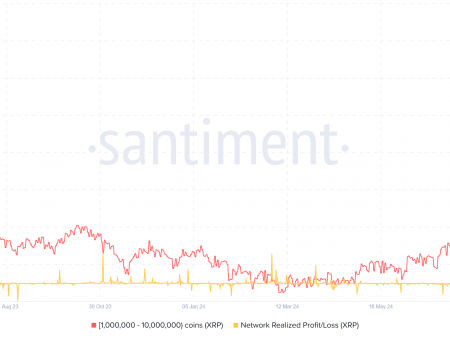

Solana memecoin Dogwifhat (WIF) is gaining attention after significant whale accumulations. Over the past two weeks, two whale addresses have purchased a total of 20.58 million WIF tokens. Their value is $33.35 million. These purchases have raised hopes for a price recovery even during the market consolidation.

Whale stockpiles boost market optimism

On-chain metrics highlighted two addresses that recently downloaded large amounts of WIF tokens from Binance and Bybit exchanges. This whale activity has positively impacted market sentiment as traders and investors anticipate further price gains.

2 whales have accumulated $20.58 million WIF ($33.35 million) from #Binance and #Bybit in the last 2 weeks! https://t.co/4bnfADQpqG https://t.co/FOWIMI1S0P pic.twitter.com/tOUIDlDEXY

— Lookonchain (@lookonchain) September 11, 2024

September is known to have poor market performance. These whales may try to take advantage of the ‘buy the dip’ and increase the value of WIF in the coming months.

Despite the volatile performance of the cryptocurrency market as a whole, experts believe that there will be positive movement in the fourth quarter. The activity of whales and the possibility of easing by the Federal Reserve may thus support the positive market environment. Consequently, WIF traders continue to become more and more confident that the token price will soon increase.

Dogwifhat (WIF) Technical Analysis Signals Potential Breakout

The WIF price chart shows a potential breakout from a long-term falling wedge formation. The meme coin has been in a downtrend since April 2024. It peaked at $4.8571 before falling to $1.07. However, recent price action has indicated the beginning of a double bottom reversal pattern. This could lead to a price increase.

Technical indicators including the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) are also showing positive signs of an upward movement, confirming the likelihood of a price breakout. Analysts have predicted that if WIF can maintain its current trend, it could easily break through the $2 mark and continue to rise.

On the 4-hour chart, WIF has broken out of the triangle and surpassed the 200-day exponential moving average. This breakout has put more upward pressure, with analysts focusing on the $2.04 and $2.52 Fibonacci levels. If this trend continues, WIF could easily break through its key resistance levels. Higher resistance is expected at $175, which if broken would allow WIF to continue its bullish trend.

$WIF

There is literally no chart pattern/constellation that is more bullish than this WIF chart right now. My take. https://t.co/lhAHV0PlTX https://t.co/jt6VVpaYG9 pic.twitter.com/8viUfnBnBT

— Muro (@MuroCrypto) September 10, 2024

However, if the price fails to hold above the $1.55 support level. This could open the way for further decline with the next key support at $1.50. A move below $1.50 could pave the way for further selling with a target around $1.40 or even $1.30.

Dogwifhat (WIF) Price Trend

At the time of writing, WIF is in a bearish trend with prices down to $1.55. This is a drop of 8.15% in the last 24 hours. The significant drop in trading volume is evident as it is 3875% lower, which could be due to selling pressure or lack of buying interest at these prices. Initial support for WIF is seen around $1.55 and the price is likely to face resistance at $1.65 if it bounces back.

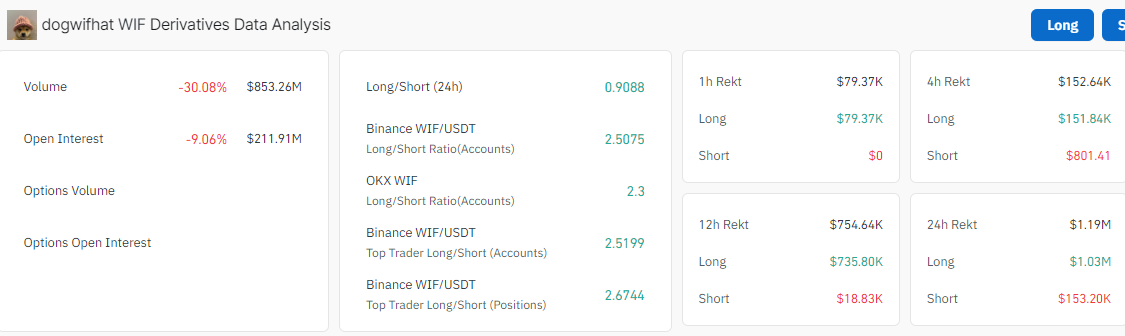

In the derivatives market, WIF saw trading volume fall by 30.08% to $853.26 million. This decline can be attributed to traders becoming less aggressive in opening new positions due to the prevailing market conditions.

Moreover, WIF’s open interest fell 9.06% to $211.91 million, which can be seen as a bearish signal as traders may be liquidating their positions instead of opening new ones.

However, some traders are optimistic, believing that current price movements and other technical aspects of WIF suggest a possible rebound. Continued whale accumulation could be the key driver of price growth only if buying interest returns and volume picks up again.