- Grayscale’s $111 million outflow triggered a net outflow from the ETH ETF last week.

- Ethereum whales have been distributing their assets since July.

- Ethereum may face a bounce near the $2,400 resistance level.

Ethereum (ETH) rose 2.5% on Monday as the leading altcoin tries to recover from pressure from ETF investors and leading whales.

Daily Market Drivers Digest: Ethereum ETF Outflows, Whale Distribution

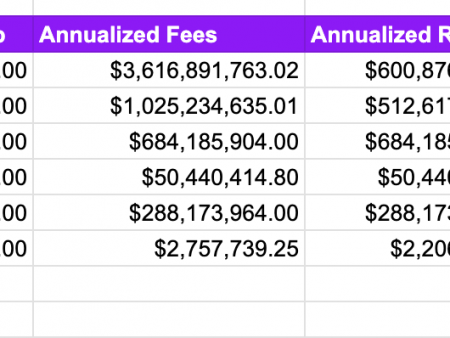

Ethereum ETFs saw net outflows of $98.1 million last week after ETH’s price struggles. U.S. spot ETH ETFs — led by Grayscale’s $111 million ETHE — dominated the negative flows after recording outflows on all trading days of the week.

The outflow is in line with that of Ethereum whales with >10k ETH in assets. Glassnode data showed that this group has been selling or redistributing their holdings since July. Recent whale activity supports this data, as Hong Kong-based asset manager Metalpha deposited 10k ETH worth $23 million on Binance a few hours ago. The asset manager has moved 23.58k ETH to Binance at an average price of $54.1 million over the past three days.

Additionally, potential Ethereum wallet Foundation sold 450 ETH for 1.029 million DAI in the last 24 hours, according to SpotOnChain. Notably, Foundation has often sold at the highest prices, given the declines that followed several of its previous sales.

Ethereum co-founder Vitalik Buterin may also have sold ETH:

Multi-signature wallet that received $ETH from @VitalikButerin is popular!

After receiving $3,800 ETH ($9.99M) from Vitalik on August 9 and 30, he cashed out by selling $760 ETH for $1,835M USDC at ~$2,414 per ETH. The last sale was just 21 hours ago.… pic.twitter.com/ELcjpPSg4K

— Spot On Chain (@spotonchain) September 9, 2024

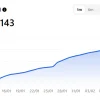

On a positive note, Ethereum recorded a four-month high in network growth after 126,210 new wallets were added on Sunday.

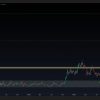

ETH Technical Analysis: Ethereum May Face Rejection Near $2400

Ethereum is trading around $2,330 on Monday, up 2.5% on the day. ETH has seen over $30 million in liquidations in the last 24 hours, with long and short liquidations totaling $8.83 million and $21.51 million, respectively.

Ethereum resumed the week, trying to recover from Friday’s price drop. The decline saw ETH lose support at $2,400 and fall inside another key rectangle. As a result, the $2,400 price level flipped, becoming resistance in that rectangle, with support near $2,100.

ETH/USDT 4-hour chart

On the way to recovery, ETH may face a rebound near the $2,400 resistance supported by the 50-day simple moving average (SMA).

On the other hand, a break of the $2100 support could lead to a decline in the ETH rate to $1550.

On the 4-hour chart, the Relative Strength Index (RSI) is showing increasing bullish momentum after crossing the midline. The Stochastic Oscillator has moved into oversold territory, meaning a small correction may be imminent.

In the short term, ETH could rise to $2,365, which would result in the liquidation of positions worth $47.09 million.