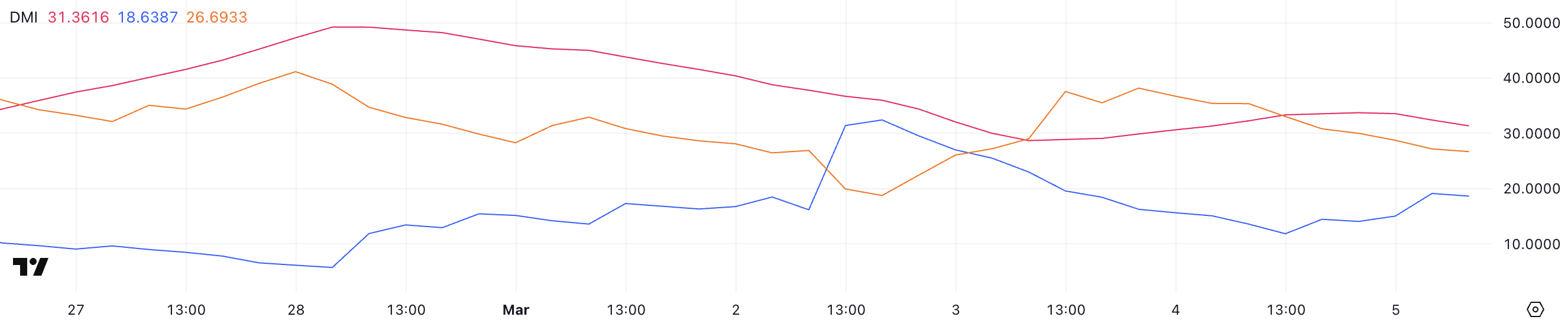

Ethereum DMI shows that sellers are still under control, but the gap is narrowing

The Ethereum (DMI) directional index shows that ADX is currently 31.3, maintaining a level of about 30 over the past two days. ADX above 25 usually indicates a strong trend, and since the indicator, stable, stable above this threshold, this confirms that Ethereum is in a clearly defined trend.

At the same time, +DI rose to 18.6 from 11.8 yesterday, and -DI fell from 33 to 26.6. This shift suggests that a bearish impulse weakens, while bull pressure is slowly increasing.

However, since -DI remains higher than +di, Ethereum is still in the descending trend, although there are signs of potential stabilization or changes in the trend.

ADX, or the average direction index, measures the strength of the trend without indicating its direction. Indications above 25 signal a strong trend, while values below 20 indicate weak or indecisive market conditions.

With ADX ETH at 31.3, the current descending trend remains strong, but the narrowing gap between +di and -di suggests that the pressure of sales loses intensity. If +DI continues to grow and overtakes -Di, Ethereum can begin to shift in the direction of a more optimistic structure.

However, if the DI remains dominant, and the ADX remains increased, the descending trend can be preserved, which will lead to a further decrease before any significant change will occur.

Will Ethereum be out above $ 3,000 in March?

Ethereum recently experienced a sharp correction, briefly testing the levels of about $ 2,000 before bouncing. If the current descending trend passes ,,

ETH can push to a resistance of 2550 US dollars with a breakthrough above this level, potentially leading to a rally to $ 2855.

A strong ascending trend can even promote Ethereum over $ 3,000 for the first time in a month, with the possibility of reaching $ 3442, if the bull impulse continues.

The power of this recovery will depend on the upcoming events, such as the crypto -Summit of the White House, and some users are concerned about the indirect representation of Ethereum.

Nevertheless, Ethereum remains at risk of further disadvantage if the pulses are returning to bear. An updated sale can return ETH to support level in the amount of $ 2,077, and if this zone does not leave, Ethereum Price may fall below $ 2,000 again.