Ethereum is faced with a resistance of about $ 2500 after a 25% immersion. Can the accumulation of whales and the growing disposal of interest encourage the return?

Since Bitcoin stabilizes around 88,000 dollars after large -scale crash, Ethereum bounced back above $ 2400. Currently, ETH is trading with a market value of $ 2,478, with a short -term restoration of almost 5%.

Since the bull turn re -checks the broken range, is Ethereum removed for reverse after repeated testing, or will it surpass $ 2500?

The price of Ethereum marks the decisive 4-hour split of the range

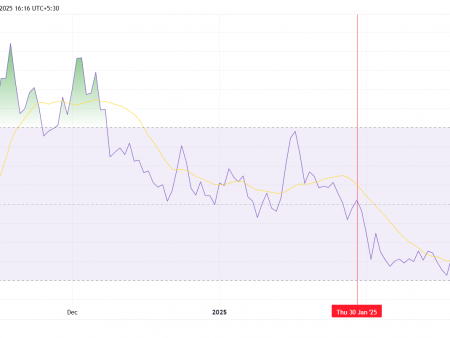

In a 4-hour price diagram, the Ethereum price trend demonstrates the Bear-tolerate breakdown of the consolidation range. The lateral consolidation varied from $ 2529 to $ 2883.

After the breakdown, Ethereum checked the 24-hour minimum of $ 2319. However, after the mass decisive step of the bear, exhaustion led to a short -term mitin of the Ethereum.

Thanks to the short -term restoration of bull, Ethereum now re -protests the broken range of consolidation. Nevertheless, the possibility of a new pattern of the evening star near the level of support, which has become a subordinate, warns of a bear turn.

In addition, the price of Ethereum was not able to maintain above the psychological zone in the amount of $ 2500, faced with a higher price rejection of $ 2530. Therefore, a short -term price analysis hints at a potential bear in turn.

Battle for $ 2500

Meanwhile, the bull return led to a decrease in the trend in bear histograms. If Ethereum recovery continues, the Chaikin cash flows index, which finally became positive after several days of consolidation, confirms the possibility of bullshit.

Consequently, technical indicators give a bull point of view, the contrary to the threat of the pattern of the evening star.

The worst February in history

Among the very unstable conditions, the price of Ethereum prices has become the worst February since 2017. Until 2024, Ethereum registered only one bear February in 2018 with a decrease in 24%.

Nevertheless, a recent immersion in February 2025 noted almost 25% of the fall. This notes the second and, possibly, the worst February of the Ethereum, if he cannot return to normal.

Kit holiday: Ethereum on discount?

Nevertheless, the chances of a bullish return to Ethereum are gradually growing. According to recent Twita Crypto Jack, Ethereum Balance by Value Value brought a significant surge. In the balance range from 10,000 to 100,000 ETH there is a noticeable increase, crossing 17 million ETH.

Whales buy unprecedented amounts of $ ETH! 🚀 pic.twitter.com/3ML22PPN2N

– Cryptojack (@cryptojack) February 25, 2025

This emphasizes the mass purchase among whales for the acquisition of Ethereum at discounted prices.

Power surge: increasing confidence by 5 billion US dollars

The general Ethereum, set over the AAVE network, saw a significant surge. Over the past year, the Ethereum basin on AAVE has grown from 500,000 ETH to more than 2,000,000 ETH.

The dense Ethereum basin on AAVE surpassed $ 2,000,000.

$ 5,000,000 👀 pic.twitter.com/ijjrzpwkq0

– Ted (@Tedpillows) February 25, 2025

This is more than $ 5 billion in Stosted Ethereum. Since investors who put Ethereum for remuneration and agree for a short blocking period, this signals increased confidence in the largest altcoin.

The final verdict

In accordance with the analysis of the price action, the bull bounce above the lower strip of the area of broken consolidation at 2530 dollars will probably restore a new bull tendency. This will increase the probability of Ethereum recovery to $ 2900.

And vice versa, if Ethereum cannot hold more than $ 2360, a bear’s disorder can move the prices to the previous minimum of the swing of $ 2150.