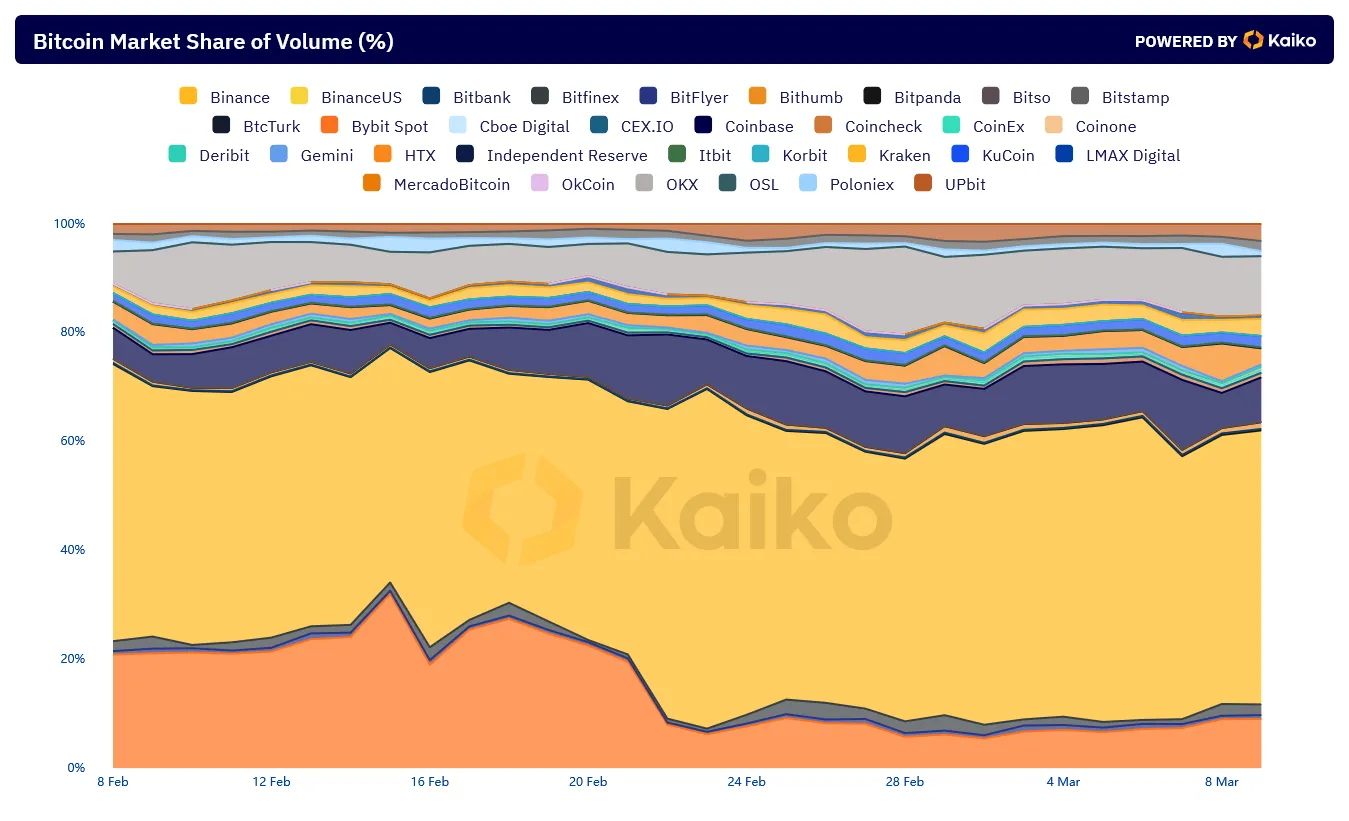

Bybit is no longer one of the three best centralized exchanges, trading in volume after the hacking of Lazarus Group in the amount of $ 1.4 billion led to a significant reduction in the market share. According to the analytics platform during the KAIKO chain, the BYBIT share in the total trade fell by more than 50% from the moment of hacking.

According to Kaiko, the BYBIT market share for all main centralized exchanges over the past 30 days reached a peak at 32.04% of February 15, and the exchange was 22.5% of the volume of February 20, just the day before the hacking. However, at present it has decreased to 9.04% as of March 9, which is approximately 60% decrease during this period.

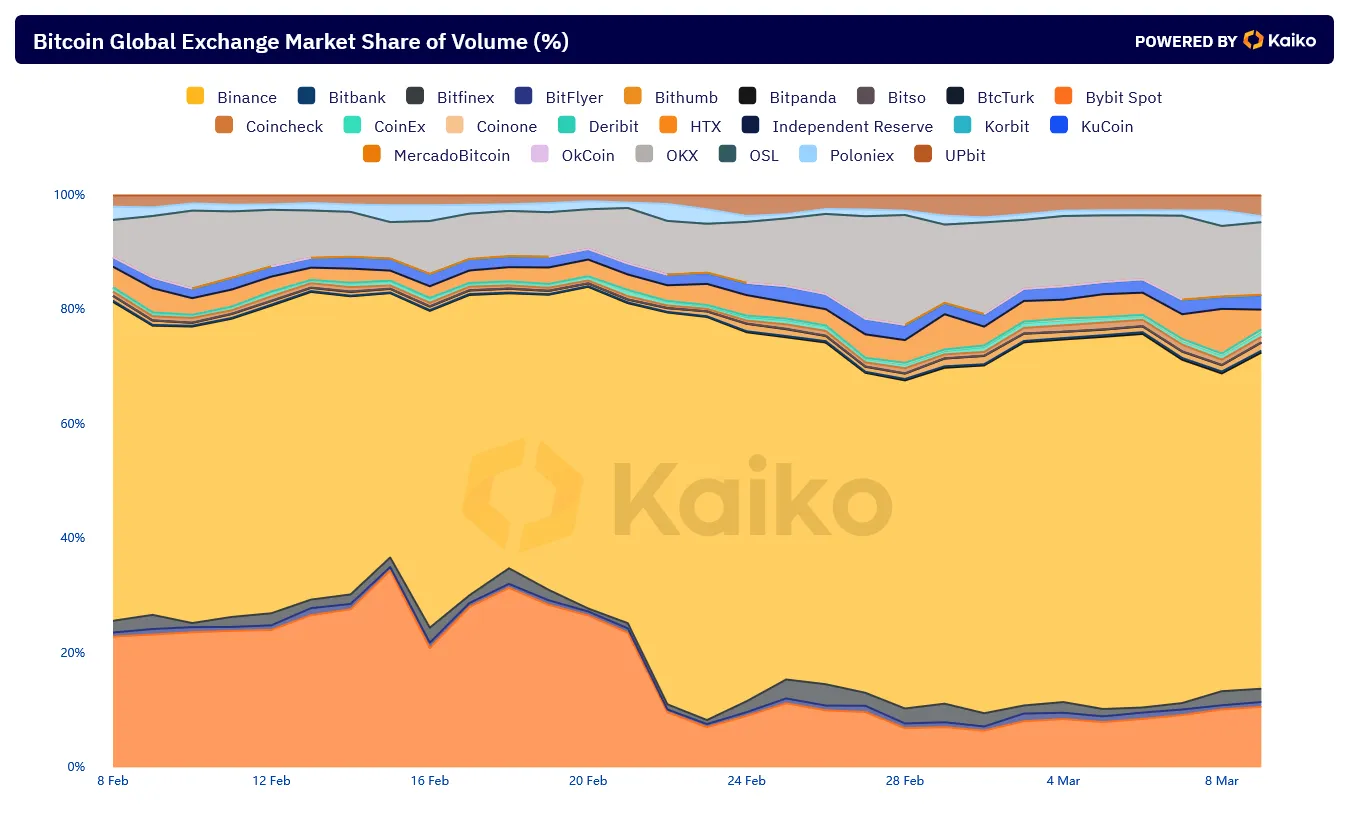

The receipt in Bybit is even more pronounced in studying the volume of trade of offshore exchanges, that is, centralized exchanges that are not based in the United States.

In this category, Bybit was second only to Binance in the amount of trading before hacking on February 21, on average more than 25% of the volume of trading as a result of the incident. Now it fell to 10.57% until March 9.

In the Intersheet, Bibita losses were a profit of Binance. The world’s largest exchange was the largest beneficiary of the outcome of the user, since trading activities increased significantly after BYBIT hacking. It was clear how the share of the Binance market increased significantly.

Before hacking, Binance answered about 50% of the daily trading volume for centralized offshore exchanges. However, this has changed significantly after hacking, while the average market share increased above 60%. Binance. The exchange accounted for 70.5% of the bidding on February 23, 48 hours after the BYBIT hack.

Nevertheless, other exchanges also saw how their market share increased after the incident, even if not from the point of view of a similar rate of Binance. The share of OKX and Coinbase in the amount of trade was relatively higher since the incident.

Bybit shows signs of recovery

Meanwhile, the current share of the BYBIT market is a sign of revival in trading activities, showing that some of its users are returning. In the following days of hacking, the market share was in a free fall, which led to the total share of Bybit, reached to 5.44% on March 2, just like its share in offshore exchange volume also reached its bottom by 6.42%.

This emphasizes how the management of the exchange crisis allowed him to survive the largest robbery against the financial institution. When choosing not to stop the withdrawal of funds at the worst hours of the crisis and update users, the exchange was able to maintain the trust of the majority in the crypto community.

Nevertheless, the restoration efforts were quite slow. Despite the multi -party efforts with the participation of several security experts, only about 3% of the funds have been frozen so far. According to the BYBIT LAZARUSBOUNTY page, only $ 43.71 million has been restored so far.

The exchange also retained its word in order to distribute 10% of each restored fund as a reward. Until now, he paid 4.32 million dollars. The United States to several persons and organizations who helped to freeze funds or provided information that led to freezing.

Despite these efforts, hackers were able to transform at least $ 300 million stolen, according to Elliptic.