Orientation of the XRP on fast, inexpensive transactions made it one of the leaders in digital currency when it comes to the utility. At the time of writing, the XRP is the third largest cryptocurrency in the world with market capitalization.

To load, the statement of President Trump on March 2 on the strategic crypto reserve included a bull catalyst – since the XRP should become part of the reserves.

This announcement lit a surge in the cryptocurrency market. However, on March 4, the introduction of tariffs for China, Canada and Mexico caused sales on the market-and followed the drop in the price of XRP.

Despite the fact that on March 2, about 15%, the US dollars reached on March 2, it reached March 2, XRP coped with the last rollback relatively well. Prices fell to $ 2.26, but quickly set the restoration.

According to the print time, token passed into his hands to $ 2.49, which marks 5.67% growth in a daily diagram that brought annual (YTD) profitability up to 20.41%.

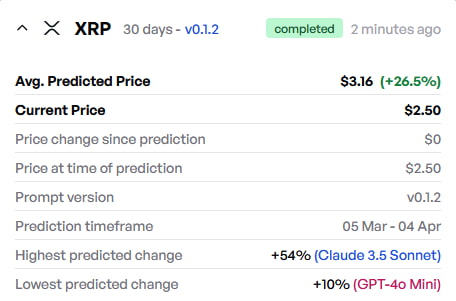

With all this in mind, Finbold consulted with his own tool for predicting artificial intelligence prices (AI) for a balanced review of what prices can reach XRP by the end of the month.

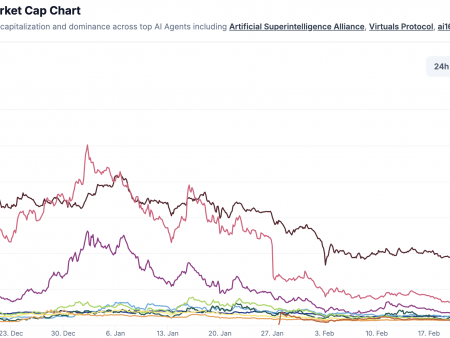

Models of artificial intelligence set bull goals at the price of XRP March 31

Studying technical indicators and market data, four large language models (LLMS), requested on the topic, set an average target price of $ 3.16 for XRP by the end of the month. If you meet, this forecast will be equated to 26.5% rally from current prices.

The Bully target price was set by the Claude 3.5 sonnet from Anpropic, which expects a digital asset to see an increase of up to $ 3.85, which implies 54% of growth from prices at the time of publication.

Claude 3.5 referred to a strong ascending trend, demonstrated by a 200-day small sliding medium digital asset (SMA) is significantly higher than its 50-day SMA. Despite the optimistic prospects, he also warned of short -term volatility.

Openai’s Chatgpt-4O emphasized the appearance of the Golden Cross on the XRP graph in November as a promising technical indicator and set a target price of $ 3.20.

On the contrary, the GPT-40 Mini set the lowest forecast for the price of the XRP-prognosis that the asset would be traded by $ 2.75 on March 31. The smaller cousin of the flagship model suggested that market moods were positive, and that the recent development associated with the clarity of regulation can lead to a midshipie by 10%.

Technical analysts weigh XRP

Technical analysts are still divided into the short-term price of token. The famous crypto -expert Ali Martinez claimed that the chart of the chart of the head and shoulders was formed. In case of confirmation, the signal may portend a drop in prices up to $ 1 per token.

On the other hand, a pseudonymous analyst Dark defender I presented a more bull analysis based on the waves of Elliott. The researcher noted $ 1.99 as a key level of support – and put forward the thesis that consistency is closed above the support level of $ 2.33, can increase the price of XRP to reach the target price of $ 3.39 in the short term and, possibly, up to $ 5.85.

Readers should also note that the analysis of artificial intelligence also outlined the case for a rally to levels in the range from $ 2.85 to $ 3.35, it should be approved so that the exchange of exchange tracks (ETF) (ETF).

Nevertheless, traders and investors should also keep in mind the dynamics of supply and demand. Ripple can be ready to sell $ 795 million in March, which will bring an additional risk of reduction in the short term.

Shown image through Shutterstock