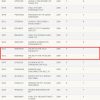

Depository Trust and Clearing Corporation (DTCC) In the list The first Futures Futures ETF from volatility shares are 2X Solana ETF (SOLT) volatility assets and SOLANA ETF volatility assets.

To be added to DTCC means that these ETFs are entitled to clean and resolve through this central infrastructure that is necessary for effective and reliable trade. However, the list is not equated with the approval of investment products.

In December last year, volatility shares specializing in exchange funds (ETFS), focused on investment strategies based on volatility, Submitted With the SEC for three new ETFs that will monitor Solana futures contracts.

In addition to the two products listed on DTCC, the company also seeks the approval of regulatory authorities for its -1x Solana ETF, which will offer the opposite exposure, obtaining valuable when the Solana futures contracts are reduced.

This step caused curiosity, since at that time there were no futures contracts on SOLANA on exchanges regulated by CFTC.

However, according to Bloomberg ETF analyst Erica Balchunas, this was a convincing sign that Solan Futures would appear soon.

Earlier this month, Coinbase Derivative LLC Runned CFTC-regulated Futures Contracts SOLANA. These contracts are considered an important step towards the potential approval of ETFS in the future.

Coinbase launched after He leaked The site for the production of commercial exchange in Chicago suggested that Futures XRP and Solana could begin to trade on February 10 in anticipation of the approval of regulatory authorities.

Cme Group, however, explained that there was no official decision on these contracts. The CME representative attributed a leak with the “error” and noted that he is still at the stage of evaluating these potential products.

The availability of adjustable futures contracts SOLANA provides institutional investors with a more reliable and structured way of trading SOLANA, overcoming the gap between traditional finances and crypto -market.

The potential approval of the ETF Solana can increase the likelihood that the point ETF will approve in the future.

SEC confirmed the receipt of several applications for spot ETF from 21Shares, BitWise, Canary and Vaneck.