This is a segment from the newsletter 0XRESEARCH. To read full publications, SubscribeField

The useless character of crypto means anyone who has a computer and connection to the Internet can have a bag. It is very difficult to value tokens.

A lot of prices for the sale price, such as cardano or pulsation trade in absurdity from four to five fig.

Then there are tokens, such as OM (who?), Which at the highest prices account for 47.6% after the largest liquidation in the industry at the beginning of this month.

There is no rational explanation. These are all narrative and speculative awards.

But is it going to prevent investors from trying to officially try tokens of values? No, because there is a lot of money that can be earned from the disclosure of precious stones.

In the short history of this industry, investors tried to evaluate L1S with various now abandoned tools, such as a model from shares to stream, with the coefficients of the total cost to market capitalization or the profitability of cash flows with a persistent position.

The last shift in the mood of investors around tokensal assessments doubles on an emphasis on the importance of the basics.

Maelstrom Fund points to Vertex Perps dex, claiming that the markets “underestimate” DEX growth and that it “should“ trade ”at 200-300% more estimated in accordance with its peers.

The recently published thesis of Ronin Chain Fund from 1kxnetwork indicates the deflationary burn of the SLP Game chain, as well as growing daily active users and pixels that receive income ($ 20.7 million in USA in 2024).

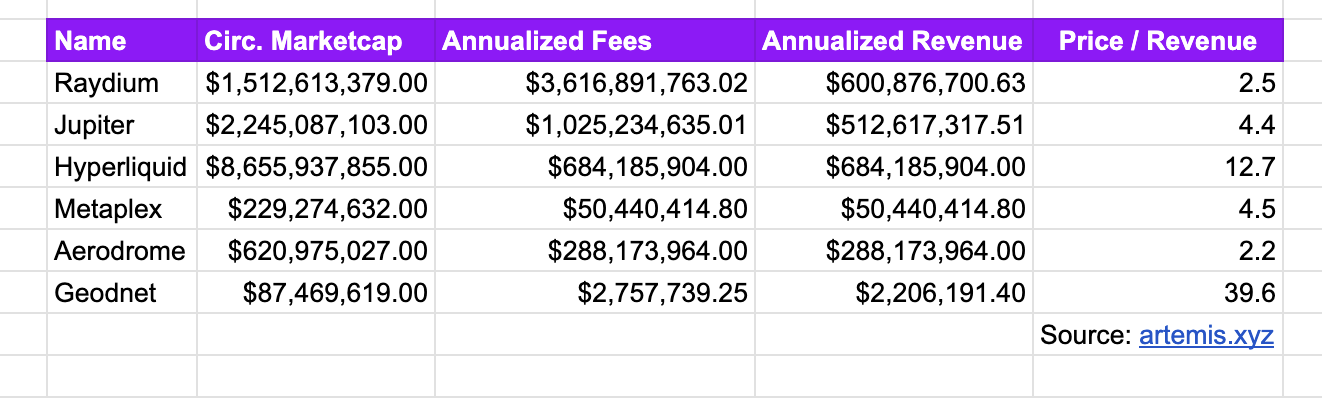

Applications, such as Raydium, Hyperiliquid, Metaplex, Geodnet and Jupiter, are trading in reasonable “rational” P/S ratios, which are based on sequential cash flows and more measurable growth potential.

Many of these projects also participate in huge token ransom, often perceived as “based on the basis” of the strategy to increase the attractiveness of multiple price.

The Jupiter tokens redemption program may be the largest (from the point of view of the US dollar) with an obligation of 50% of the protocol. This is suitable for buying ~ 9.4% of the total circulating JUP proposal based on this approximate estimate.

Support for the fact that the “foundations returned” is also an ugly reality of reducing the rating of L1/L2.

The legendary Premium Layer-1 is slowly evaporating. L1 in the previous cycle, as Starknet, raised by updating an estimate of $ 8 billion, while the newer L1S orders less than half of these assessments (Brachain $ 420 million, a history protocol of $ 2.25 billion, Celestia $ 3.5 billion).

The price action is only down the price of the majority of L1S/L2 over the past 12 months, probably, will be even further in the future.

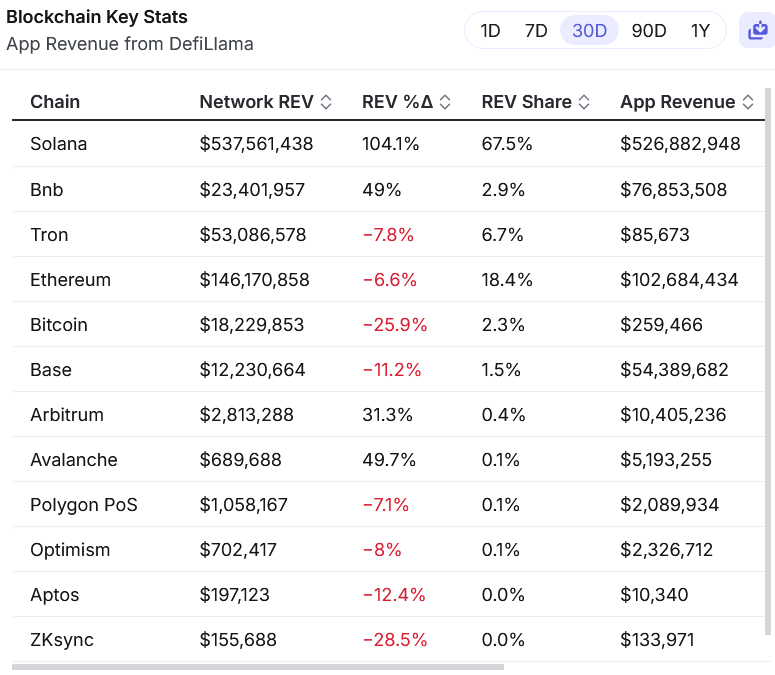

Revenues from applications also begin to ahead of the income of the basic protocols L1 and L2, notes Dan Smith from Blockvors.

All this depends on the growing contempt for the infrastructure of the industry. The thesis of the fat protocol is no longer, at present, the Fat App.