Cardano (ADA), once proclaimed as a higher opponent in the space of the blockchain, is now encountering a complex phase, since its price diagrams make a sharp turn to the worst. Over the past few weeks, ADA tried my best to maintain its foundation, with technical indicators, which are increasingly indicating the possibility Further drawback

With caution, traders and investors are closely follow the following steps of ADA. Will the Treatment Treatment be launched by a sharper decline, or can ADA be stabilized and configure the return?

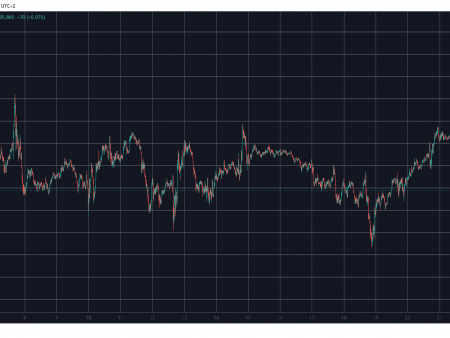

Breaking recent market movements

Recent market movements for ADA were drawn in relation to the picture, emphasizing the obvious absence of a strong bull pulseDespite random attempts to recover, Altcoin invariably could not restore the critical zones of resistance, leaving the asset vulnerable to more disadvantages.

ADA shows signs of an increase in bear pulse, since the assets made a negative crossover below the 100-day simple sliding medium (SMA), a key indicator that often dictates market Trends. Sustainable trade under this level reflects a decrease in bull force and increases the likelihood of a descending trend.

Add to problems, Relative force (RSI) index Below below the threshold value of 50%, which indicates a decrease in the pressure of the purchase and a shift towards the bear trajectory. This weakening of demand suggests that sellers gradually receive control, which complicates the ADA to establish recovery. If the RSI continues to refuse to reassess the territory, this can strengthen pessimistic prospects by increasing the risk of a deeper price correction.

The negative trend of the ADA will probably remain if the ADA cannot break through above the 100-day SMA, and the RSI remains lower than the threshold value of 50% in combination with the increase in sales pressure. As a rule, this scenario can lead to an expanded reduction, which pushes the price to the side The main support levelsField

Key levels for viewing: where can ADA find support?

As ADA is struggling to gain impulse up, the identification of key support levels becomes decisive when assessing potential risks of reducing and rebound possibilities. Due to the fact that price trade below 100-day SMA and bear mood prevails, market participants closely monitor how the asset reacts to the zones of critical prices.

The first key support for viewing is about $ 0.6822. If Sale of pressure It is preserved, re -testing of this area is probable when bulls can try to protect the price and prevent further decline. Refusal of this level may indicate short -term recovery.

Nevertheless, the inability to maintain support in the amount of $ 0.6822 sets the next main zone that will observe $ 0.5229, a historically significant level that served as a key turning point in previous market movements. The loss of this support can accelerate the bear’s impulse, which will lead to a deeper correctionField