Bitcoin fights with low trade and weak impulse, which leads to muffled price actions near a 100-day sliding average.

Nevertheless, a strong bull rebound remains possible, depending on the return of sufficient liquidity to the market.

Technical analysis

Shayan

Daily diagram

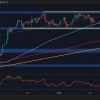

Bitcoin remains at the stage of indecision, and the price action ranges about a 100-day sliding average of 98 thousand dollars. This prolonged consolidation, characterized by low volatility and weak impulse, involves a balance between buyers and sellers.

The RSI indicator strengthens this concept, emphasizing the continued struggle between bull and bear forces, with a support of $ 98 thousand. USA and a resistance of 108 thousand dollars arising as a key field of battle. Nevertheless, the decisive step in any direction is unlikely until liquidity returns to the market. Despite this uncertainty, the final breakthrough of the bull breakthrough seems more likely, given the presence of several support zones below the current price, which indicates the strong interest of the buyer.

4-hour table

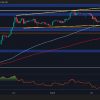

In the lower terms, Bitcoin initially tried to make a bullshit, but could not break over the upper boundary of the bull flag, faced with a refusal to insufficient purchases. Consequently, the assets moved to the gap of fair value, a historically significant zone of demand, which has provided support in recent months.

Bitcoin is currently limited between critical support of 90 thousand dollars. USA and the dynamic upper line of the Bull Flag trend. A breakthrough above this template can light a fresh rally, which can lead to the fact that the price to a new record maximum for $ 108 thousand. USA. BTC, most likely, will remain in the range within this phase of consolidation until a clear directed movement occurs.

Analysis on the chain

Shayan

Given the indecisive price effect of Bitcoin and the absence of a clear directional movement, the analysis of the accumulation and distribution of market participants can give valuable information.

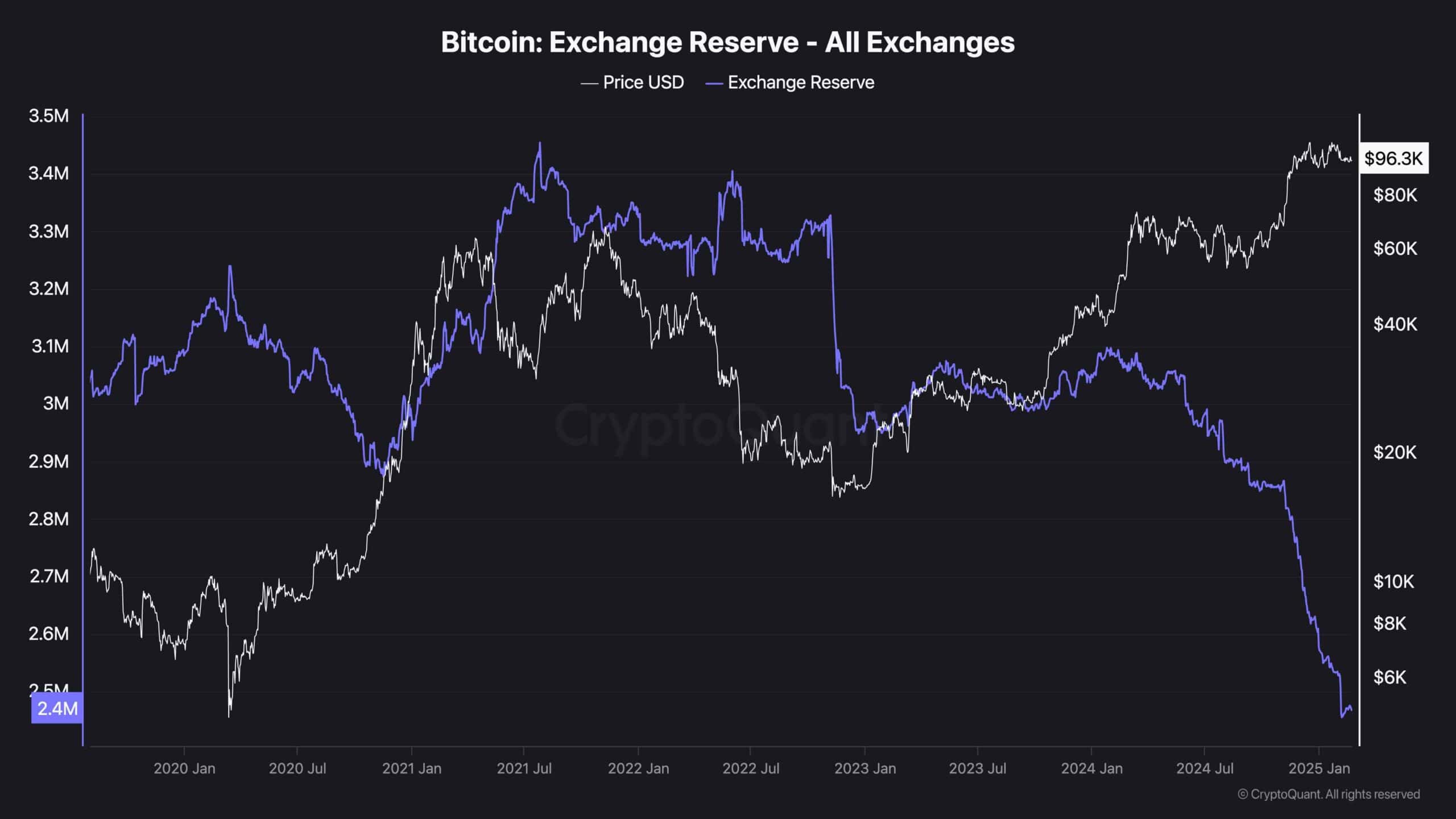

The diagram below illustrates the BTC Exchange Reserve metric, which tracks the amount of bitcoins held in the wallets of trading platforms. This indicator serves as an indicator of potential sales pressure, since the assets stored on exchanges can be quickly sold.

It is noteworthy that in recent days the exchange reserve has decreased sharply, signaling the possible phase of accumulation and reducing the available supply. A similar trend was observed in December 2022, preceding a significant increase in price after a significant fall in exchange reserves. If this template is preserved, this can strengthen the case for the upcoming bull breakthrough.