Following Nvidia’s (NASDAQ: NVDA) recent earnings report, in which CEO Jensen Huang and CFO Colette Kress discussed demand for their company’s artificial intelligence (AI) chips, Blackwell’s plans, and more, Wall Street analysts have begun to revise their price targets for Nvidia stock.

Indeed, Nvidia delivered an earnings report that beat expectations, saying the semiconductor giant’s data center sales more than doubled in the second quarter from a year earlier to hit a new record, and Huang called Blackwell a “complete game changer for the industry.”

Nvidia Stock Prediction From Wall Street

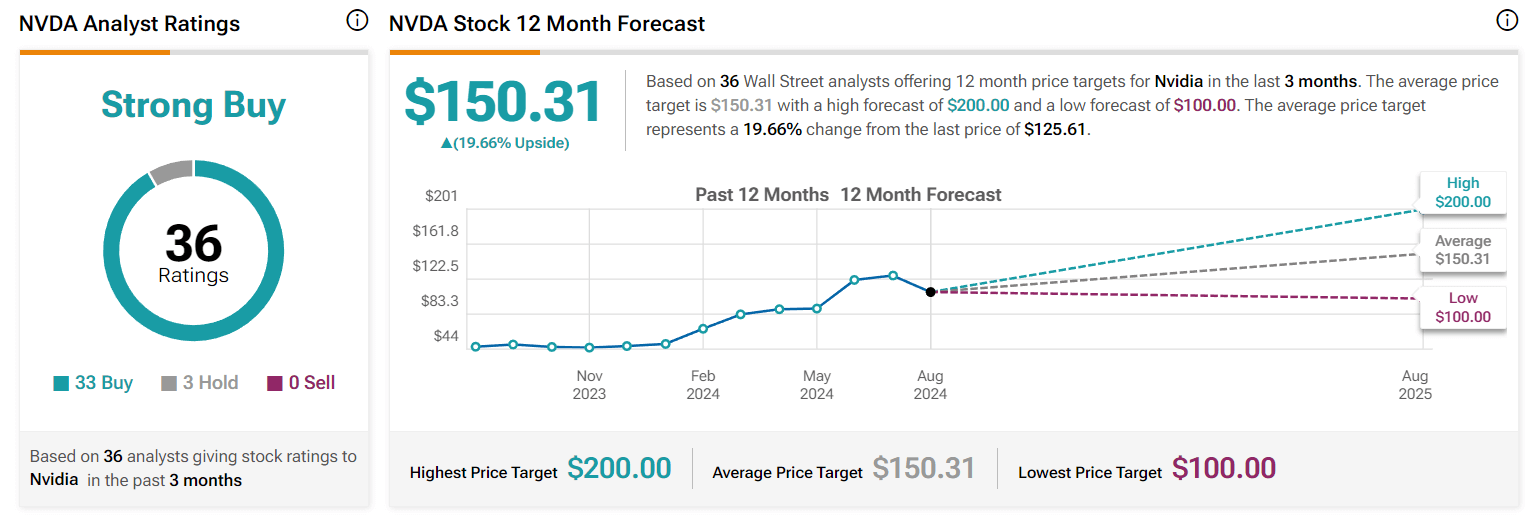

In this context, Wall Street experts have begun to update their price target for Nvidia shares, with the average target price now standing at $150.31, implying an upside of 19.66% from the price at press time, maintaining a “strong buy” rating, according to the latest data. TipRanks data as of August 29.

At the moment, the minimum target price for Nvidia stock is $100, which is 20.39% lower than the current Nvidia stock price, while the maximum recommended price for the next 12 months is $200, which is 59.22% higher than what is indicated in the data.

Among the analysts who have revised down their Nvidia stock price targets is Bernstein, whose research experts increased their NVDA forecast from $130 to $155, while maintaining an “outperform” rating, as they emphasized that Nvidia continues to meet high expectations with clear prospects for consistent data center growth.

Additionally, Bernstein analysts emphasized their expectation that the introduction of “several” billion dollars of additional revenue from Blackwell in the fourth fiscal quarter will support continued strong sequential growth, as well as the expectation that Hopper’s architecture will maintain its sequential strength.

Meanwhile, analysts at Citi (NYSE: C) commented on Nvidia’s results and non-GAAP gross margin forecast of 75.0% as better than expected, thanks to “robust AI demand,” while Wells Fargo (NYSE: WFC) raised its price target from $155 to $165, urging investors to “buy the pullback.” As they explained:

“We find it difficult to see the negatives in NVDA’s F2Q25 report, F3Q25 guidance and/or Blackwell’s forward-looking commentary on the cycle.”

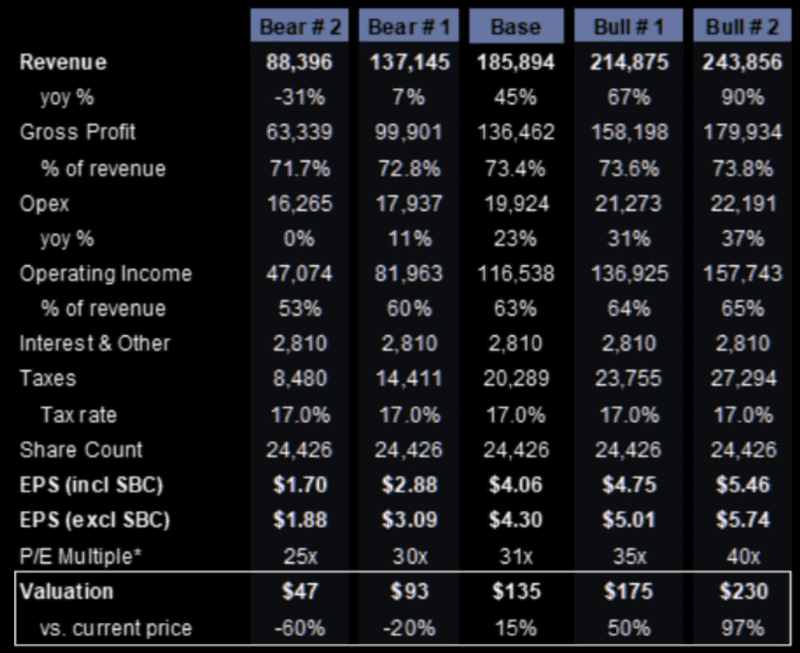

Goldman Sachs (NYSE: GS) analysts have laid out five potential scenarios for Nvidia shares, suggesting a minimum target of $47 and a maximum of $230, with a “base” target of $135, according to data provided by Histogram in post X from August 29.

Nvidia Stock Ratings Supported

Meanwhile, Barclays analyst Thomas O’Malley maintained a “buy” rating on Nvidia shares with a $145 price target, along with KeyBanc’s John Wein, who also maintained a “buy” rating and set a $180 price target. However, Piper Sandler’s (NYSE: PIPR) Harsh Kumar cut it to $140, though he reiterated his “buy” rating.

In addition, TD Cowen analyst Matt Ramsey maintained a buy rating with a $165 price target; Oppenheimer’s (NYSE: OPY) Rick Schaefer also reiterated a buy rating with a $150 price target; and Morgan Stanley’s (NYSE: MS) Joseph Moore joined in, maintaining a buy rating and setting a $150 price target.

Nvidia Stock Price History

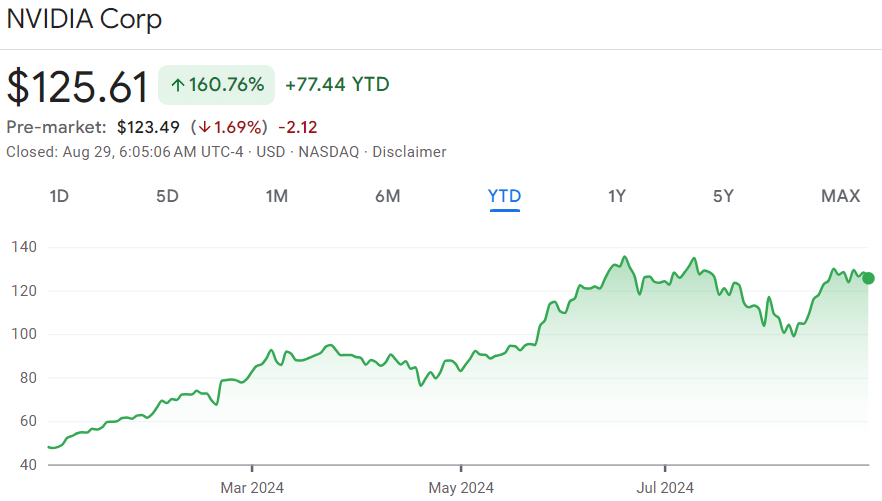

Nvidia’s stock price is currently at $125.61, down 2.10% on the day and down 3.37% on the week, while still up 12.56% on the month and accumulating 160.76% year-to-date (YTD) gains, according to the latest data obtained by Finbold on August 29.

So, why are Nvidia shares down today? Clearly, Nvidia’s better-than-expected results weren’t good enough to lift its stock price, and the answer to the question “why are Nvidia shares down?” may lie in investors’ concerns that Nvidia has gone too far, too fast.

All things considered, Wall Street’s outlook for Nvidia stock is generally bullish, but doing your own research, including monitoring Nvidia’s stock price history and any related news, is critical when investing, as stock market trends can change quickly and easily.

Buy Stocks Now with eToro – The Trusted and Advanced Investment Platform

Disclaimer: The content of this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.