Bitcoin is trading at 97,705 US dollars with a market capitalization of 1.93 trillion US dollars and below the usual 24-hour trade volume of $ 15.54 billion, holding a quiet session on Saturday, February 15, 2025, within the intraday price range in the amount of 97,089 US dollars to 97.965 US dollars.

Bitcoin

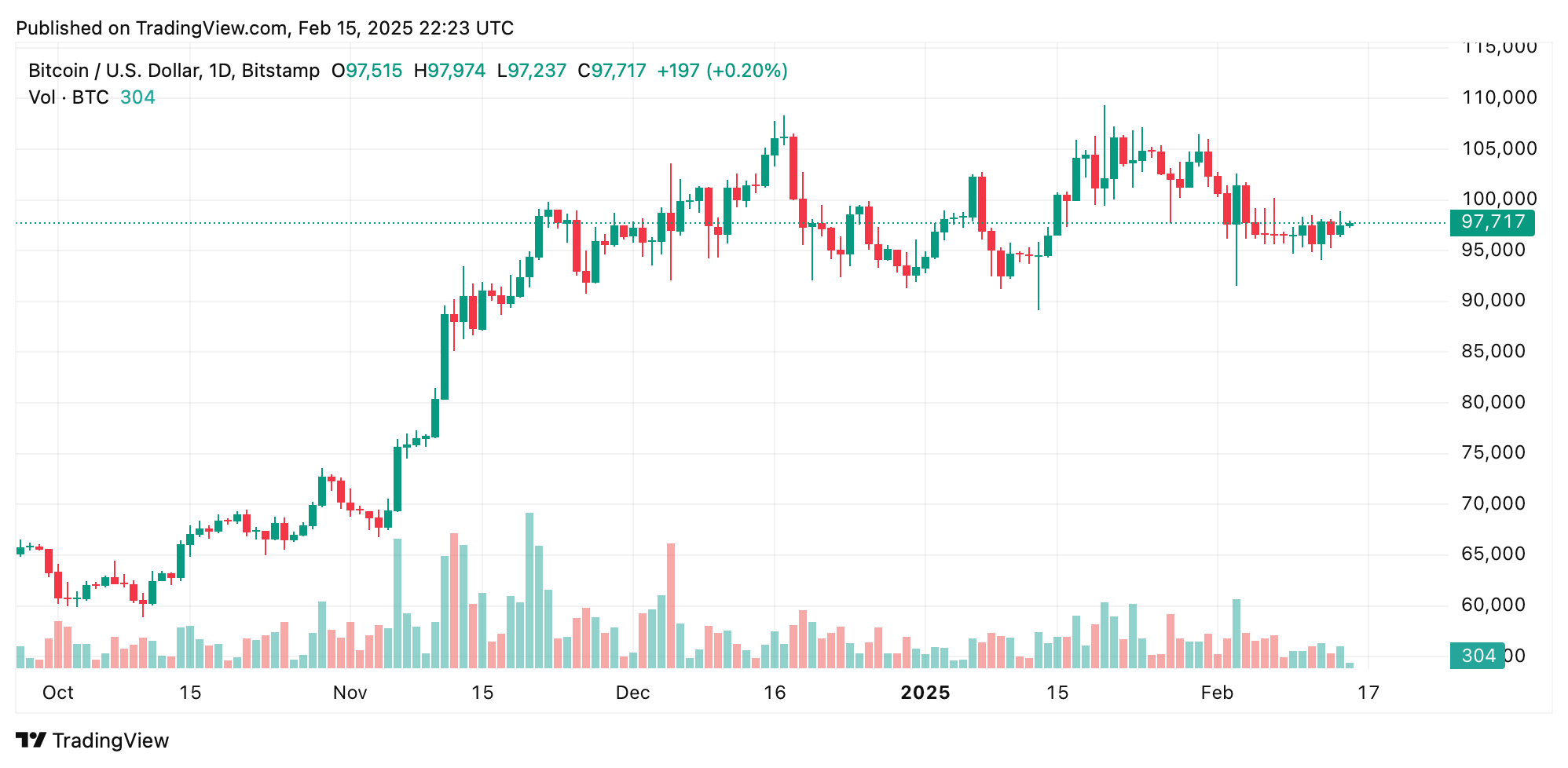

A daily analysis of bitcoins shows that BTC is consolidated after a sharp correction, with key support of $ 89,164 and a peak resistance of $ 109,356 at Bitstamp. A break above the level of $ 100,000 may indicate a bull continued, while a refusal can lead to a further drawback. Fibonacci recovery levels based on a recent maximum in the amount of $ 109,356, and the swing is $ 89,164, moreover, $ 93,929, $ 96,877, $ 99,877, 50.0% – $ 99,260, 61.8% of 101,643 US dollars and US dollars and US dollars and $ 61.8% 78.6.60 US dollars at $ 10.60. The decisive step outside $ 101,643 can advance BTC to higher resistance zones, while the inability to retain more than $ 99,260 can cause a decrease to $ 96,877 or lower.

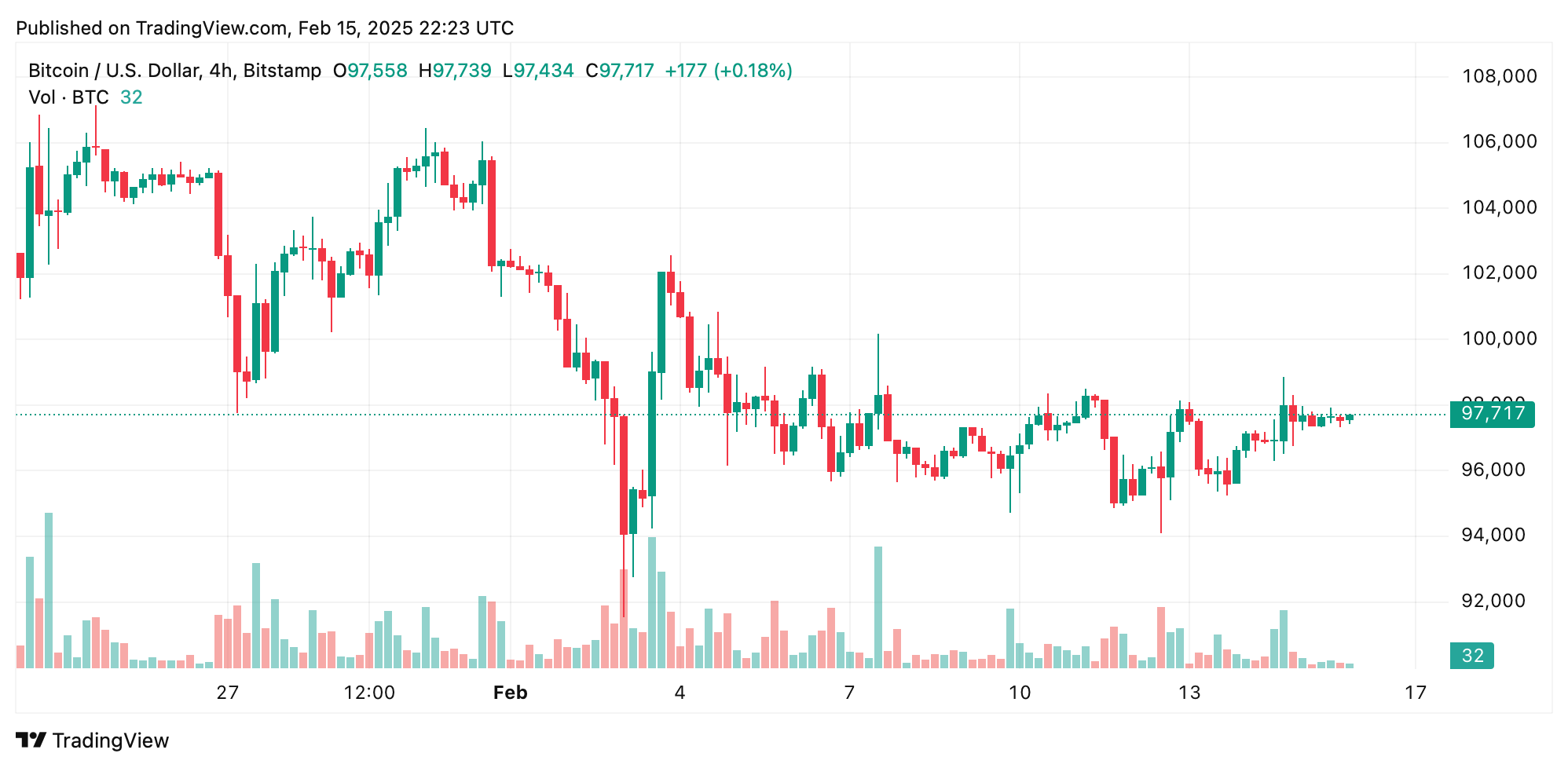

The four -hour BTC diagram shows a slowdown in the descending trend on Saturday with support for $ 94,091 and a resistance of $ 102,569. A higher low level was formed, signaling the possible handling of bull appeal if Bitcoin can maintain an impulse above $ 99,000. Conversely, the refusal of a mark of $ 100,000 can lead to resuming sales pressure. Four -hour Fibonacci recovery levels in Bitcoins from recent high swing to low level indicate that the restoration of 50.0% in $ 98,330 and 61.8% at $ 99,751 is critical resistance points. If the BTC breaks over them, probably a step towards $ 102,000 may be, while the inability to maintain pressure on the purchase can lead to a repeated test of $ 94,091.

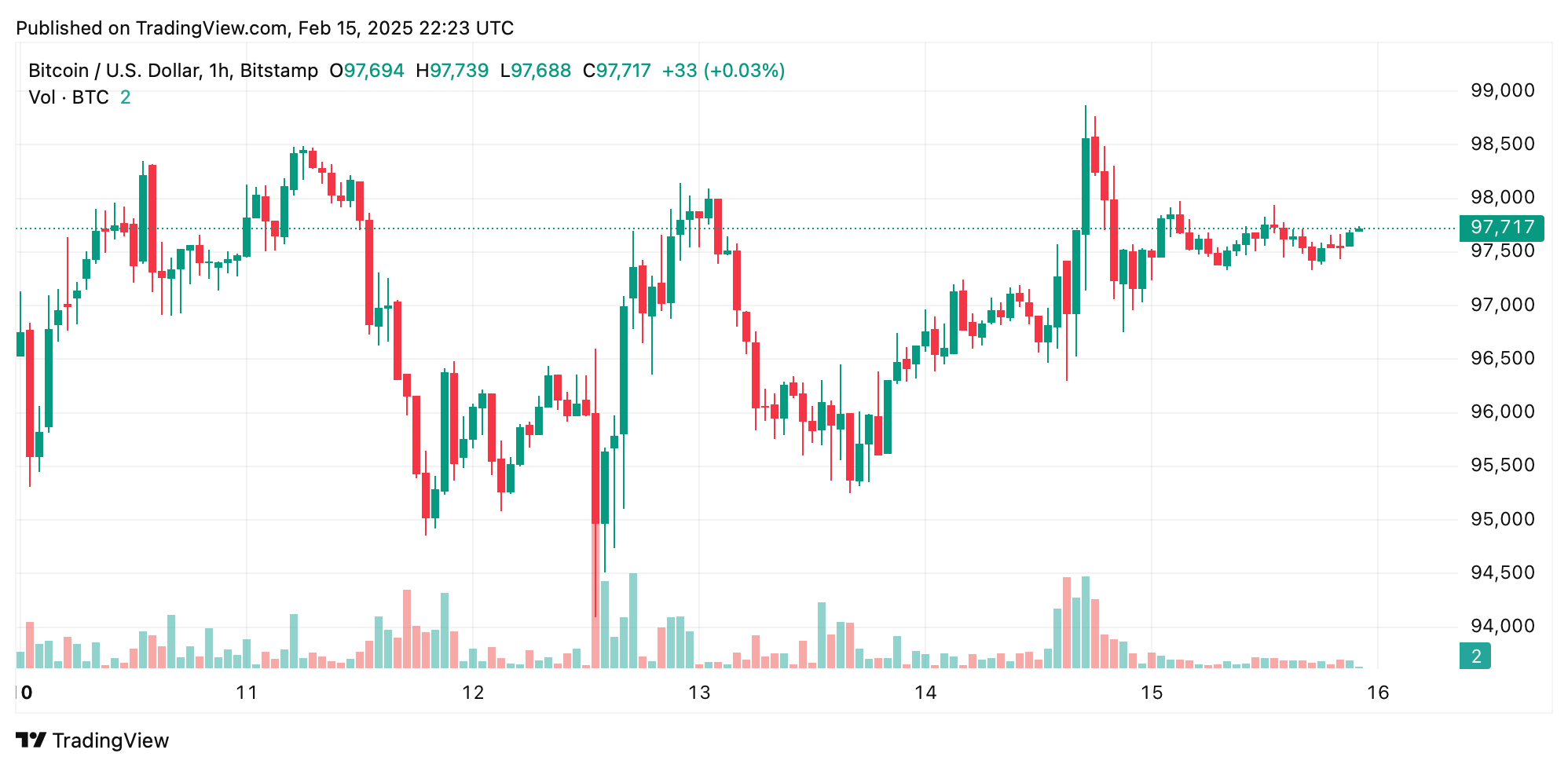

The same -sex Crypto Asset schedule currently reflects a short -term rebound of $ 95,249, and the resistance is $ 98,871. The volume has decreased, which implies price stagnation, and a break above $ 99,000 with a strong percentage of purchase can lead to an increase. Nevertheless, the lower maximums formed below 98,500 US dollars may indicate an impulse weakening. Currently, Fibonacci recovery levels in the clock card are allocated 50.0% of the recovery of $ 97,060 and 61.8% in $ 97,750 as key areas that can be observed with a break higher than potential signaling of bull duration, while the failure can lead to the fact that it falls near U.S.

The oscillator testimony is mixed this weekend, with the relative force index (RSI) in 47, a stochastic stance of 48, the commodity channels (CCI) on -37 and an amazing generator of -3.164, everything on the neutral territory. Nevertheless, the pulse of 1081 indicates an optimistic signal, while the level of divergence of convergence (MACD) from the average average (MACD) at -892 involves some bear.

Medium movements are also divided on Saturday, with an exponential sliding average (EMA) 10 at the price of BTC 97 516 dollars and a simple sliding average (SMA) 10 with a signal of $ 96,900, while EMA 20, SMA 20, EMA 30 and SMA 30 indicated negative signals. Long -term EMA and SMA for 100 and 200 periods remained optimistic, reflecting the main force in the Bitcoin price structure at present.

In general, Bitcoin’s price action remains at the critical stage, with key resistance levels of about $ 100,000, which determines its next direction. A breakthrough above this psychological barrier with a strong volume can push prices by $ 102,569 and higher, while the inability to maintain an impulse can cause re -testing of lower support levels of about $ 94.091.

Bull’s verdict:

The Bitcoin price structure remains untouched, despite the recent consolidation, with severe long-term support from the 100-period and 200 periods of the Middle Moving. A break above $ 100,000 with a sustainable volume can light a bull impulse up to $ 102,569 and potentially $ 105,035, which corresponds to the key levels of Fibonacci recovery. If buyers restore control, Bitcoin can enter the updated ascending trend, aiming at fresh maximums in the coming weeks.

Bear Verdict:

Due to the multiple deviation near the key levels of resistance and a decrease in volume, Bitcoin is faced with the risk of further pressure in the deficiency. The MACD remains in the bear territory, and the inability to break through over $ 100,000 can lead to re -testing of support of about $ 94,091, or even a fall in the US $ 89,164 with an increase in sales pressure. If Bitcoin is struggling to keep Fibonacci’s recovery by 50.0%, a deeper correction may be unfolded.