A rumor about the BlackRock ETF sparked a huge pump and dump in the XRP market, which may result in a 20% correction in the coming weeks.

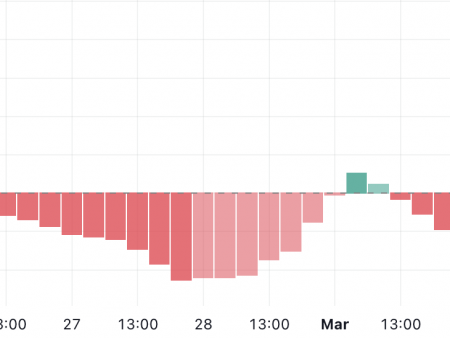

XRP (XRP) is down today and is on track to post its worst weekly performance since August 2023.

XRP has fallen, underperforming the cryptocurrency market

As of November 17, the price of XRP is around $0.60, down nearly 9.5% so far this week, including a 7.5% drop in the last 24 hours. The bearish trend reflects the price behavior in most top-tier cryptocurrencies. However, XRP has underperformed the crypto market, which fell just 2.5% this week.

A closer examination reveals multiple events that significantly impacted the XRP market dynamics leading up to November 17. Let’s take a closer look at the reasons below.

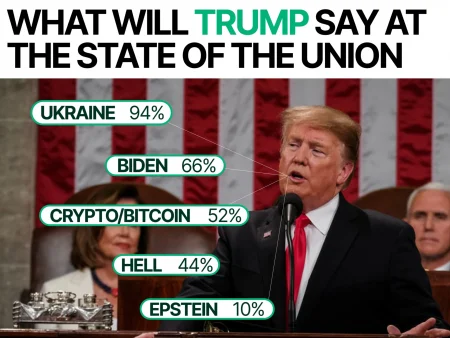

BlackRock XRP ETF Rumor

On November 13, the price of XRP soared 12% to around $0.75, driven by a rumor about a BlackRock exchange-traded product (ETF) focused on

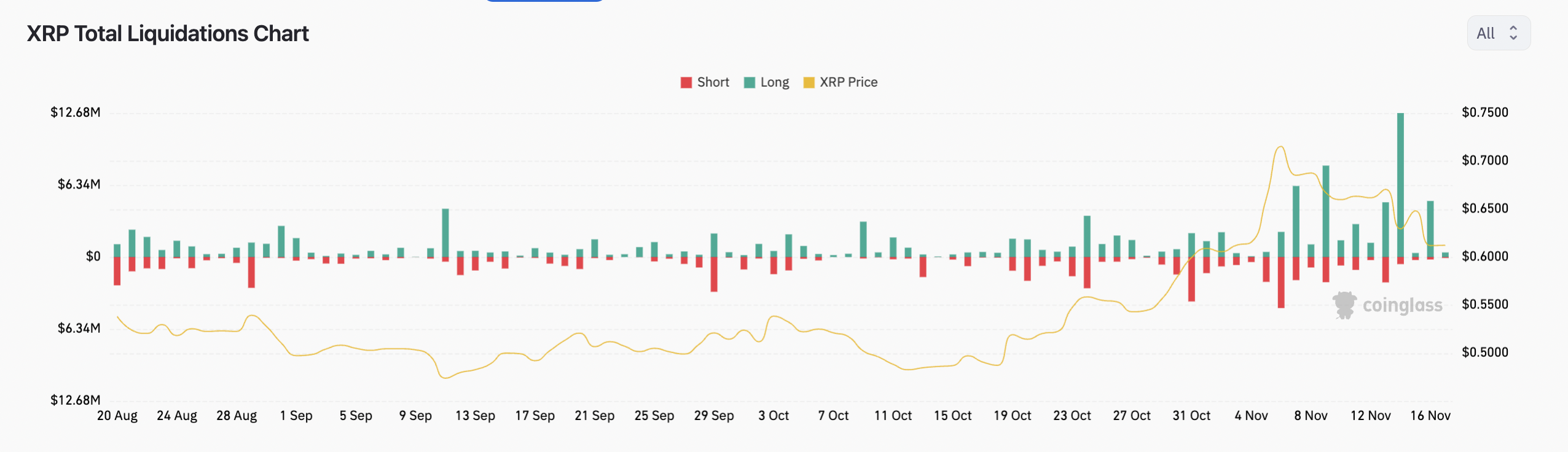

However, Bloomberg ETF analyst Eric Balchunas later debunked the rumor, leading to a rapid collapse to XRP’s initial value that day. The pump and dump of XRP price resulted in massive liquidations, mainly affecting long position holders.

For example, between November 13 and 14, the derivatives market witnessed long liquidations worth $17.5 million. In comparison, only $2.87 million worth of short positions were liquidated, according to Coinglass.

The fallout from the BlackRock XRP ETF rumor was a major factor in the cryptocurrency’s price trajectory downwards for the rest of the week.

Its price action on November 17 is somewhat similar, having fallen over 7.5% in the last 24 hours, with long liquidations worth around $5 million versus $300,000 in short liquidations.

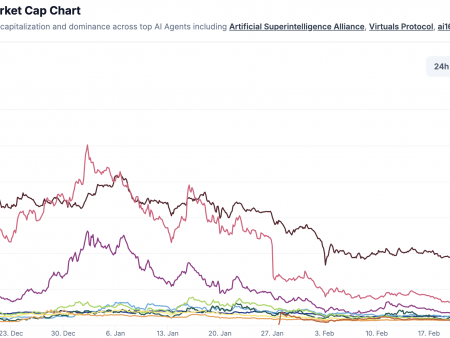

XRP Whale Distribution

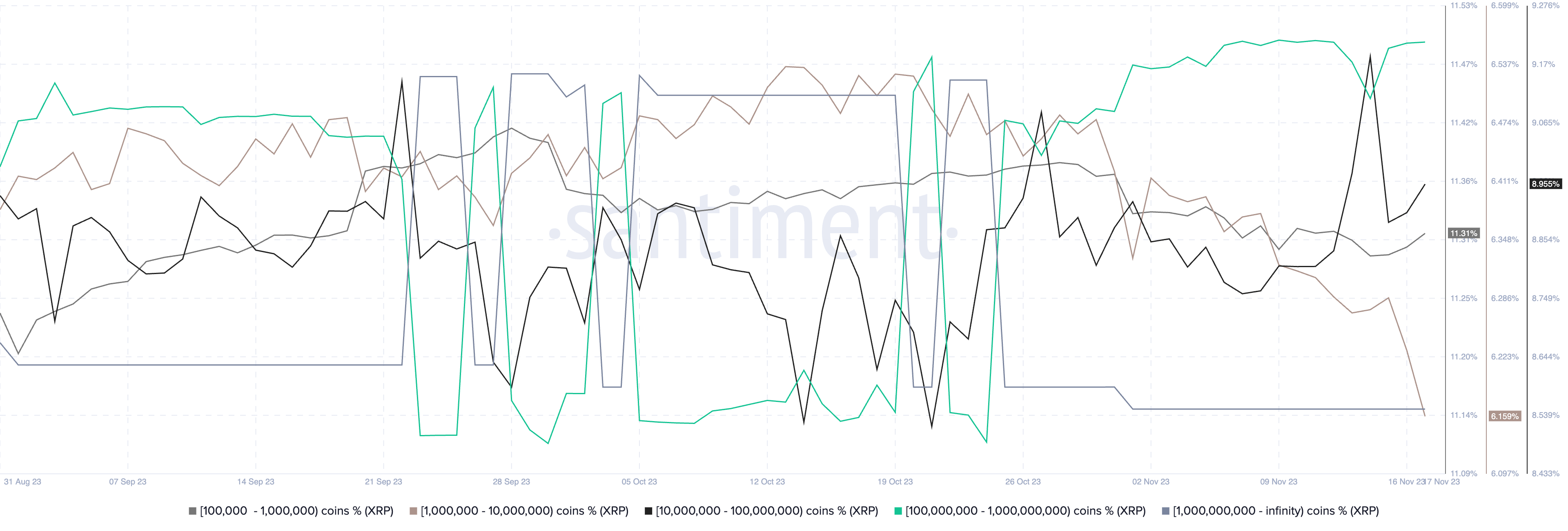

XRP’s price weakness on November 17 comes after modest declines in the holdings of its richest addresses.

For example, the supply of addresses with a balance between 100,000 XRP and 100 million XRP has decreased modestly since the BlackRock ETF rumor. In contrast, the XRP balance cohort of 100 million to 1 billion XRP (mint green) has seen an increase of 0.11%.

The infinite 1 billion XRP balance cohort remained stable throughout the week.

Technical setback

The XRP price drop on November 17 is part of a correction that began after testing a historical resistance trend line near $0.75, as shown below.

The drop is also part of an overbought correction that began on Nov. 6, when XRP’s daily Relative Strength Index (RSI) hit its highest level since July 2023. An “overbought” RSI typically precedes sell-offs. , as illustrated below.

Is the XRP bull run over?

The current XRP price drop so far appears to be a typical bull market correction, after which the overall uptrend has a good chance of resuming.

XRP/USD has been fluctuating within a giant ascending channel since June 2022. Starting in November 2023, the cryptocurrency entered a correction period after testing the channel’s upper trendline as resistance.

From a technical point of view, it is now at risk of falling towards the lower trend line near $0.50, down 18.5% from current price levels.

Interestingly, the downside target of $0.50 coincides with the 50-week (the red wave) and 200-week (the blue wave) exponential moving average (EMA). Furthermore, the level has served as support between March 2021 and January 2022.

Related: Delaware Authorities Refer False BlackRock XRP Trust Filing to State Department of Justice

Conversely, a decisive break above the current resistance level near $0.75 will put XRP price on track towards $1.13 in 2023 or early 2024, more than 80% higher than current price levels. .

The bullish target coincides with XRP’s 0.382 Fibonacci line.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Add reaction