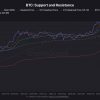

The recent journey of Bitcoin (BTC) Price was bumping, and its cost saw a rollback up to 93.5 thousand dollars. USA. This leads to focusing a critical level of 91 thousand dollars. The United States, which serves as average for short -term owners.

BTC Price receives a blow

Currently, Bitcoin’s ability to maintain above this price is crucial to maintain a bull mood that permeates the market. If this level is held, it can restore trust among investors, potentially preparing the soil for recovery.

Nevertheless, those who bought in or above 100 thousand dollars are now faced with unrealized losses. The decision of this group will conduct or sell it to the key. If they decide to unload their assets, we will be able to see the increased pressure of sales, which can further reduce prices.

Conversely, their decision to resist can help stabilize the market, which allowed bitcoins to consolidate and, possibly, retreat back. The stability of the support level for 91 thousand dollars is closely attention. If this support is preserved, this can strengthen the trust of investors, perhaps initiating the recovery stage.

Currently, BTC continues to vary, since it is traded above 96 thousand dollars. USA after this fall. But if this fails, BTC can find itself testing the following significant support at the price level, which is gradually lower, which indicates potential places for an updated purchase based on historical behavior.

Violation below 91 thousand dollars. The United States will probably lead to further corrections, checking lower supports at about 70 thousand dollars, as shown by historical realized prices. This can verify the power of the market and the determination of long -term holders, which may lead to the bear.

Future BTC Price movements were significantly dependent on its ability to keep at 91 thousand dollars. USA. Successful retention can lead to market stabilization and gradual restoration to levels above 100 thousand dollars.

Nevertheless, the failure of this test can cause a decrease in a sharper decline, challenging the conviction of long -term holders and setting a bearish tone for the market.

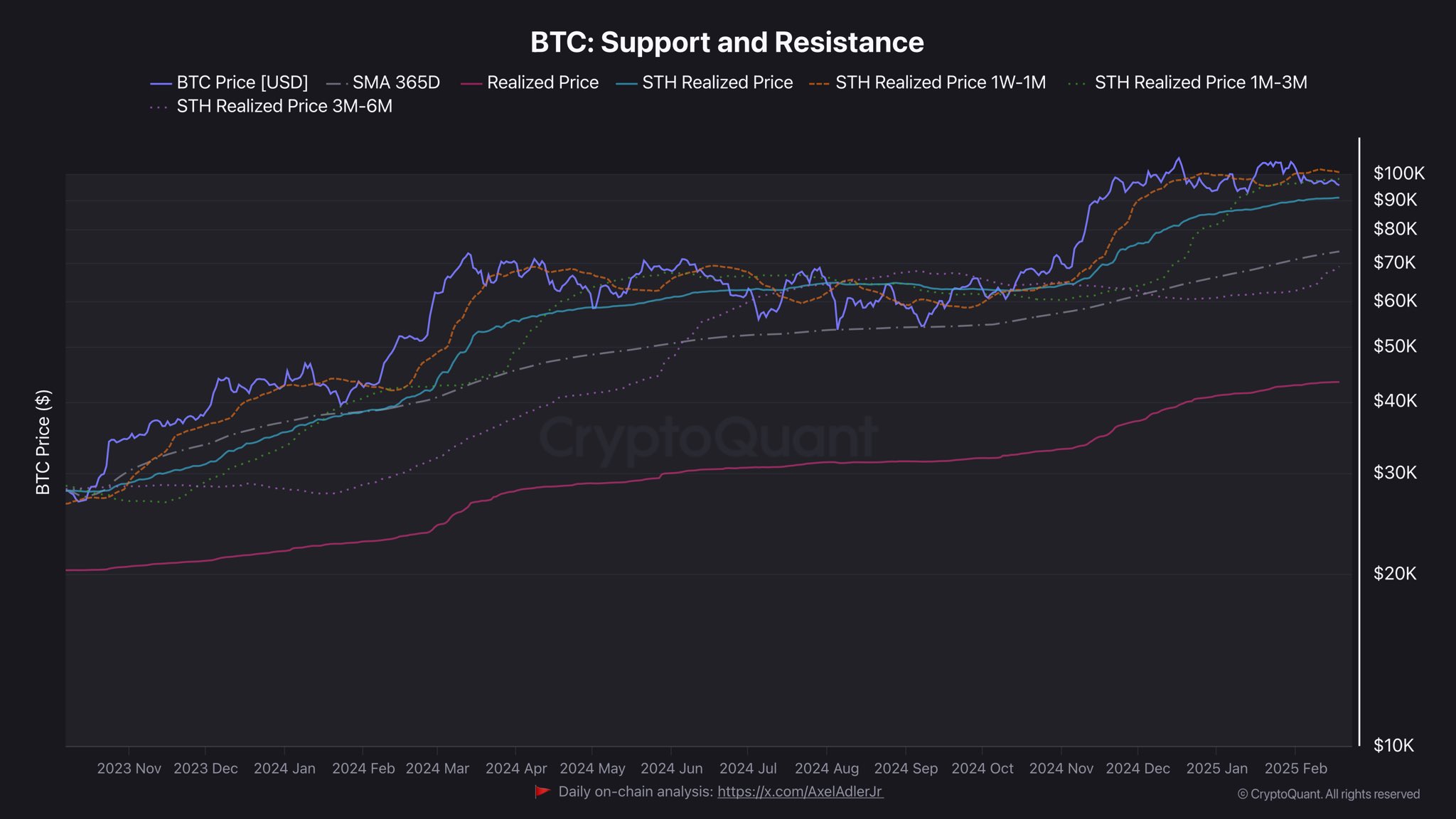

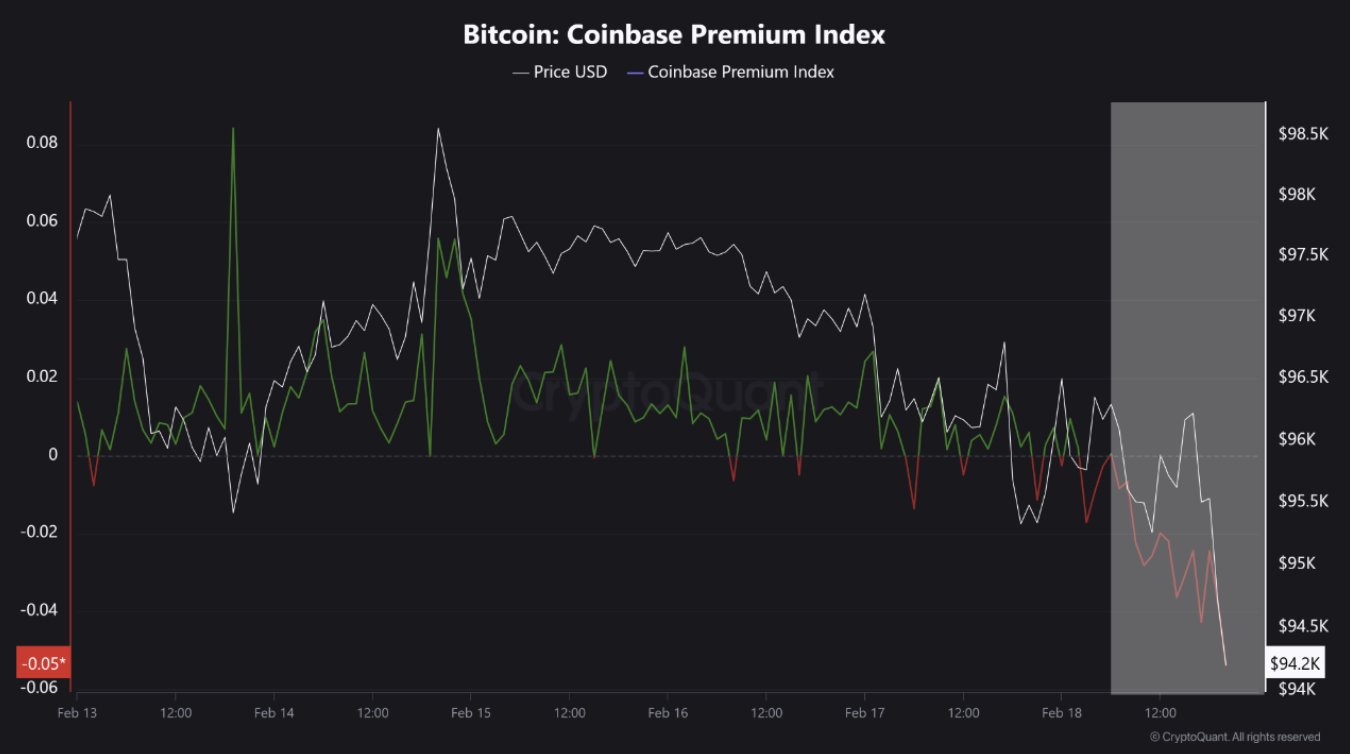

Bitcoin -Monetary Premium Class index

The further assessment of the Coinbase Premium premium index, which measures the price difference between the bitcoins on Coinbase and its price on Binance, took over immediately after the opening of the US markets, which indicates volatility.

This sudden fall, from almost zero to -0.05, reflected a shift in trading behavior, which suggests that the traders on Coinbase unload bitcoins at lower prices compared to Binance.

As the index fell, and the BTC price falling from $ 96,000 to U.S. to $ 94,200. This suggests that the demand for BTC and other cryptography was potentially low because of a fall in prices in a wider market.

This negative award is a red flag, hinting that the mood of the investor on Coinbase has become bearish, probably affecting a wider market. If this trend is preserved, Bitcoin may encounter further decrease, since confidence will decrease.

However, if the bonus returns to the positive, this may indicate a softening of sales pressure, potentially stabilizing or even increasing the price of bitcoins.

This index can offer key information about market moods and upcoming prices for BTC. This can make it a critical indicator for traders that control the dynamics between the exchange.