- Ripple’s stablecoin is set to launch in the next few weeks, according to CEO Brad Garlinghouse.

- The analyst believes that RLUSD could benefit XRP due to the stablecoin’s transaction activity.

- XRP is trading at $0.53, slightly correcting on Tuesday.

Ripple (XRP) recently announced the launch of its stablecoin project Ripple USD (RLUSD). In an interview at Korea Blockchain Week in the first week of September, CEO Brad Garlinghouse said that the asset will be launched in a few weeks.

XRP is trading at $0.5387 and traders are eagerly awaiting the RLUSD launch date.

Daily Market Drivers Digest: Analyst Predicts XRP Will Gain From RLUSD

- The crypto analyst behind the handle X @Sentosumosaba claimed in a recent tweet that Ledger’s native XRP token would benefit from the launch of Ripple’s stablecoin.

- The launch of RLUSD could benefit the altcoin as it will encourage more activity on the ledger and XRP is a gas token.

- The analyst expects XRP to rise due to increased demand for the altcoin.

Just like #ETH is used for gas, #XRP is also used for gas (among other things). Since the SEC documents explained that ODL is price neutral, move as many stablecoin gas transactions as possible to the #XRPL mainnet. Trillions, please.

Any currency would be good.— Crypto Eri Carpe Diem (@sentosumosaba) September 8, 2024

- While on-demand liquidity provided to institutional investors typically does not impact the price, demand for the gas token could be a catalyst for growth.

- During a fireside chat at Korea Blockchain Week on September 4, Brad Garlinghouse said that Ripple’s stablecoin launch is just a few weeks away.

- CTO David Schwartz recently tweeted to crypto market participants that RLUSD will be available exclusively to institutional clients, comparing it to Circle’s stablecoin, USD Coin (USDC), and Tether’s USD Tether (USDT).

Technical Analysis: XRP Corrects Slightly on Tuesday

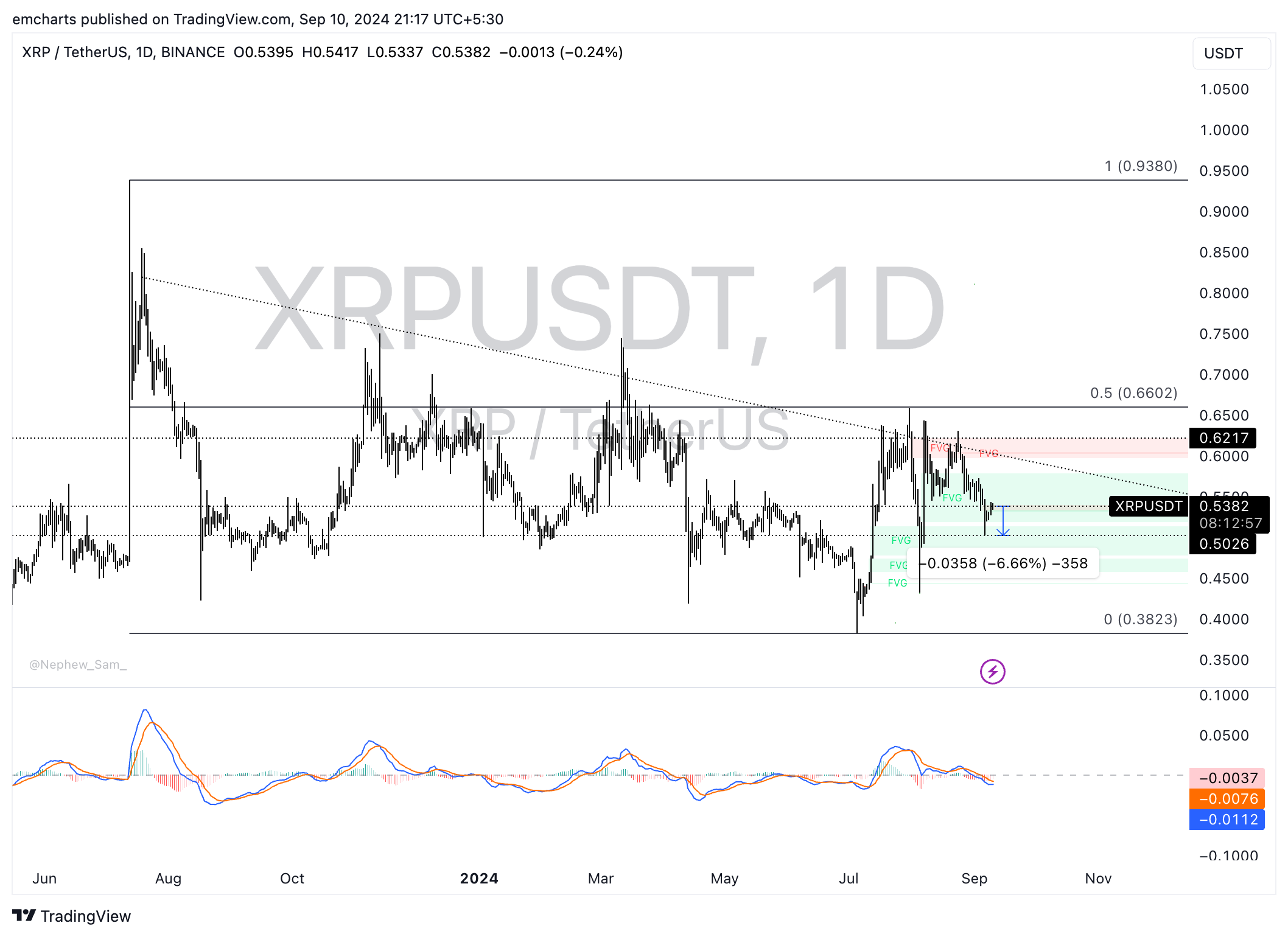

Ripple is currently in a downtrend. The altcoin could extend its losses to the September 6 low of $0.5026. This would represent a 6.7% drop in XRP from the current price level. The moving average convergence divergence (MACD), a momentum indicator, supports the bearish thesis.

The red histogram bars below the neutral line on the MACD indicate underlying negative price momentum in XRP.

XRP/USDT Daily Chart

A daily candle close above $0.6000, a key psychological level for XRP, could invalidate the bearish thesis. XRP could target the upper end of the fair value gap (FVG) at $0.6217, the altcoin’s July 31 low.