The price of ethenes demonstrates remarkable stability in the conditions of a wider bloody battal of crypto -market, and most altcoins publish losses in the range from 8 to 20% over the past 24 hours.

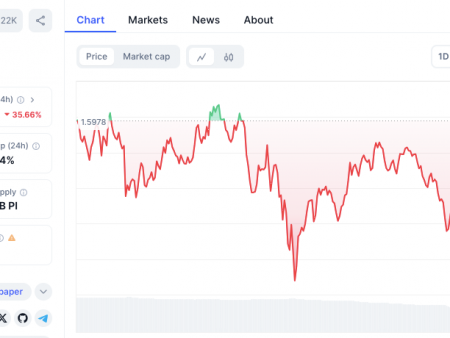

Currently, the price of trading in $ 0.40, the price of Ethena (ENA) has decreased by only 3% in daily terms, and the volume of bidding increased by 108%. The key factor underlying the stability of the price of ethenes may be recent successful efforts to raise project funds that have received $ 100 million to launch iUSDE, a new institutional token focused on the dollar. This round of funds was completed in December, but was not previously disclosed, Bloomberg reports. He attracted several large investors, including Franklin Templeton, F-Prime Capital, Dragonfly Capital Partners, Polychain Capital LP and Pantera Capital Management LP.

The new iUSDE token, in fact, is an adjustable version of the existing synthetic dollar of Ethena, specially intended for traditional financial institutions striving for the exposure of cryptocurrencies, without investing in digital assets, according to the JAN blog. Guy Young, founder Ethena Labs.

In addition, the company plans to allocate some of the income from the sale of tokens in order to finance the development of its own blockchain, a source close to this issue told Bloomberg.

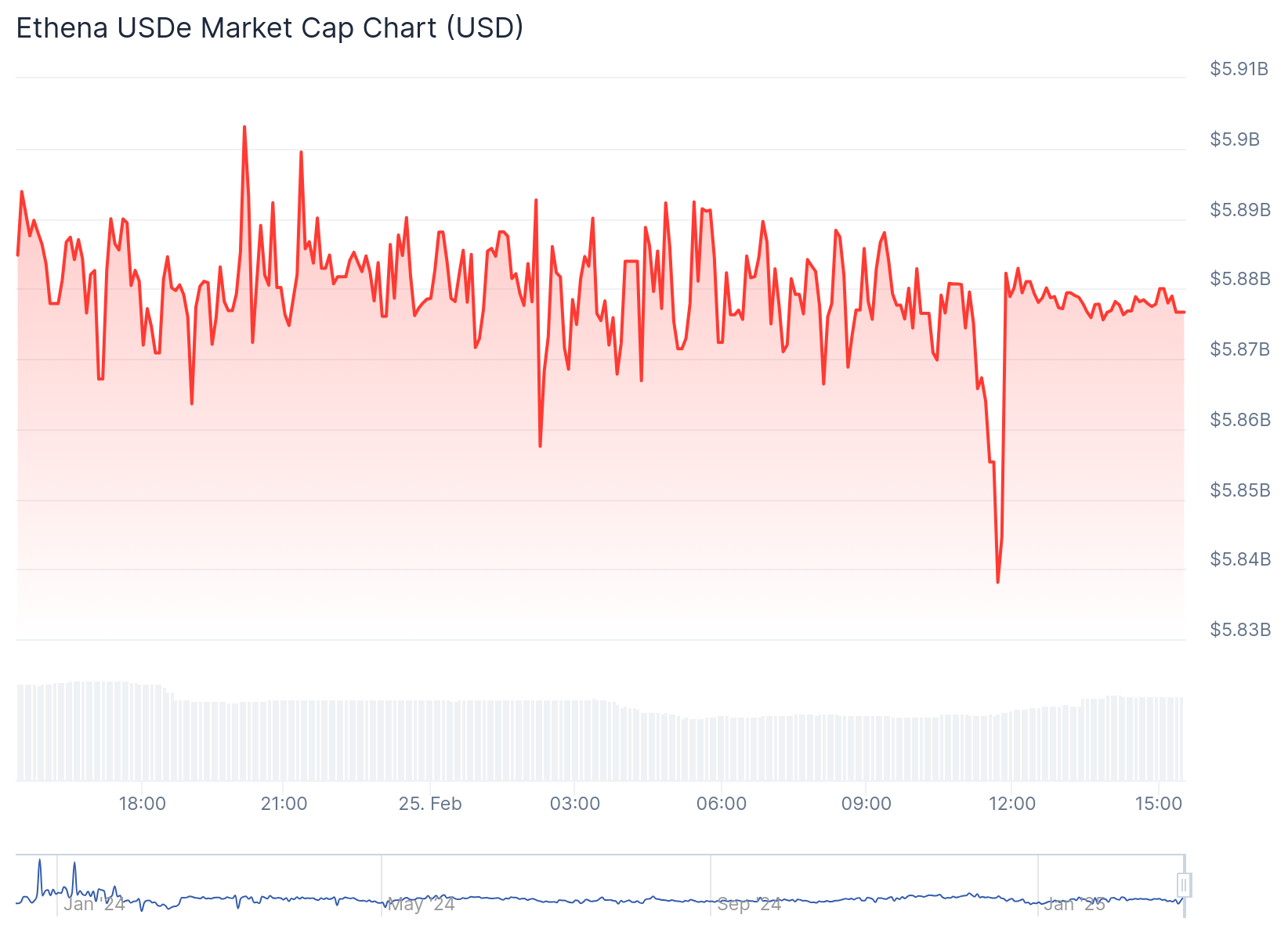

Another probable factor contributing to the stability of ENA prices is a high demand for the existing stable Ethena Ethena Ethena (USDE). With its market capitalization, about 6 billion US dollars have become one of the leading synthetic dollars in crypto, an ecosystem due to its ability to generate significant profitability through basic trade strategies, even against the backdrop of increased market volatility. While the USDE yield once reached a peak by 60%, since then they have stabilized about 9%, which is still a convincing profitability compared to traditional financial instruments.

From a technical point of view, the AlejandrobtC trader expressed optimism regarding the ENA price trajectory. He noted that at present this asset is in a familiar accumulation range, which previously led to an increase of 300% to $ 1.25 in December 2024 after consolidation from August to November, if history repeats, Ena can see another huge meeting.

$ EnA is a good purchase in this area for accumulation, it is better to add up and forget about it IMO. pic.twitter.com/n5ovlha2yj

– alejandro₿tc (@alejandro_xbt) February 24, 2025

Nevertheless, it is important to note that the long -term sustainability of ethenes is uncertain. This is due to the fact that ethena generates profitability using a basic trade strategy that uses the advantages of prices for spot and futures. Therefore, its performance largely depends on market conditions. When the financing rates are high, the strategy can lead to high profitable attractions, which leads to the demand for the assets of the etins, including ENA. Nevertheless, in the bear market with lower funding indicators, this strategy can be checked.