Blockchain data shows that Chainlink investors have been suffering significant losses recently, a sign that the price drop has instilled fear in them.

Chainlink FUD May Lead to Bottom Formation

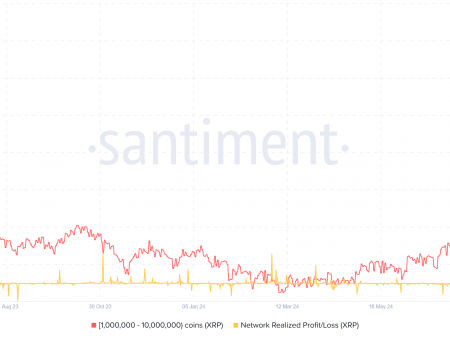

According to data from analytics firm Santiment, LINK investors just saw their biggest capitulation this year. The relevant indicator here is “Network Realized Profit/Loss,” which tracks the net amount of profit or loss that Chainlink traders are making right now.

The metric works by looking at the blockchain history of each coin sold to see what price it was previously moved at. If that previous price for any coin was lower than the spot price it is currently moving at, then selling the coin makes some profit.

Likewise, transactions of coins of the opposite type would result in losses being realized. The indicator sums these gains and losses for the entire network and then calculates their difference to find the net situation.

When the Network Realized Profit/Loss value is positive, it means that investors are generally making a profit. On the other hand, a negative metric suggests that loss taking is the dominant form of selling in the market.

As you can see from the chart above, the realized profit/loss of the Chainlink network has recently shown a negative spike, indicating that LINK investors have suffered major losses.

This significant spike in losses from LINK traders comes as the cryptocurrency’s price has seen a significant decline over the past few weeks. The coin has fallen nearly 10% in the last seven days alone.

Given this point, it can be assumed that investors were so scared by the bearish price action that they decided to exit the market at a loss.

In the same chart, the analytics company also included data on another metric, Age Consumed, which tracks whether inactive coins are moving.

This figure also appears to have risen in line with investor losses, suggesting that even some holders who had previously held off on investing were being put off by the price decline.

This FUD in the market could benefit Chainlink, as the asset has historically been more likely to bottom when fear has brewed among investors. As Santiment highlighted in the chart, the indicator’s red spike also proved bullish for LINK in April.

LINK Price

At the time of writing, Chainlink shares are trading at $12.8, down about 3% over the past 24 hours.