Bitcoin (BTC) is under strong sales pressure, losing the level of $ 85,000 just a few days ago. This gap pushed the market to the lowest levels since November 2024, increasing fear and uncertainty among investors. The whole crypto market fought, burdened from negative macroeconomic conditions and general shift in the field of risks.

The policy of US President Trump added to the volatility and instability, since the growing fears of the world trade war and unstable economic decisions continue to rattle investors. The US stock market fell to the lowest point from September 2024, which even more caused concerns that wider financial markets are wearing, dragging bitcoins and other cryptocurrencies with them.

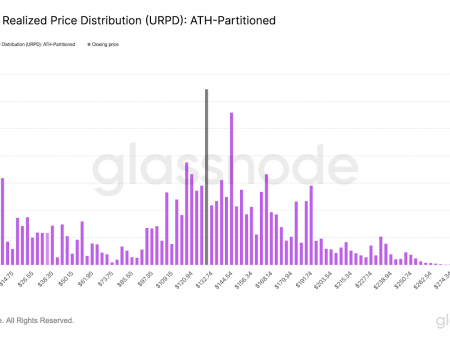

According to Glassnode, the Mayer multiplier suggests that the next level of key support for bitcoins costs $ 66,000. If the current sale continues, BTC can check this level in the coming weeks, noting a significant correction from its recent maximums.

With bitcoins at the decisive moment, traders and investors carefully monitor whether BTC can stabilize and restore key levels or, if a further drawback is ahead. In the coming days, it will be critical for the short -term prospects of Bitcoin.

Bitcoin fights below 200-day MA

Bitcoin has been in a consistent descending trend since the end of January, and fear dominates the mood of investors. Many now believe that the bull cycle is over, since the BTC continues to install lower maximums and violate the support levels of the keys. When installing pressure on sale, the market remains under the control of bearish, and lower investors set lower goals.

Since the elections in the United States in November 2024, macroeconomic uncertainty and volatility have been the main market factors. The growth in world trade tension, unstable economic policy and the shock of investors contributed to the expanded correction of Bitcoin. Due to the fact that the stock markets are also fighting, Bitcoin could not find the impulse necessary for recovery.

The leading analyst Ali Martinez shared information about X, emphasizing that Bitcoin is now trading below the 200-day sliding medium, key technical indicator, which often signals the long-term direction of the trend. According to Mayer Multy, the next large level of support costs $ 66,000. If the BTC cannot be stabilized above the current levels, further sales pressure can send bitcoin to this lower support area in the coming weeks.

To Bitcoin, in order to cancel their tendency to decrease, bulls must restore the 200-day mA about $ 83,500. A break and retention above this level indicate force, returning to the market and can prevent a further drawback. However, if the BTC cannot restore the impulse, fear and uncertainty will continue to reduce prices, which makes the next few weeks decisive for the Bitcoin market structure. Investors carefully monitor the price action, since Bitcoin remains at a critical point that can determine its medium -term trend.

BTC Eyes 85 thousand dollars. USA for recovery

Bitcoin is currently trading at 81,700 US dollars after the loss of 200-day sliding average (MA) in $ 83,450, which is a key technical level that previously supported its bull impulse. Since the BTC is now traded below this critical indicator, the market remains under bear pressure, and traders carefully monitor the signs of potential changes.

In order for the bulls to restore control, the BTC must restore the mark of $ 85,000 in the coming days. A strong impetus above this level will indicate an updated percentage of purchase, which potentially prepared the soil for the restoration rally. However, if the BTC cannot exceed 85 thousand dollars. USA, the market can see further pressure down.

If the BTC decreases below the range of 80,000–88,000 US dollars, this will increase the likelihood of a decrease in the following main support levels at the level of 75,000–72,000 US dollars. Such a step will strengthen bearish feelings, delaying any chances of a significant recovery in the near future. The next few trading sessions will be crucial, since Bitcoin remains in a vulnerable position where the restoration of key levels is inevitable or deeper correction.

Dall-E shown image, TradingView diagram