Since geopolitical events reduce the pressure of both traditional and digital markets, bitcoin exhales with relief. Trade uncertainty caused a period of volatility, but a significant 90-day tariff pause on important technological import accelerated the restoration. After lifting to the local maximum of $ 85,000, Bitcoin may soon surpass the long -awaited stage of $ 100,000.

Since imports of more than 390 billion dollars are currently exempted, the markets considered this as a positive indication. Important technological elements, such as computers, smartphones and semiconductors, were excluded, which is also a positive development for the cryptocurrency industry.

The stop allows technological hippos such as Apple and NVIDIA, to avoid raising prices and failures that would be set with high tariffs. In fact, in accordance with previous political analysts, they warned that the iPhone could cost up to $ 3,500. Removing this risk caused a surge in bitcoins and joint -stock markets. During a tariff suffering only Apple, a reduction in the market value of more than $ 640 billion, which influenced more risky assets, such as cryptocurrency.

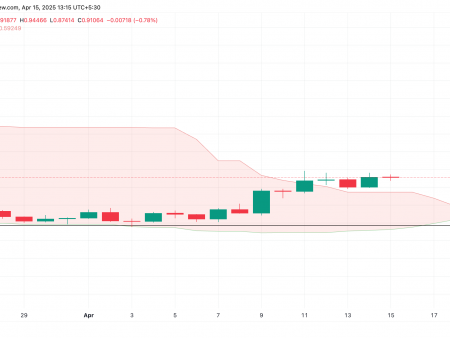

At the level of 84.08 billion dollars, Bitcoin also recorded the highest weekly bidding in 2025. The revival of the activity indicates that investors are confidently returning. With RSI in 51 and BTC, technically, as above 200 EMA, there is still a place for growth. Another important consideration is a quiet, but powerful fair wind of the release of computer and semiconductor components.

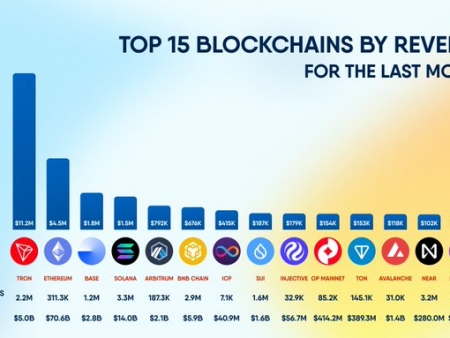

These elements form the cornerstone of blockchain technology and cryptocurrency mining. From the mining installation to the platforms of smart contracts, the basis of the cryptocurrency remains untouched and can become more affordable, since production, as predicts, will remain a stable and reasonable price. Given all the circumstances, Bitcoin has a place to expand during this 90-day lull. Bitcoin can have a more obvious path to $ 100,000, if the macroedes remain the same.