Bitcoin broke below the key 200-day sliding average of 83 thousand dollars, demonstrating a well-known bear sign. Nevertheless, the price is found with the last line of defense of buyers of 80 thousand dollars, with a potential breakthrough, which leads to a significant decrease to 75 thousand dollars.

Technical analysis

Shayan

Daily diagram

Bitcoin was rejected with a resistance of 92 thousand dollars. The USA, which caused a strong sale, which led to a break below the key 200-day mA of 83 thousand US dollars and the level of recovery of 0.5 Fibonacci. It was assumed that this zone would provide high demand, but the bear pressure defeated the buyers, which led to a long elimination and a negative shift in the mood of the market.

Bitcoin is currently checking the last line of protection against buyers in the region 80 thousand dollars. The United States, which corresponds to the lower border of the rising channel and the level of recovery of Fibonacci 0.618. If this level does not succeed, another sale can lead to prices up to 75 thousand dollars, which notes a deeper correction in the market.

4-hour table

In lower terms, the price of Bitcoin combines from 80 to 92 thousand dollars. USA. A recent refusal in the upper part of this range emphasizes the market fluctuations. To establish the final trend, a clear breakthrough of this zone is necessary.

Moreover, the liquidity pool exists just below the recent minimum of $ 78 thousand, where numerous orders for sale were accumulated.

This pool can serve as an attractive goal for smart money, increasing the likelihood of a breakthrough of bear in the medium term. Consequently, it is expected that Bitcoin’s price action in the coming weeks will remain unstable, and further consolidation can be up to any decisive move.

Analysis on the chain

Shayan

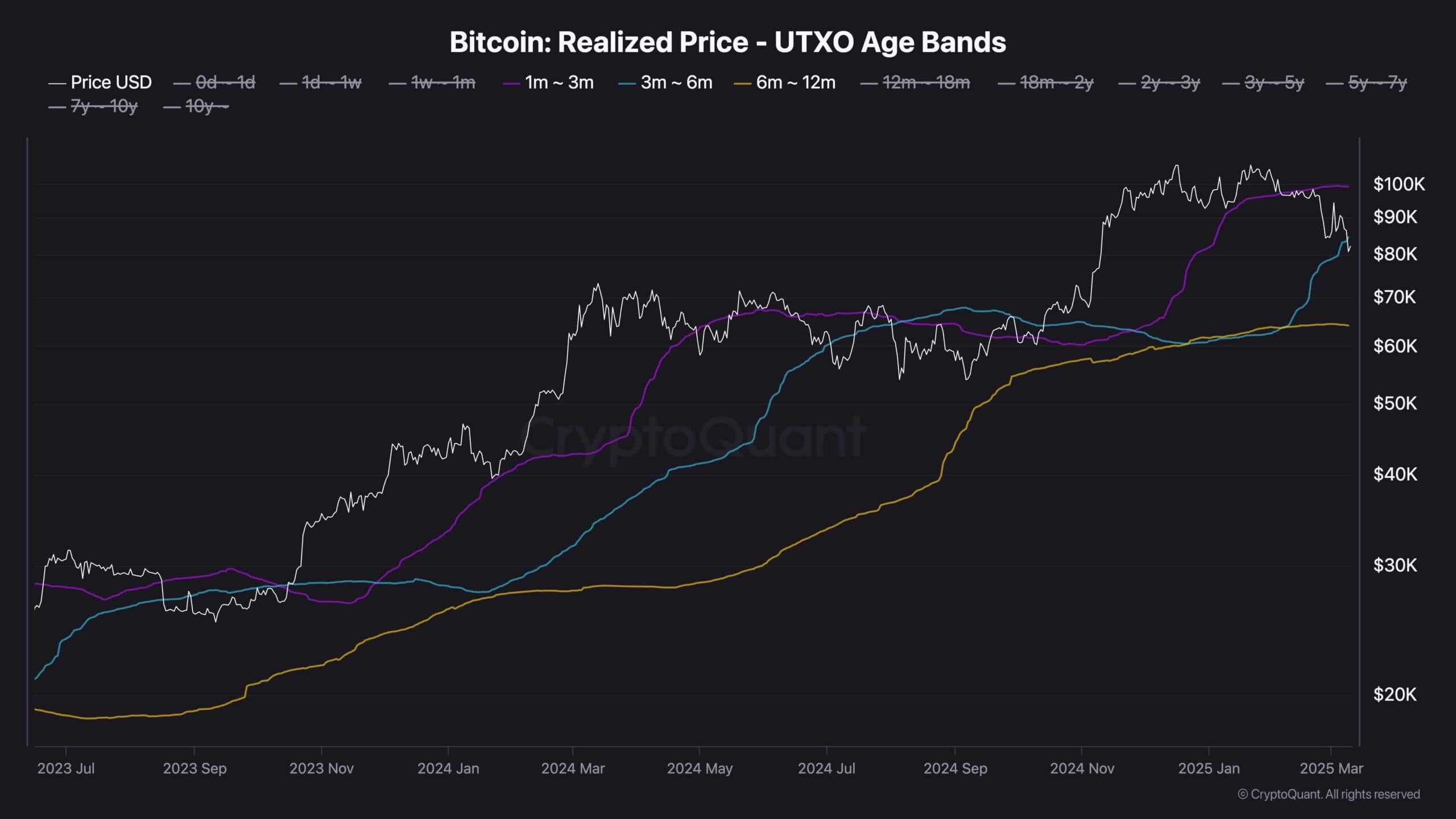

Historically, the interaction of Bitcoin with a 3-6 months of UTXOS has played a key role in determining the direction of the market. This indicator often serves as a strong zone of support or resistance, reflecting the average purchase price of medium -term owners.

Bitcoin is currently checking the realized price of 3-6-month owners at the price of 83 thousand dollars. USA. The holding above this zone will indicate strong confidence in the market, strengthening bull moods and increasing the likelihood of further growth of the pulse.

However, if Bitcoin cannot maintain support on this threshold and is torn below, this can cause a shift in feelings for fear. This scenario can lead to the distribution phase when the short -term investors defeat their assets, potentially promoting the price in a deeper correction and giving the possibility of intellectual money to accumulate at low prices.

Thus, the price action of Bitcoin at the level of 83 thousand dollars. The United States will be crucial for the formation of its short and medium -term trajectory. Whether it is a rebound or destruction, most likely, will determine the following main trend in the market.