Over the past 24 hours, the cost of Layer-1 (L1) coin has increased by 13%, which made it a higher level of the highest level during this period.

The rally brought Braa closer to its record maximum of $ 15.20, which caused the resumption of interest on the period of consideration.

Braa sees a two -digit increase when strengthening the purchase pressure

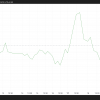

The BERA double leap is maintained by the strong pressure of the purchase, as is reflected in its positive cash flow Chaikin (CMF). At the time of writing this article, the CMF indicator, which measures, flows into the asset, above the zero line at 0.04.

A similar CMF up, similar to this, indicates that the BERA rally is supported by an increase in volume, which makes its rally price more stable. This reduces the risk of false or short -term sharp growth.

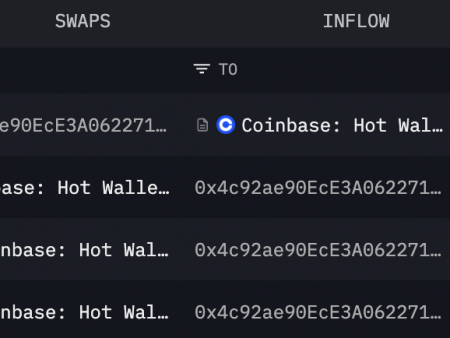

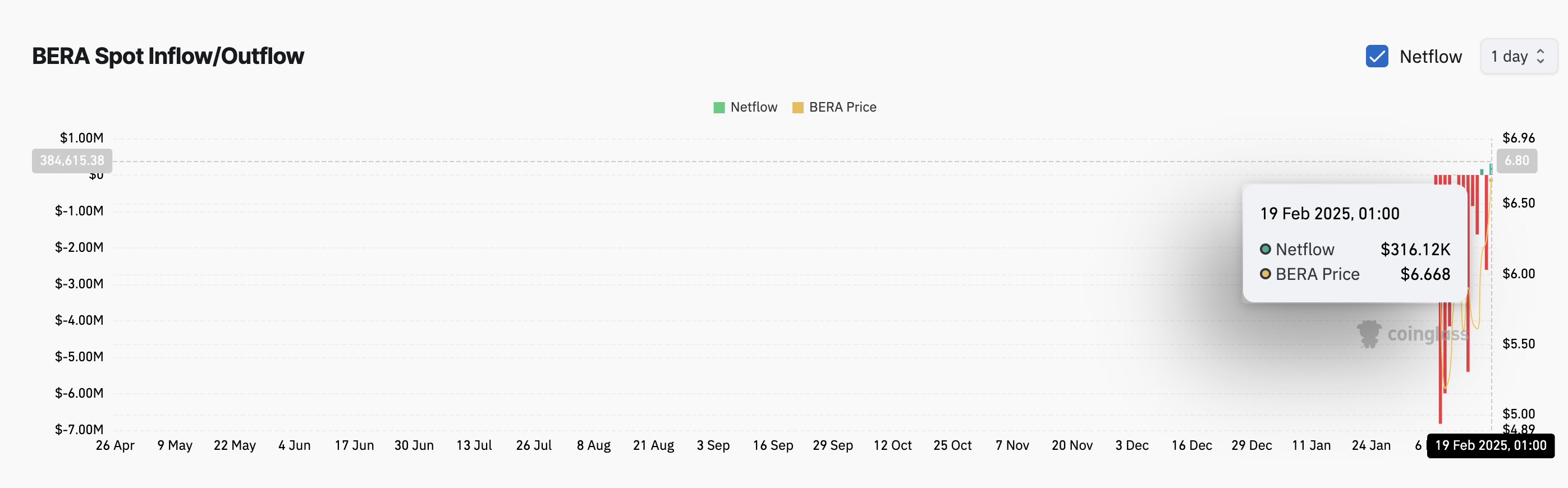

In addition, on Wednesday, the coin recorded a point tributary totaling 316,120 dollars. This happened after on Tuesday he saw the outflow of capital from its spot markets up to 2.60 million dollars.

When the records of the assets determine the influx, there is a significant increase in the activity of direct purchase on the spot exchanges, which indicates high demand from investors who seek to hold assets. This signals a bull impulse in the BERA market, since the real pressure on the purchase will lead to an increase in its prices.

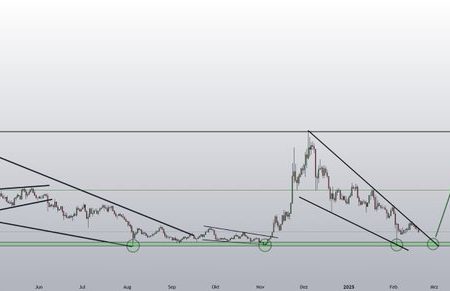

The next step BERA: Select 8.49 dollars or slides to $ 5.37?

Currently, Braa is traded at 6.52 US dollars, below the critical resistance formed at $ 8.49. If the demand for Altcoin has taken off, he can violate this resistance and try to regain himself all the time at $ 15.20.

Nevertheless, an increase in activities to make a profit can cancel this bull projection, and the price of BERA can fall to $ 5.37. If the bulls cannot protect this level of support, the cost of the coin may plunge in $ 3.89.