Cardano (ADA) is faced with intensive sales pressure, falls by almost 10% over the past 24 hours and almost 29% over the past week. Since its inclusion in the strategic crypto -USA, USA ADA has fallen by 39%, with all its might, trying to restore a bull impulse.

Indicators such as BBTrend and DMI show that bear feelings remain strong, and sellers are still under control. If the current descending trend continues, the ADA can check the key support levels, but the change can push it back to the main resistance zones.

ADA BBTREND shows that sales pressure are becoming stronger

The Cardano Bbtrend indicator is currently -19.52, continuing to decline since yesterday. Earlier this month, from March 5 to March 8, Bbtrend remained positive to reach the peak on March 31.

This transition from the positive to the negative territory involves the weakening of a bull tendency with an increase in the lack of pressure on the price of the ADA. Traiders now monitor whether this decrease continues or ADA can restore the impulse.

BBTREND, or BOLLINGER BAND TREND, is an indicator that measures the price of Bollinger bands. He shows whether the asset is in a strong, bull or bear phase. When the BBTrend is positive, this implies a strong impulse up, while negative values indicate the growing pressure of sales.

With the BBTREND ADA is now at -19.52, this signals an increase in bear mood, assuming that the price may continue to decline if buyers do not enter the road. If the descending trend is preserved, the ADA can check the key support levels in the coming days.

Cardano DMI shows that sellers are still under control

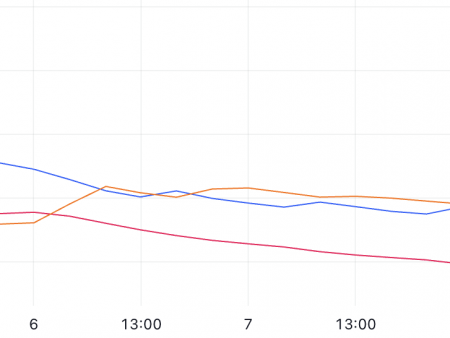

The Cardano (DMI) directional diagram shows that its average direction (ADX) index has grown to 34.5, compared with 26.6 yesterday. This increase suggests that the current ADA trend – bubbled or bearish – is gaining strength.

Considering that the ADA is in a descending trend, the growth of ADX indicates that the sale pressure is increasing, which complicates the return price in the short term.

ADX measures the trend on the scale from 0 to 100, and the values above 25 indicate a strong trend and above 50, which indicates an extremely strong trend.

Meanwhile, ADA +DI (a positive direction indicator) rose by 12 from 9.6 yesterday, but a few hours ago it decreased a little, which indicates the weak attempts of the bull.

At the same time, -DI (negative indication of the directed) by 29, lower than yesterday 32.3, but grew from 25.2 a few hours ago.

This suggests that although sellers still control the trend, some short -term rollbacks arise. If -DI remains dominant, and ADX continues to grow, the ADA anizurd trend can last further.

Does Cardano fall below $ 0.60?

The Cardano EMA lines indicate that the potential cross of death can form in the near future, signaling a bear pulse.

The deadly cross occurs when the short -term EMA intersects below a longer EMA, often leads to an increase in sales pressure.

If this bear crossover occurs, the price of the ADA may decrease further, and the support level of $ 0.58 will become a key area for observation. Breaking below this level can cause even deeper losses.

However, if buyers restore control, and ADA can change their trend, the price can rise towards the resistance level of $ 0.818. The breakthrough above, which can open the door for further profit to 1.02 dollars and even $ 1.17, if the pulse intensifies.