David Bailey, a well -known lawyer of Bitcoin and BTC Inc CEO, suggested that a recent decrease in Bitcoin’s prices may be associated with sales of the US Department of Justice (DOJ).

“If the Ministry of Justice eliminated the bitcoin of America with a rush (in disobedience of the president) since it received permission for the court 3 months ago … Then it makes sense the price action of Bitcoin,” writes Bailey, who recently attended the crypto -Sammit of the White House along with other industry leaders on X.

Subsequently, Bailey indicated that clarity in the situation should be within “30 days”.

His comment appeared after President Trump issued an order to create a strategic reserve of bitcoins using captured coins.

In accordance with the new order of Trump, the secretaries of the Treasury and Trade will be responsible for creating strategies, neutral budgets for further acquisitions of BTC, provided that these strategies do not charge additional costs for American taxpayers.

The exact number of bitcoins, as well as other altcoins captured by the US authorities, remain unknown. According to data tracked by Arkham Intelligence, the wallet marked with the US government currently owns 19 109 BTC worth almost $ 16 billion.

In an interview with Bloomberg TV last Friday AI White House and Crypto -Tsar David Saks said that the government would conduct a full audit of its crypto activists after creating a strategic reserve Bitcoin.

The audit is part of Trump’s executive order, the purpose of which is to ensure that all digital assets, including bitcoins, are properly taken into account and protect. According to SACKS, DOJ can have up to 200,000 BTC, but an official audit is needed to check.

In December last year, the Ministry of Justice was authorized to sell about 69,370 bitcoins captured from the Darknet Silk Road market. In the January GIP Digital Watch, however, it was assumed that the US government had not yet taken steps to sell its bitcoin active.

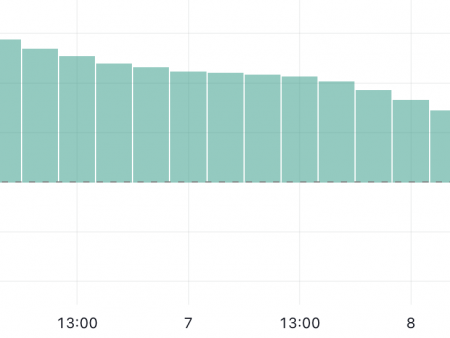

Analysts see how Bitcoin tests lower support before potential recovery

It is still unclear whether the Ministry of Justice unloaded part of government bitcoins. However, it is clear that decreasing enthusiasm for strategic narrative about strategic bitcoins, since in the near future no new purchases are expected.

Moreover, fears about a potential recession were deepened after Trump left to open the possibility of an economic recession in a recent interview with Fox News, which increased lower pressure on risk assets.

According to Coingecko, Bitcoin reached a minimum of $ 79,300 on Monday morning, since bear mood continued to dominate world financial markets.

The total market capitalization of Crypto over the past 24 hours has fallen by 5% to 2.7 trillion dollars, while the crypto pages and the greed index fell by seven points, firmly landing in the “extreme fear” zone.

Ryan Lee, the chief analyst of Bitget Research, expects Bitcoin to test support levels from 70,000 to 75,000 dollars this week, with a resistance of about $ 85,000-87,000.

“The inability to maintain a level of $ 77,000 may lead to the fact that BTC has tested a lower range of $ 70,000–72,000. However, if the market sees recovery, a potential rebound of $ 75,000 can push the price in the range of $ 80,000–85,000, ”Lee said on Monday.

“The most likely scenario this week implies a test in the middle of the week at 72,000–75,000 US dollars, while by 18-19, Bitcoin is stabilized about $ 83,000.