Ethereum has been hovering in the critical range of $3.5-4k, with its price recently finding support near the lower boundary at $3.5k.

After this rebound, the bulls are trying to break through to the $4,000 resistance level again.

Technical analysis

Author: Shayan

Daily chart

The upward momentum of Ethereum price met a pause at the $4,000 resistance level, which turned out to be a key selling area. This refusal led to a fall to the lower limit of the $3.5 thousand range. However, the resumption of buying activity at this support caused another strong push upward, reaching the threshold of $4 thousand.

The $4K resistance is critical as it matches Ethereum’s previous swing highs and has repeatedly thwarted bullish attempts. Consequently, the short-term forecast assumes continued consolidation in the range of $3.5-4 thousand. A decisive break above the $4,000 level could pave the way for a broader bullish rally.

4 hour chart

On the 4-hour chart, ETH faced sharp rejection at the $4K resistance level, resulting in an impulsive fall below the ascending channel’s midpoint at $3.8K. The move reflects the strong presence of sellers at the $4K level, making it a huge barrier for buyers.

Despite this setback, Ethereum found support near the $3.5k level, where buying pressure intensified. The subsequent bullish momentum pushed the price back above the channel’s middle boundary, bringing it back closer to the $4,000 resistance.

While buyers remain keen to break above the $4,000 threshold, bearish RSI divergence is signaling caution. Short-term consolidation below this resistance appears likely ahead of another potential bullish breakout.

On-chain analysis

Author: Shayan

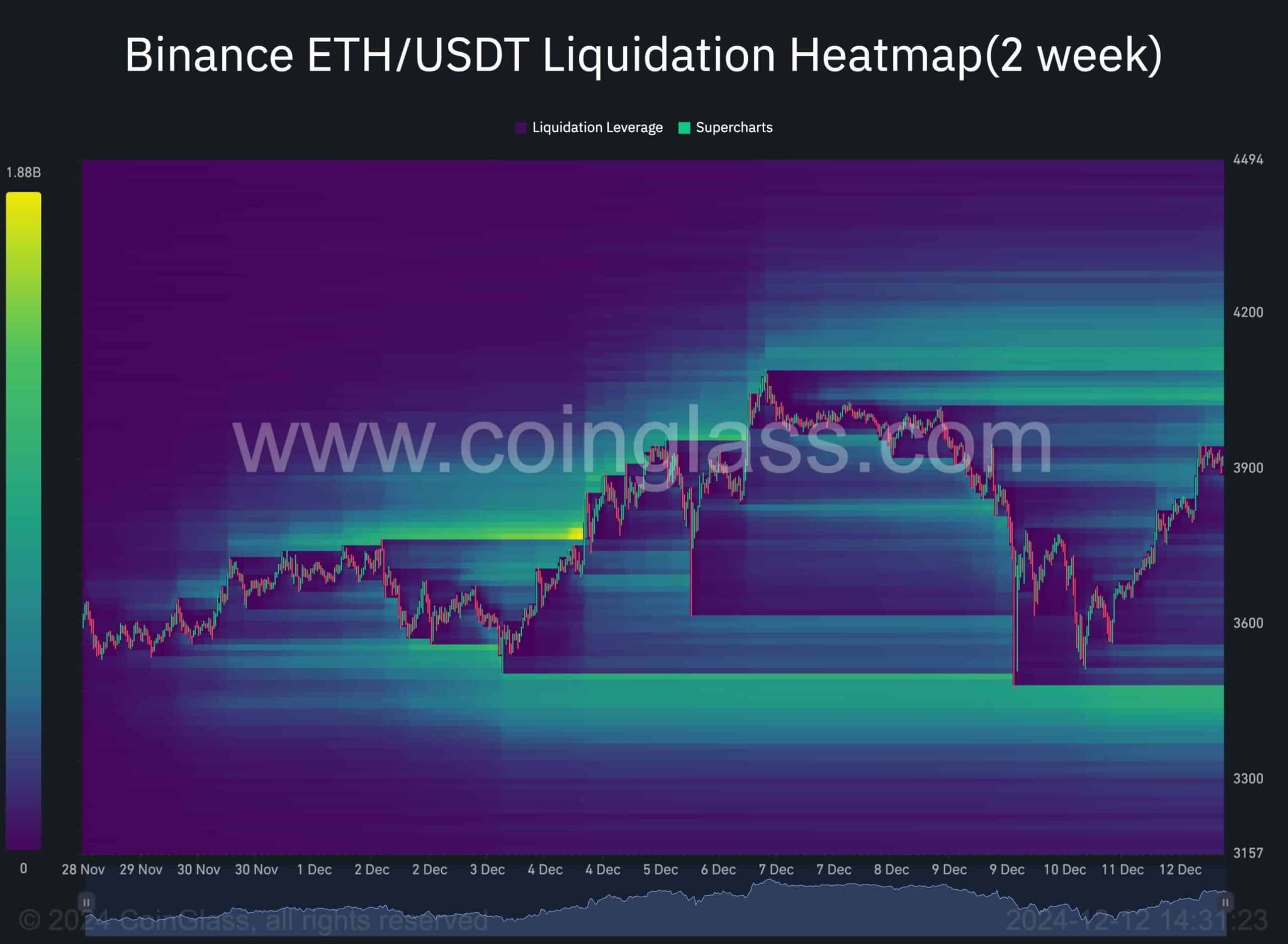

Ethereum price action, especially its stability at the $3.5K support level, reflects significant liquidity concentrated below this threshold, as shown in the Binance liquidation heat map. Likewise, the $4K resistance level marks another critical liquidity zone, primarily associated with short positions placed in anticipation of price rejection.

These two levels represent the highest concentration of liquidity near the current price. If ETH successfully breaks through the $4,000 resistance, it could trigger a cascade of short liquidations as short sellers rush to cover their positions. This will likely lead to an impulsive rise in prices as the closing of these positions will contribute to further upward momentum.

However, a breakout in either direction can trigger a cascade of liquidations, amplifying subsequent price movements. Given the prevailing market dynamics, a bullish breakout above $4K seems a more likely scenario.