This is a segment from a forwarding information ballot.

Since Covid closed the global economy in 2020, evaluating where we are in the business cycle was a very difficult act.

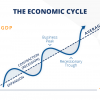

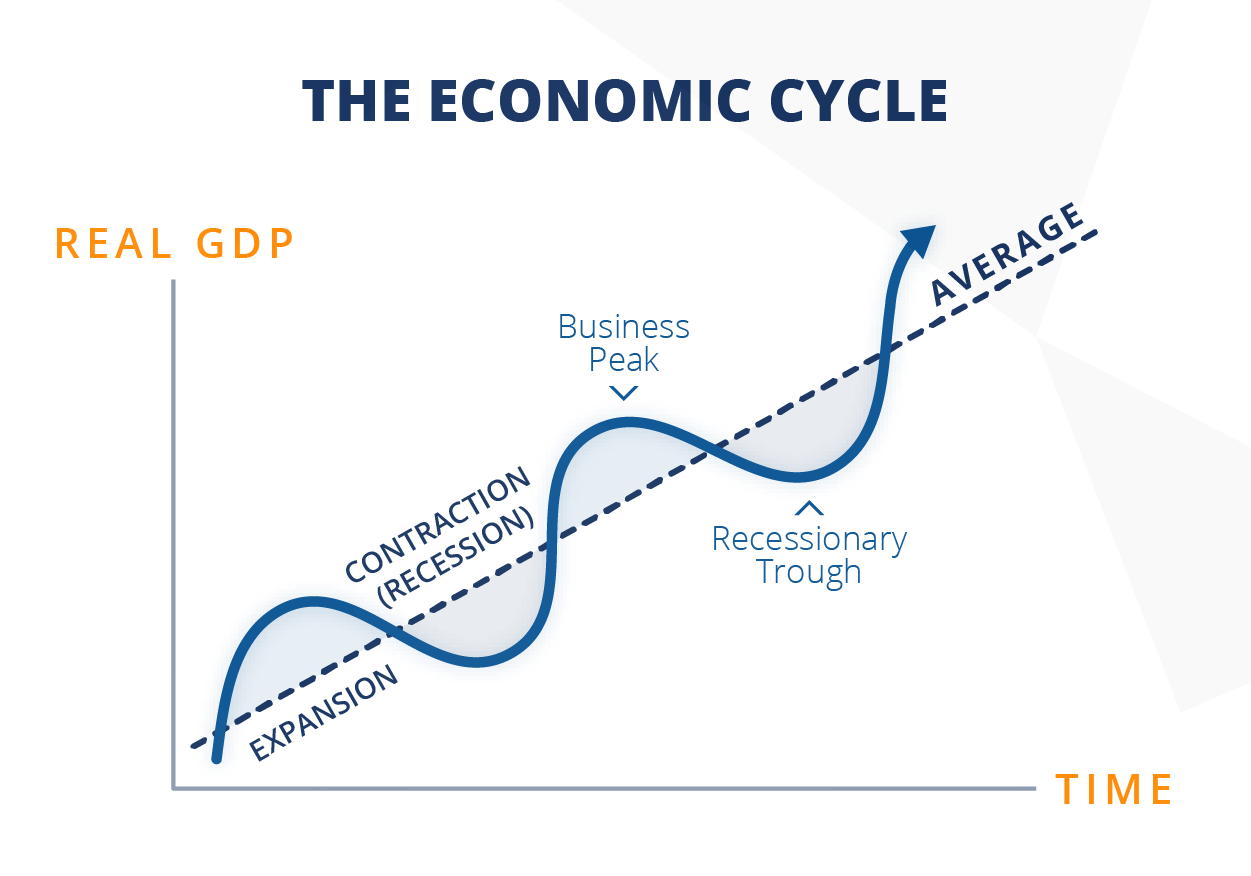

A typical business cycle looks as follows, and historically it was quite easy to have a general idea of where we opposed it with interest rates and monetary policies:

Nevertheless, in recent years, everything has been a little with their heads, as a result of which many economists starred.

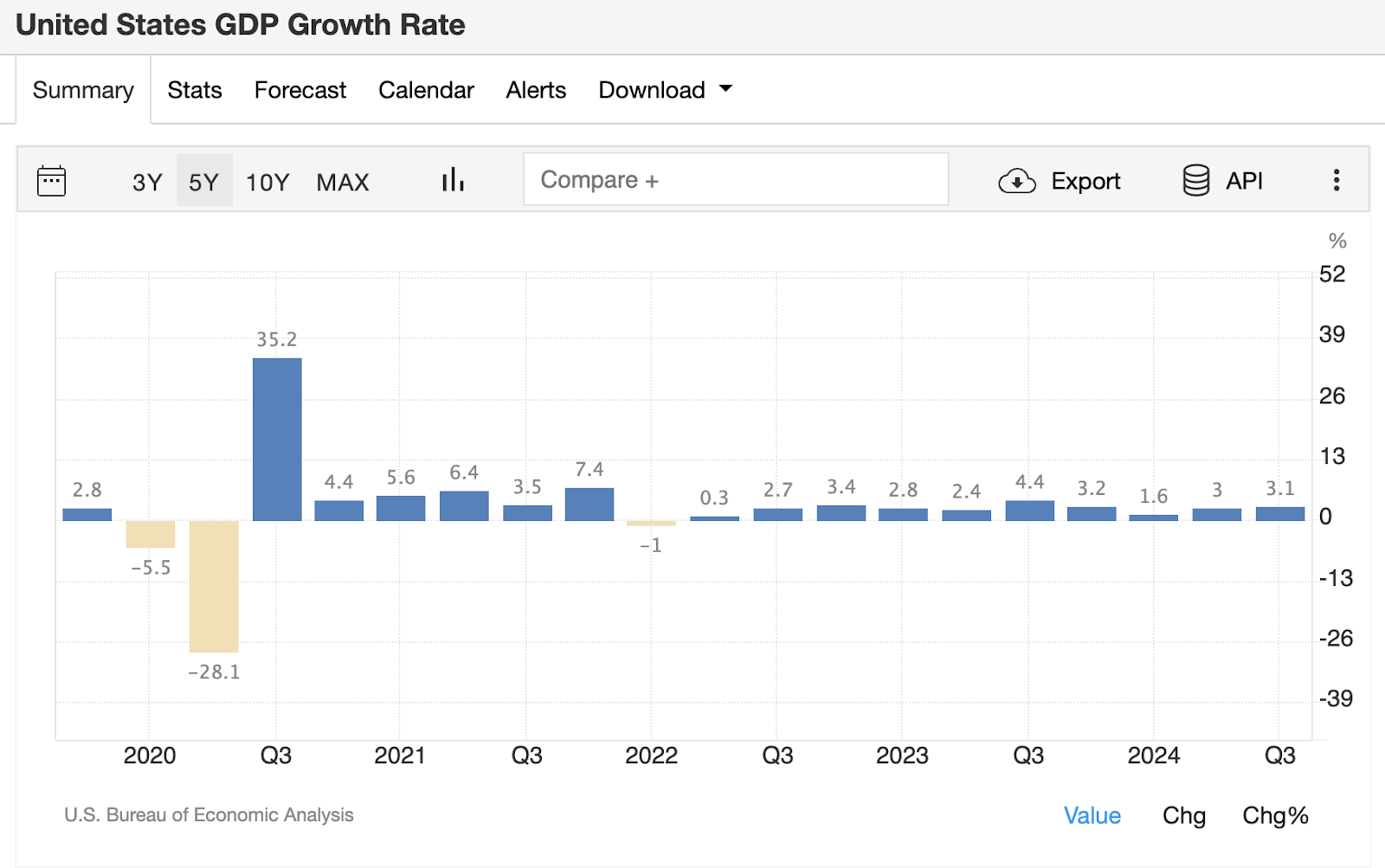

For example, in 2022 we saw negative real prints of GDP (initially at two, but then revised to one):

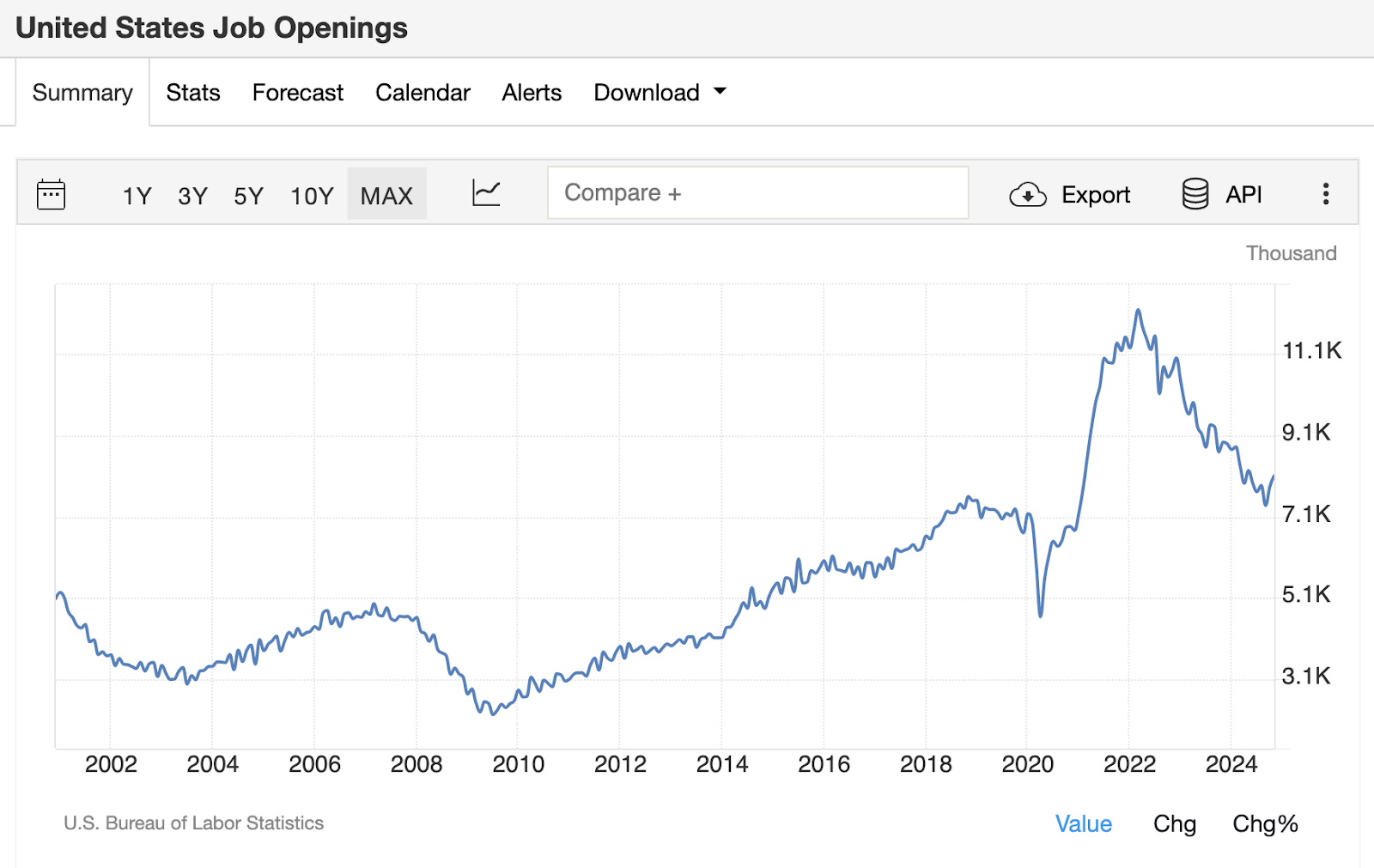

However, at the same time, we saw one of the hottest labor markets that we when we saw, according to Jolts.

It is hard to believe in a recession with such a strong labor market:

Since 2022, we have seen the main tariff cycle of hiking tourism from the Fed, which in some way also did not tilt the economy into a recession when I looked at it on a total basis. The shares reach new maximums every day, the labor market was cooled, but remained stable, and GDP growth was promoted forward.

However, at the same time, if you have pushed into the production and goods sector and canceled the services economy, it seems that we had just held a production recession.

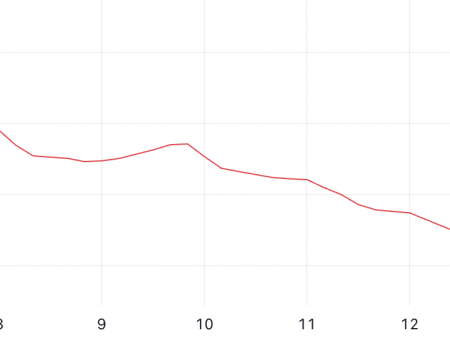

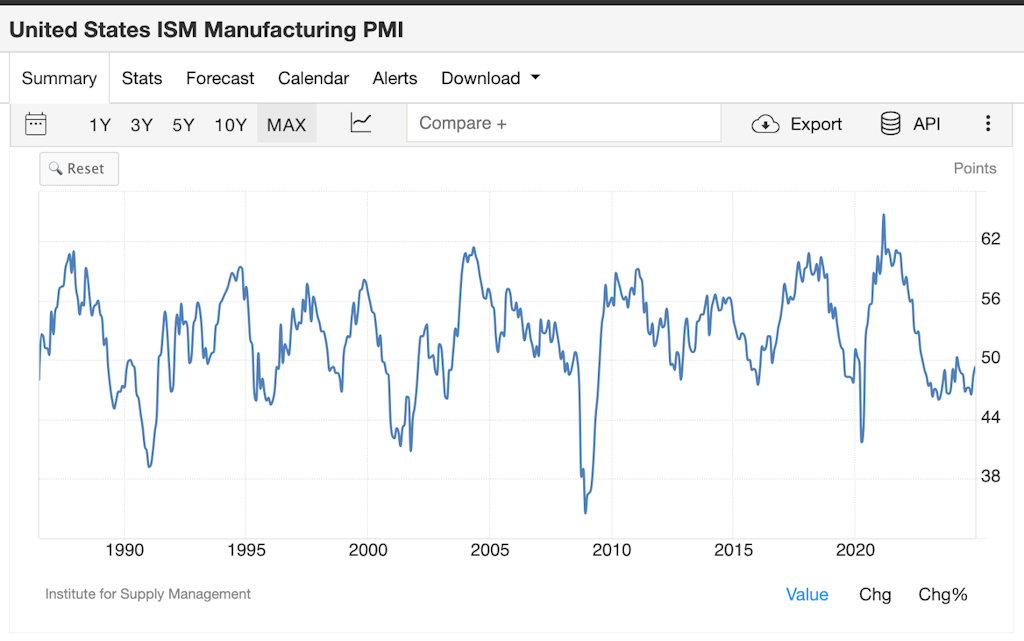

PMIS ISM PMI production has been on the territory of the reduction for a couple of years:

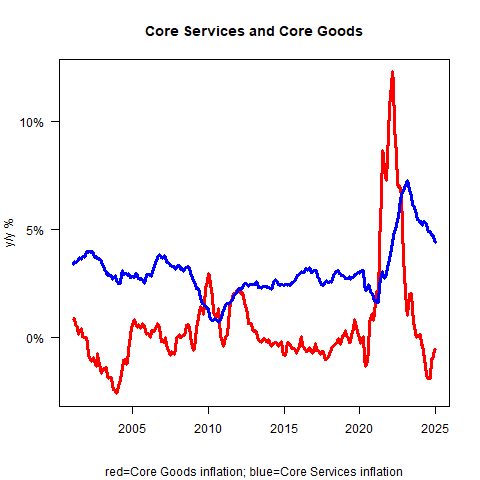

During this time, we saw significant disinflation leading to direct deflation in the sector of economics:

We will move to today, and we saw how the Fed reduces the rates in order to withstand fears about the labor market and continue to try a soft landing of the economy, where we go to a new business cycle without recession.

Now we see the leading indicators hinting that the production sector can leave Doldrums and go to a new rise.

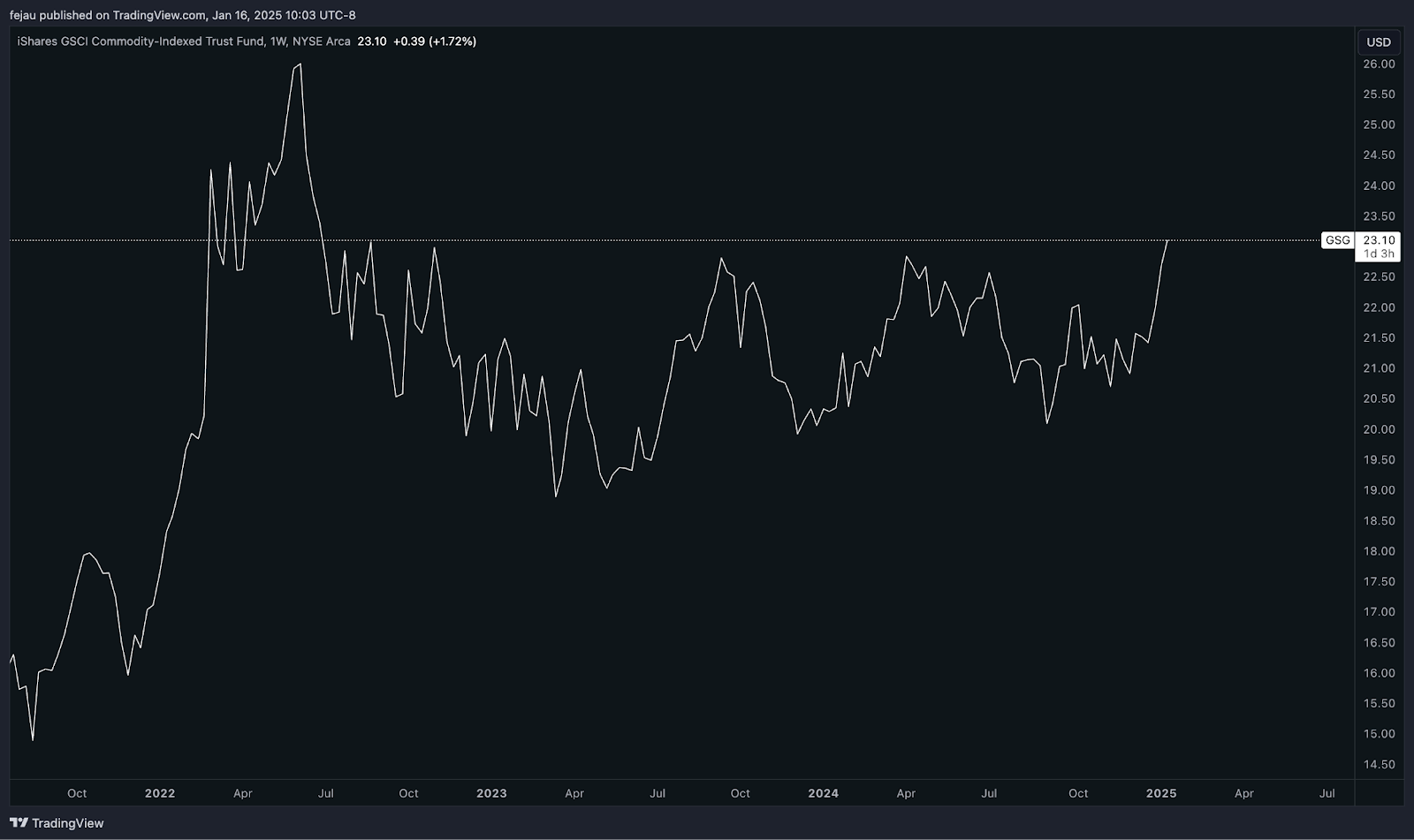

We begin to see how the goods begin to burst after two years of consolidation, hinting at increasing economic growth:

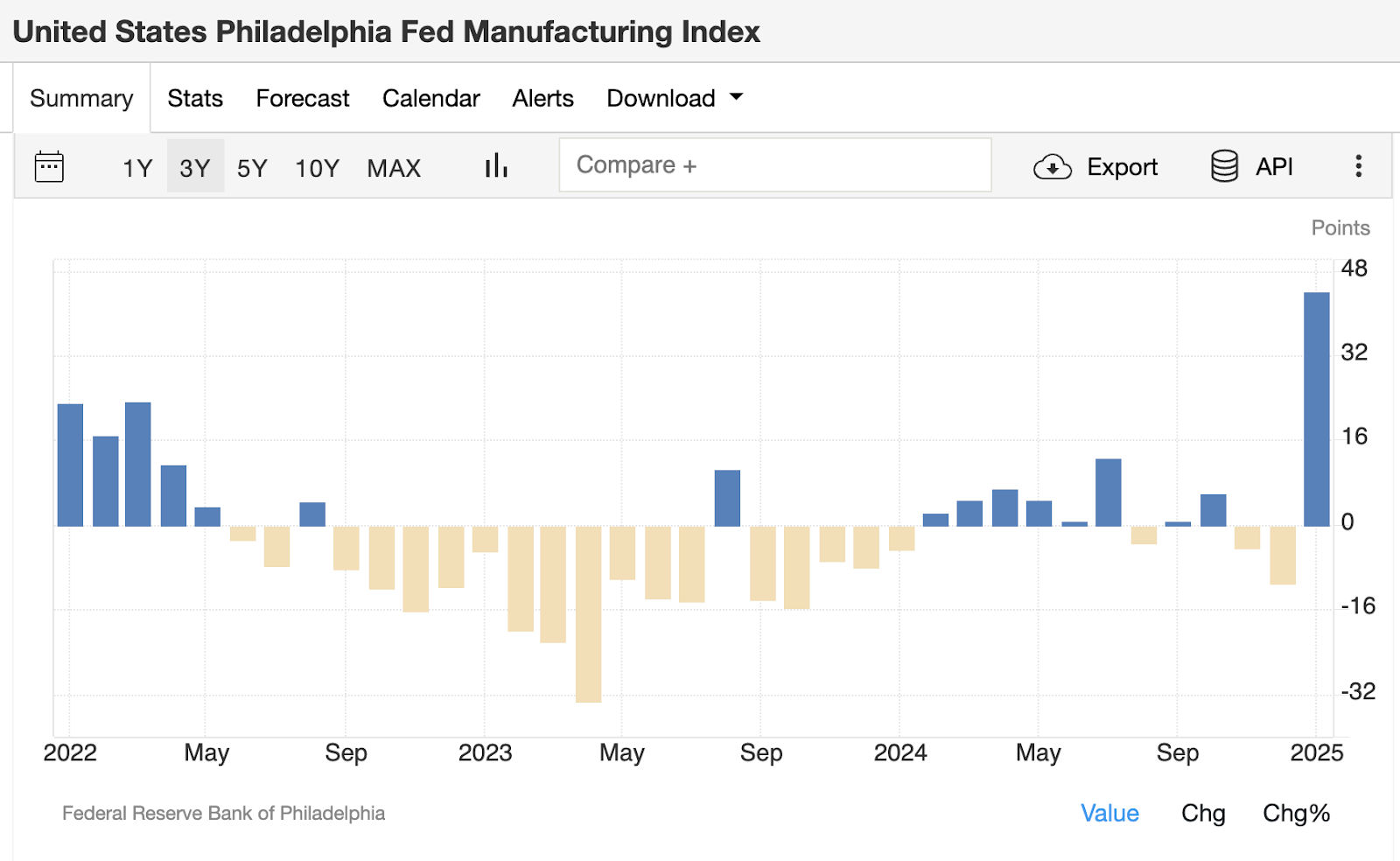

New ISM orders, by the same, fail, as well as the Philly Fede production index:

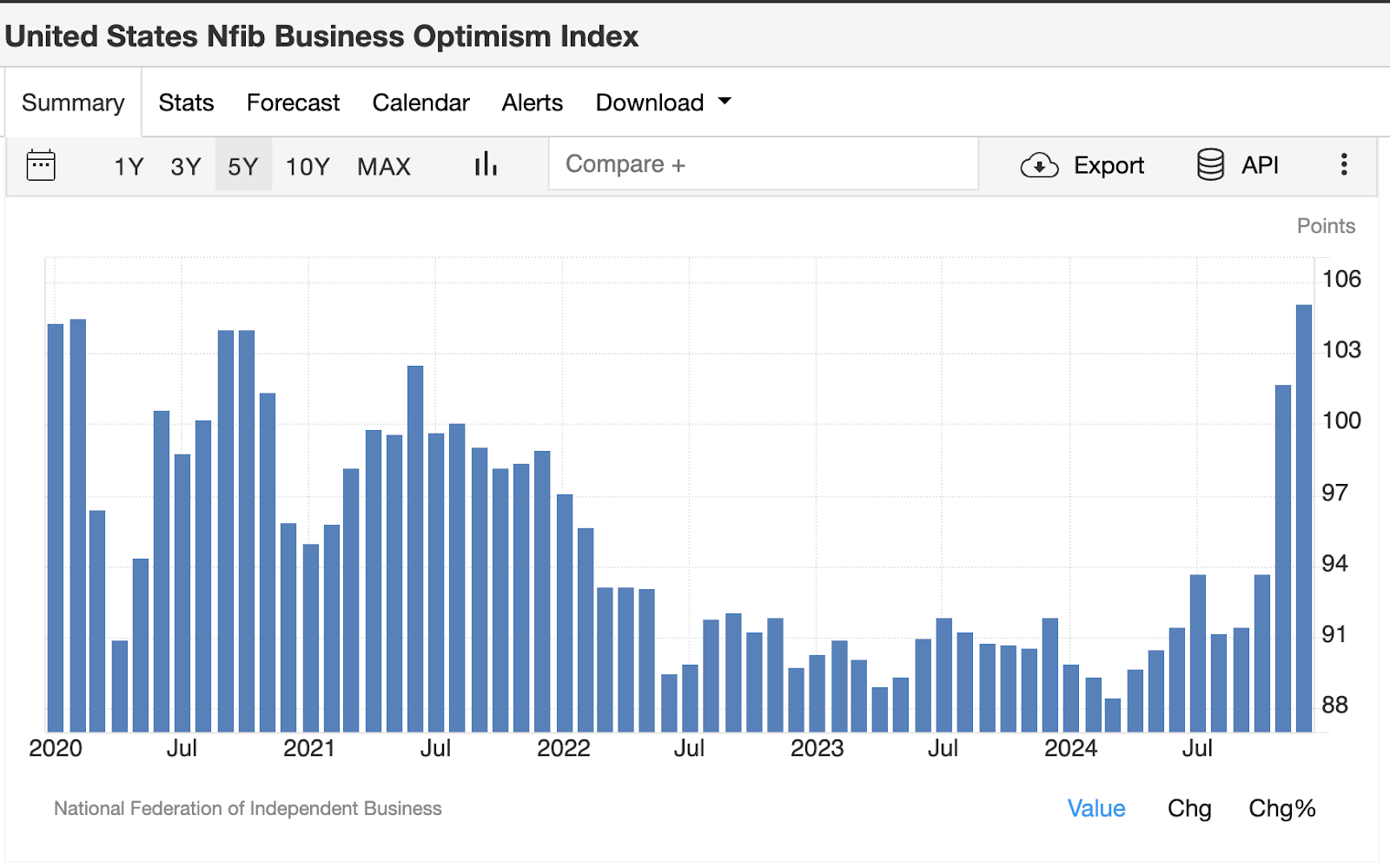

According to the survey, it looks as if many of this lead optimism from a business sector from the moment of the election:

So where does this journey lead us on schedule?

I think we can say with confidence that we were not late for the cycle. It seems that we are actually in the early presentations of the new business cycle, which avoided recession from a huge financial stimulus and deficit over the past few years.