With the expansion of night recovery, bitcoin is traded at a market price of $ 89,817. Over the past 24 hours, the price of BTC reached $ 90,623. This marks a significant recovery after a 78-day minimum of $ 78 197.

Nevertheless, mass fluctuations also created a 7-day maximum of $ 95,152. The management in BTC Price had a potential return of up to $ 94,000.

Bitcoin prices are directed at 50d EMA

In daily graphics, the price trend of BTC demonstrates bull support above the 200-day EMA line. This leads to a morning star scheme with a low price deviation that controls the rally.

Since the price of BTC ranges at $ 90,000 in the USA, the restoration extension is as a result of the purchase of pressure. Consequently, the pulse indicator reflects the MACD line and the signal on the verge of pressure of the positive crossover.

In addition, the morning star formed in Bitcoins is located next to the dynamic level of support. This increases the chances of Bull Return to BTC prices.

Nevertheless, the prevailing fall projects the 100-day EMA line as an immediate resistance of about $ 92,964.

Analysts indicate a bull step forward

Crypto -Analist Titan of Crypto emphasizes the possibility of a large -scale rally in BTC prices. According to his ICHIMOKU analysis, a lower price deviation in weekly candles emphasizes the price of BTC, which accepts support on the Kijun line.

#Bitcoin Redizing Immentum 🚀#BTC strongly reacted to Kijun 🔵, acting as support in a weekly diagram.

The weekly closure of tenkan 🔴 about 94,000 people will confirm the pulse shift and would strengthen the bull case. pic.twitter.com/wckrmbgtw

– Titan Crypto (@washigorira) March 5, 2025

The Kijun line acts as a weekly support for BTC prices. The current emission of a lower price hints at a potential weekly closure in Bitcoin above the Tenkan line at $ 94,000.

This will signal the shift of the pulse in bitcoins and increase the chances of a new record high level.

ETF retain a flowing position

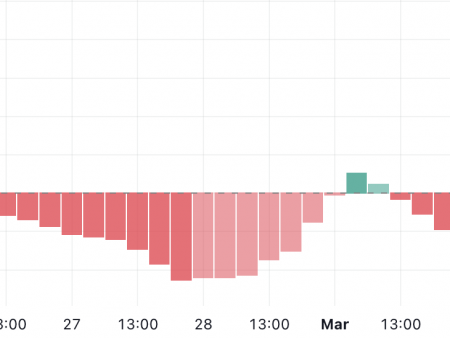

On March 3, US Spot Bitcoin ETFS has witnessed an outflow of $ 143.43 million. USA. Greyscale recorded an influx of $ 35.79 million. Nevertheless, the Six Bitcoin ETF recorded a clean outflow of 13 to 46 million dollars.

Meanwhile, five local ETFs, including BlackRock, retained a clean zero stream. This marks the second day of the consistent outflow of ETF bitcoins, exceeding a total of $ 200 million.

Will there be a bitcoin price to reach 100 thousand dollars?

According to the analysis of prices for BTC, recovery in bitcoins will probably follow if a wider market remains stable. However, with the ongoing tariff wars and the instability of the world market, the price of BTC will probably remain unstable.

Nevertheless, horizontal levels of $ 99,514 and the supply zone of $ 106,000 remain decisive resistance. On the other hand, the 200-day EMA is around $ 85,000 around $ 85,000, and psychological support in the amount of $ 80,000 remains a key level of demand.