Intoleblock market reconnaissance platform showed how the largest bitcoins holders use pressure on the background of price reducing.

Bitcoin -Mega -Kits recently reducing their reserves

In the new post on X Intotheblock, he discussed the last trend in the supply of bitcoins held by whales. “Whales” are widely related to organizations that own more than 1000 cryptocurrency tokens.

At the current exchange rate, this amount turns into colossal 88.9 million dollars. The USA, therefore, the only investors who will have the right to cohort will be large money.

In the context of the current topic, focus holders are not just ordinary whales, but in fact the largest of them: those who carry more than 10,000 BTC ($ 889 million) in their balance sheet. This group can be called “mega -kits.”

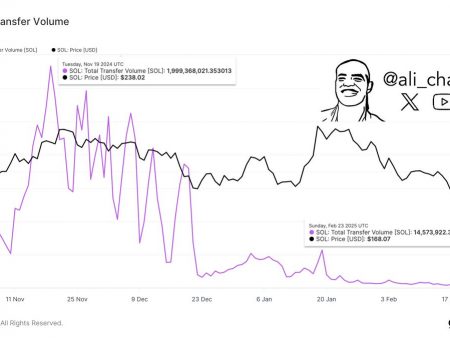

Now here is the diagram that shares the analytical company that shows the trend in the assets of Bitcoin -Mega -Kitov last week:

As shown in the above schedule, Bitcoin -Magi -Kits sold part of their offer during the accident in price. More interestingly, however, this is a detail that these investors have already begun their sale a few days ago, which is a potential sign that they saw how the price would come.

According to Intotheblock, this cohort was the main seller in this window. In fact, the analytical company indicated that the rest of the groups showed a combined accumulation at the same time, which means that smaller entities consider the fall as an opportunity to buy.

In total, the mega -Kits sold 25,740 BTC (almost 2.3 billion dollars) over the past seven days. Now in the coming days, the behavior of the cohort may consist to ensure that in the case of the rest of the market purchase, what these huge investors do, can be in one way or another to include to the Bitcoins balance.

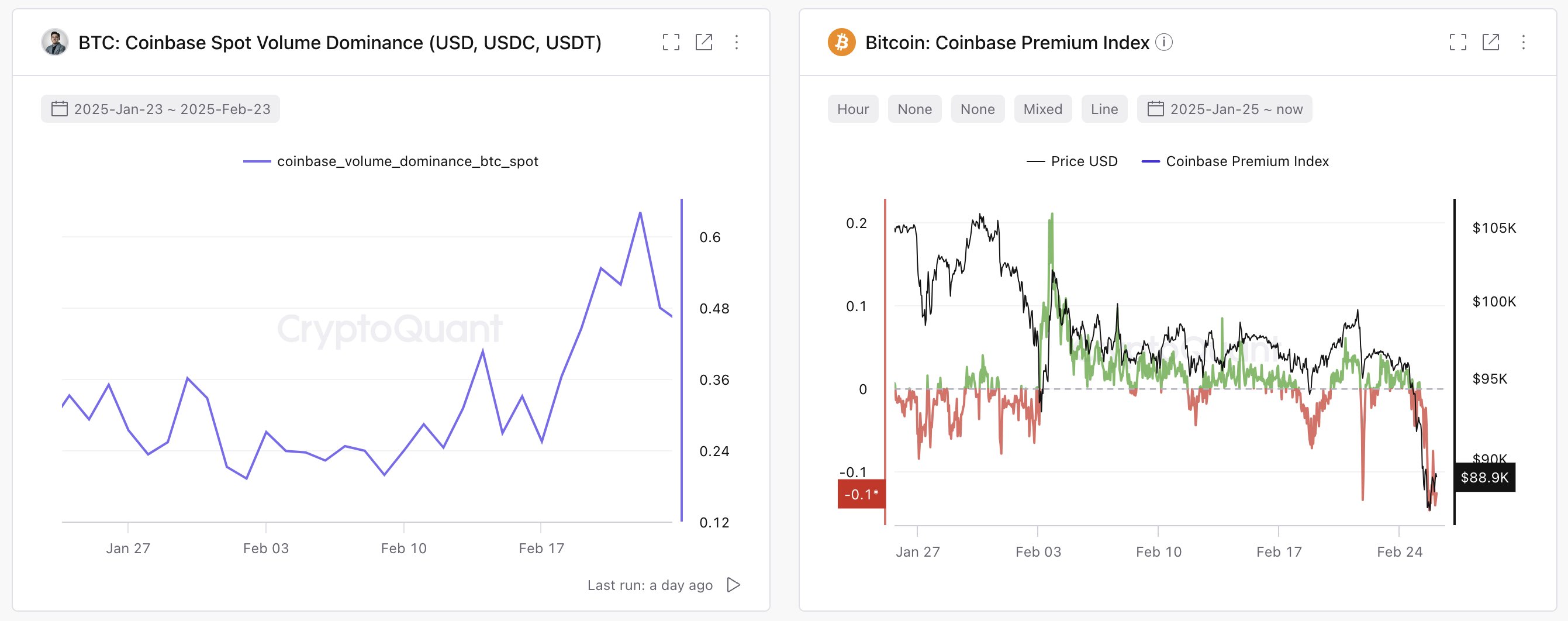

The balance of the holder is just one of the ways to classify the BTC cohort. The other is exchanges, since different platforms can place another demography of investors. In particular, two exchange, as a rule, is related to this type of analysis: Coinbase and Binance.

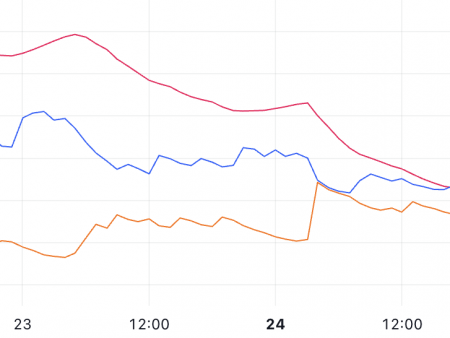

Coinbase is mainly used by organizations from the United States, especially large institutional merchants, while Binance serves global investors. An indicator that can be used to track the difference in behavior between two user bases is the premium -class Coinbase index.

This indicator measures the percentage difference between the price of bitcoins specified in Coinbase (USD pair) and on a bikant (USDT pair). As indicated in the post with Coinbase Premium, the premium -class index Cyptoquant and the general director of Ki Young Ju was negative.

This trend, along with the fact that the dominance of the point volume of Coinbase has recently grew up (left schedule), would suggest that American whales were the main drivers during the accident.

BTC price

Bitcoin approached the mark of $ 86,000 during yesterday’s fall, but since then the coin saw the rebound, since its price is currently trading about $ 88,700.