- Whales accumulate ETH, while wallets with 10 -kilometer ETH grow by 24%, signaling the strong confidence of investors.

- Ethereum dominance by stube eater and potential approval of ETF can contribute to the expansion of the market and long-term implementation.

- The increase in the price realized against the background of accumulation suggests that ETH investors are preparing for a potential breakthrough in 2024.

Ethereum (ETH) experiences a reliable accumulation that signals the run into the bull for 2024. According to Ki -Tang Ju, the CEO of Cryptoquant, after hacking Bybit there is no pressure. Market indicators are neutral, but whale wallets signal the additional accumulation. This trend signals that long -term investors create a potential breakthrough.

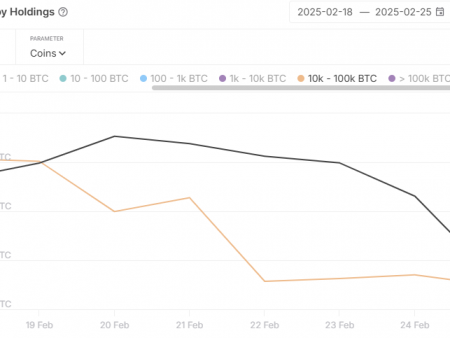

Whales accumulate ETH

The data show that wallets containing from 10,000 to 100,000 increased by 24% over the past year. These wallets mainly purchased ETH from small wallets holding less than 1000 ETH. In addition, Kate The Alt reports that the basis for the accumulation of addresses is $ 2199, and the current price of ETH is $ 2.505. This indicates that investors continue to buy ETH above their initial initial levels, strengthening confidence in the future growth of Ethereum.

Source: Kate Alt

In addition, Ethereum retains 56% dominance in the Stablecoin market. With the promise of a policy favorable cryptocurrency within the framework of Trump, enterprises can rely more on ETH -based stabi and intellectual contracts. It can also additionally consolidate the Ethereum market in 2025.

Regulatory winds and exposure to ETF

In addition, the approval of Eth Spot ETF adds further growth potential. Regulatory clarity can cause a “large cap altseason”, significantly bring Ethereum. Historical models suggest that such normative milestones lead to institutional interest, which leads to prices.

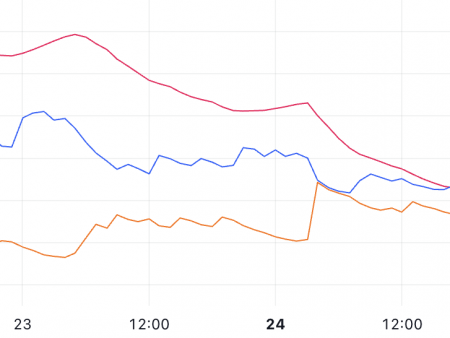

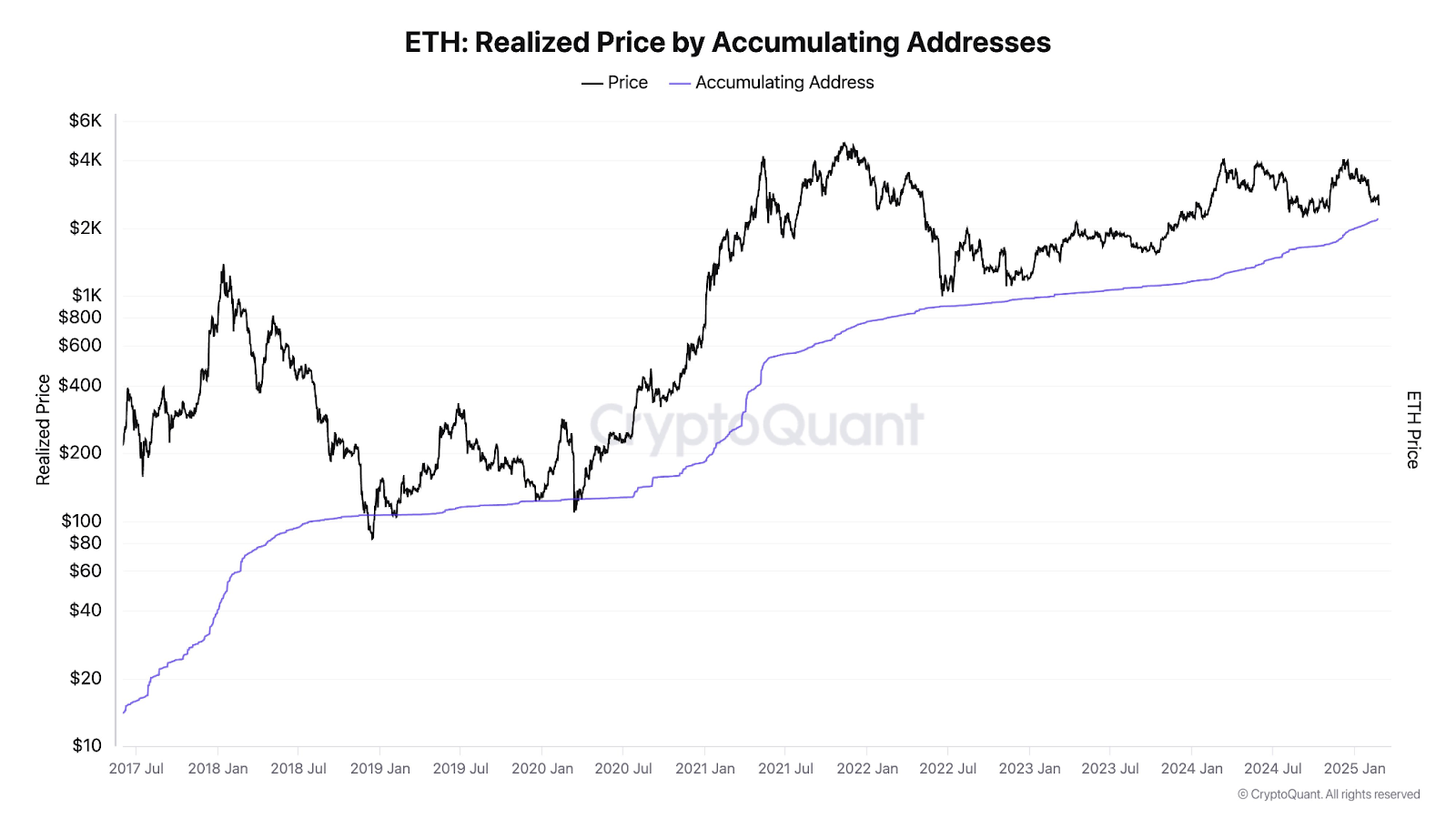

In addition, over time, the realized price of Ethereum due to the accumulation of the address increased sequentially. This measure, which shows continuous accumulation even in bad times, constantly goes up, in contrast to the differences in the market price. The realized price remained stable due to a decline in the market, which indicates a steady interest of investors.

Market cycles and long -term prospects

Ethereum saw significant jumps and falls on the market price since 2017. The price reached a kind of much earlier in the first months of 2018, before failing, leaving the market restored in 2020. With a strong bull jogging in 2021, ETH was pushed to the record maximums before experiencing another fall. The accumulation continued, which indicates that investors retained their faith, despite price turbulence.

By the beginning of 2024, the market price of Ethereum remained higher than the price realized, signal force. The expansion of the gap between the realized and market prices indicates long -term possession models. In addition, sequential accumulation during a decline enhances the bull’s bull’s gaze. Consequently, a combination of whale activity regulating support and increasing ETH adoption positions for growth in 2024.