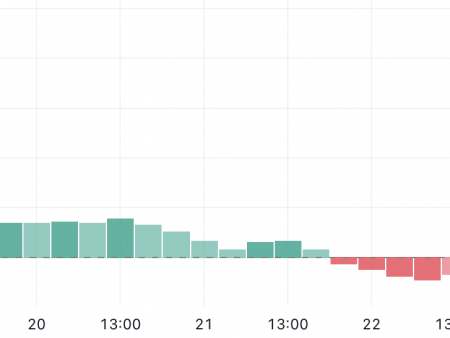

Bitcoin (BTC) fell by more than 7% in one day, decreasing to $ 87,000 on February 25, which is at the lowest level since November 2024. A sharp decrease pushed BTC into a critical risk zone, fueling the assumptions about whether the destruction is temporary or signals a deeper correction.

In this context, Crypto -Analytic Rend I highlighted new price levels that can potentially consolidate the next serious step of Bitcoin.

Technical analysis: the levels of the price of bitcoins of the key to watch

According to the analysis, Bitcoin checks the key support range from $ 89,400 to $ 90,000, which can determine its next serious step. The analyst notes that both the daily and weekly time frames of the BTC remains in global consolidation, with a zone of $ 90 to $ 91,000 as a strong level of support.

In a shorter time, Bitcoin is soared near the support of local channels, which makes this decisive area for traders. If the bulls hold the zone from 89,400 to 90,000 dollars, BTC can arrange a rebound of $ 94,000.

However, if the level fails, the breakdown below 89,400 dollars can accelerate the pressure on the sale and open the door for further losses.

The recent pricing action shows that BTC violated the key key support below, campaigning the previous bull structures and indicating deeper repeated data. Nevertheless, the first cryptocurrency has since then recovered, bargaining at 89,040 dollars during printing.

The analyst indicates the resistance levels of $ 94,800 and $ 99,200, while immediate support remains at the level of $ 91,280 and 89,400 US dollars. The market is currently observing the next direction of Bitcoin, while stabilization is considered higher than critical support levels as a key factor in restoration of pulse.

Despite the uncertainty of the market, the founder of MN Capital Michael van de Poppe He noted that the area of 83,000 to 87,000 dollars may represent the “final lower case” before the BTC begins to rotate up into the new bull phase.

Bitcoin prices analysis

During the press, Bitcoin traded at the level of $ 89,014, which amounted to one -day loss of more than 7% as an increase in the pressure of the sale.

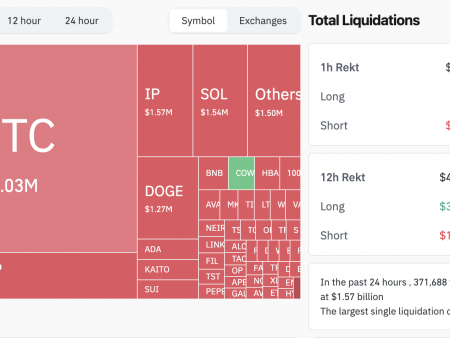

The decrease follows a constant outflow from the American bitcoin-fifth ETF, and on February 24 it records one-day outflow of $ 516.4 million. The USA, which coincides with the updated tariff threats of Donald Trump.

Market moods remain largely bearish, and traders carefully monitor whether BTC can stabilize above critical support levels or encounter a further drawback against the backdrop of growing economic meetings.

Reflecting the worsening mood, the crypto -insurance index and greed fell to “extreme fear”, signaling the increased alarm of investors and the potential to increase volatility in the near future.

Shown image through Shutterstock