The growing market Litecoin ETF potentially excites investors, as the SEC expects a key to approval solution.

Key conclusions

- ETF Litecoin from Canary Capital is indicated in the DTCC under Ticker LTCC.

- It is assumed that ETF will be the first to receive a SEC solution among such statements.

At the Canary Capital Litecoin ETF point appeared In the system of depository fund and cleaning corporation (DTCC) in the framework of the LTCC Ticker LTC, a key preparatory step for potential launch of the fund is noted.

The DTCC list sets the necessary trading infrastructure for ETF, although the SEC resolution remains under consideration. DTCC serves as the main supplier of celling and guardianship services for US securities.

Canary capital Submitted Its Pottery ETF application in October 2024, followed by similar applications from managing assets, including Greyscale and Coinshares. It is expected that the Canary application will be the first to receive the SEC decision.

Bloomberg ETF analysts Eric Balchunas and James Seyffart consider the prospects of funds based on Litecoin as more favorable compared to other crypto assets. Analysts note that ETF is already complies with approval requirements, with Litecoin Classified as a product CFTC.

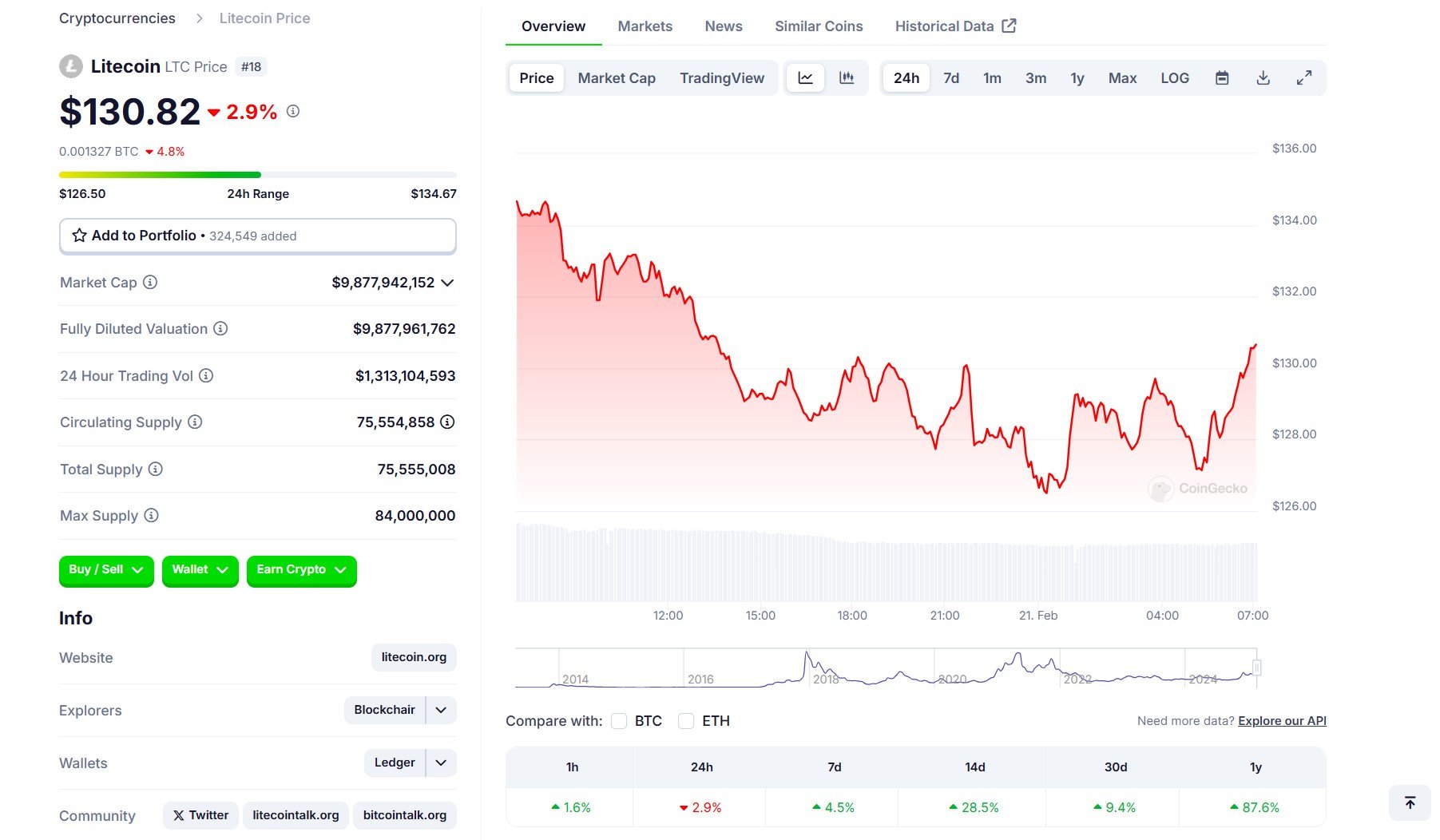

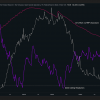

The price of Litecoin has increased by more than 100% since the first application of Litecoin ETF was presented in the SEC, according to Coingeco data. The digital asset is currently trading at about 130 dollars, which demonstrates an increase of 2% over the last hour.