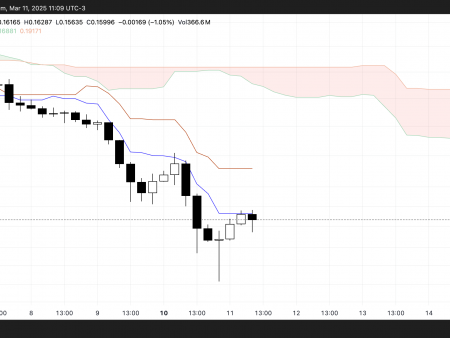

The recently published Dogecoin diagram (DOGE) Paul analyst (@zig_zagtrades) suggests that the popular cryptocurrency based on memes may contain up to 0.12 US dollars in the final corrective phase before trying to significantly rebound. The 1-day diagram divided into X describes the structure of the Elliott wave in a textbook that Pavel interprets as a larger (A)-(B)-(C) correction, the culmination of which is a potential wave of 2 near the region $ 0.12–0.15 US dollars.

More disadvantages for Dogecoin are ahead?

In the analysis of Paul, Dogecoin monitors a decrease in the five disputes since it has reached a noticeable peak marked as a wave 1 on its graphics. This top coincided with a multi-day surge, which lost the impulse and changed lower, which led to a series of smaller waves marked as 1, 2, 3, 4, and now 5. The analyst indicates that this fifth and last subsoles probably completes a wider wave of C (or 2nd waves, if calculated to a higher degree). Paul’s participation is emphasized by “GZ” (“Golden Zone”, usually used by merchants to determine Fibonacci clusters), and its labeling determines the ratio of fibonacci, which can determine the nearest floor of Doni.

The diagram shows a cluster of the key restoration levels covering from $ 0.16 to the range of mid -0.11 US dollars. Paul emphasizes the levels of Fibonacci at 61.8% about 0.160257 US dollars and $ 0.15050, along with deeper injuries at 78.6%, about 0.118726 US dollars and 100% forecast about 0.126709 US dollars. These numerical zones, in the same way, are associated with GZ, in which Paul believes that DOG can complete his last submar. According to the schedule, a pocket in the amount of 0.12–0.15 US dollars stands out as the most important price of the territory for bulls who seek to stop the ongoing downward trend.

The path from the current area of the price to this lower target is marked with calculation, which involves the final impetus under previous minimums. The scheme of the candlestick on the graph confirms the sequence of lower maximums and lower minimums in recent weeks, which is a sign that the bear impulse remains untouched. The volumetric columns below indicate the stable pressure of sales that accompany the downward impulses, in accordance with the opinion that the DOG can still cut its terminal correction leg.

The use of Paul in the cloud settings of ICHIMOKU shows that the price is constantly trading below the cloud from the end of January, which indicates that Doge has not yet restored any bull impulse. The area of the shaded green cloud on its graph, according to the visible, acted as dynamic resistance, supporting the idea that the market remains in the corrective pose for several weeks. Marking the analyst of waves outside the alleged bottom, marked as (1) BC, involves the expectation of a possible cycle of an upward age, if and when the coin finds support in the GZ zone.

While the diagram projects the subsequent rally from the expected minimum, there are no guarantees that DOGE will definitely have a strip of $ 0.12–0.15 US dollars. The inability to do this theoretically expands the corrective scheme and undermines the number of bull waves, but Paul’s annotation implies that he sees the current decrease as the last sticking of sellers. In his own words, “DOGE 1D: Subwave 5, a drop in the C/2 in GZ for DOGE wave settings, involves the expectation of a local bottom in this area, although the general direction of the market will depend on whether there are enough customers at these levels of FIBONACCI.

During the press, DOG was traded at $ 0.17