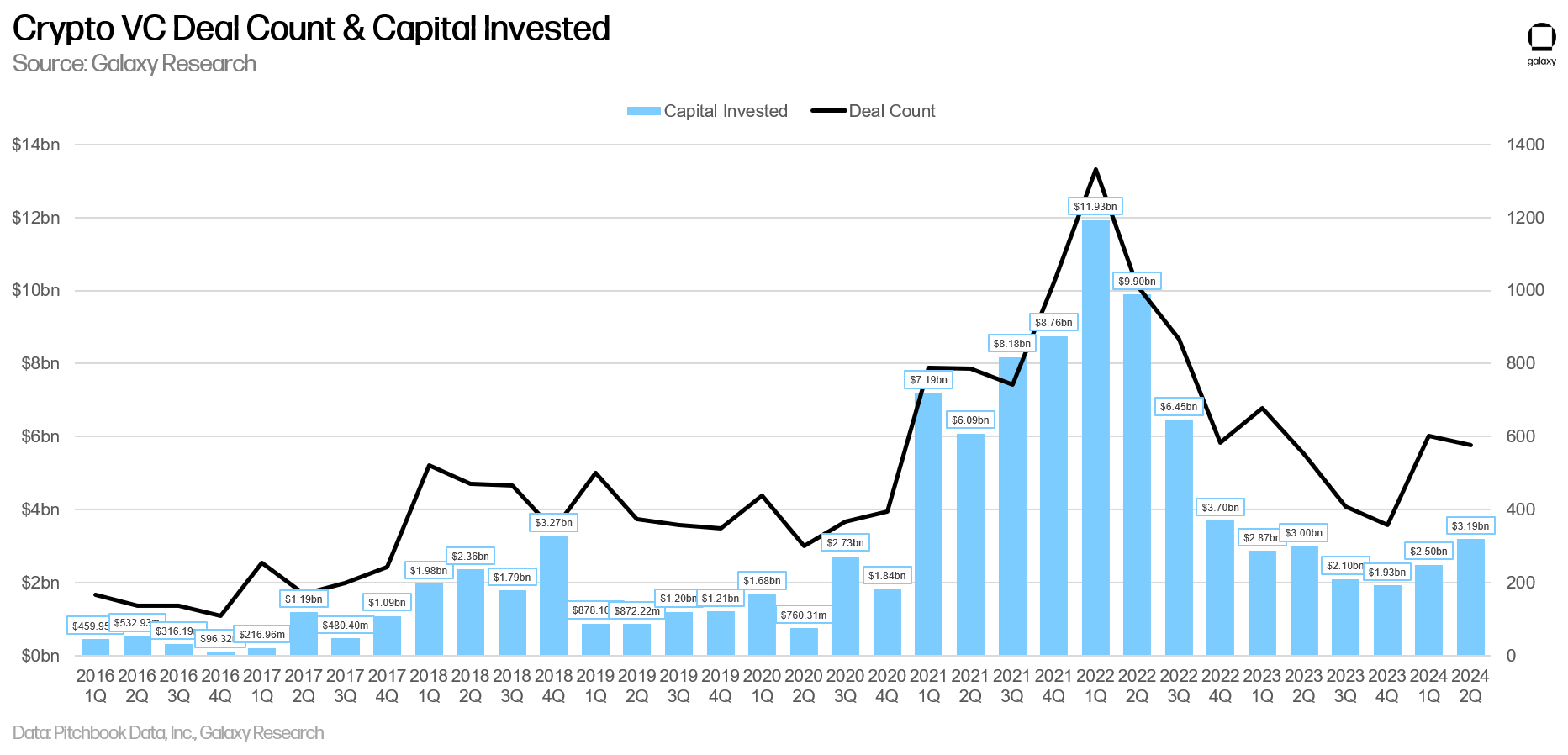

According to Galaxy Digital, venture capitalists invested about $3.2 billion in the cryptocurrency sector in the second quarter of this year.

Researchers at the cryptocurrency company note in a new analysis that the recovery in venture capital funding into digital assets that began in the first quarter continued in April, May and June.

“The number of transactions has decreased slightly [quarter on quarter]“The number of deals made has fallen from 603 in Q1 to 577 in Q2, while invested capital has grown from $2.5 billion in Q1 to $3.2 billion in Q2. The average deal size has increased slightly from $3 million to $3.2 million, but the average pre-money valuation has skyrocketed to a near all-time high, rising from $19 million to $37 million. This suggests that despite the lack of available investment capital compared to previous peaks, the resurgence of the cryptocurrency market over the past few quarters is driving significant competition and fear of missing out (FOMO) among investors.”

Grayscale researchers note that overall venture capital interest in the sector remains low compared to the previous period, when Bitcoin (BTC) traded above $60,000 in 2021–2022.

As a result, researchers note a weakening correlation between the price of Bitcoin and investments in crypto startups.

“Crypto-native catalysts like Bitcoin ETFs and new areas like re-staking, modularity, Bitcoin L2, as well as pressure from crypto startup bankruptcies and regulatory concerns, coupled with macroeconomic headwinds (rates) have contributed to this notable divergence. Distributors may be poised for a major comeback due to the resurgence of liquid crypto, which could lead to increased VC activity in the second half of the year.”

Generated image: Midjourney