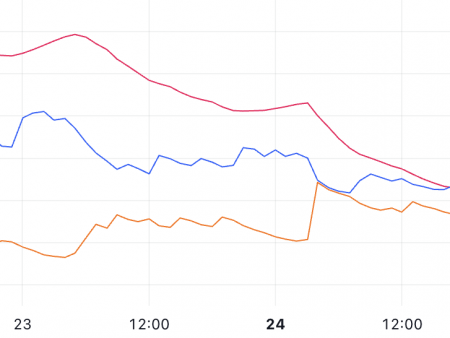

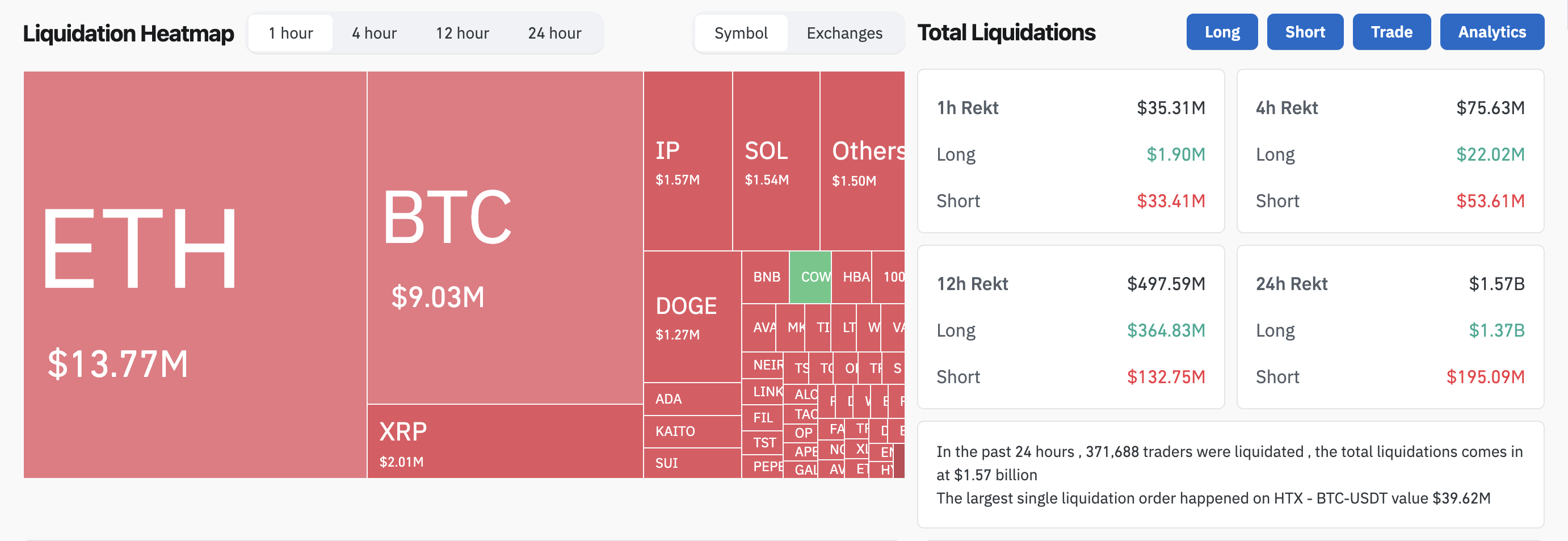

The elimination of crypto -thefts is growing more than $ 1.5 billion in 24 hours, which pushes concerns to the bear. This is the third time in February, when the market liquidation exceeded a billion mark over a 24-hour period.

Nevertheless, even if the worst forecasts come true, analysts believe that Crypto still relies well to consolidate and return by mid -2015.

Flash -Avars and lifting liquidation

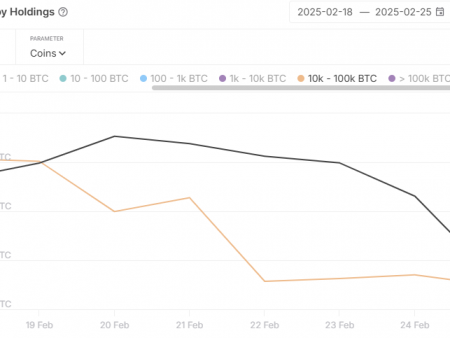

Rumors about the bear market are circulating in the cryptography market. Bitcoin ETF see huge outflow with small signs of stopping, and this has a negative impact on the price of the asset.

Nevertheless, a wider view of the data shows increased losses throughout cryptocurrency, and over the past 24 hours, the total liquidation of more than $ 1.5 billion. USA:

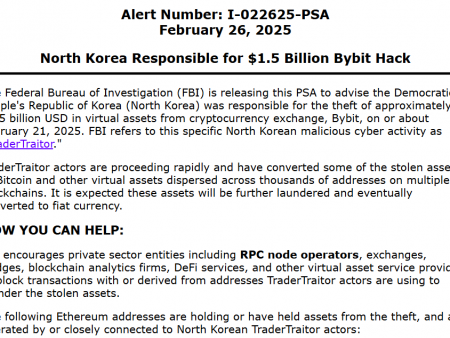

Bitcoin is the largest cryptoass, and its decrease is associated with the Titanic ETF market, but this is not the largest loser today. Ethereum was outstanding for crypto -ornaments, partly as a result of the last week of Bybit Hack.

Bitcoin fell below $ 90,000 today, for the first time in three months. A large number of consistent outflows of ETF also reflects a retreat from institutional investors.

Meanwhile, Ethereum saw the largest elimination, since the loss with Bybit Hack last week is still visible. In particular, today’s accident reflects the trend of frequent flash -avars in the market.

In 2025, the cryptography market witnessed four main accidents in a 24-hour window caused by various macroeconomic factors.

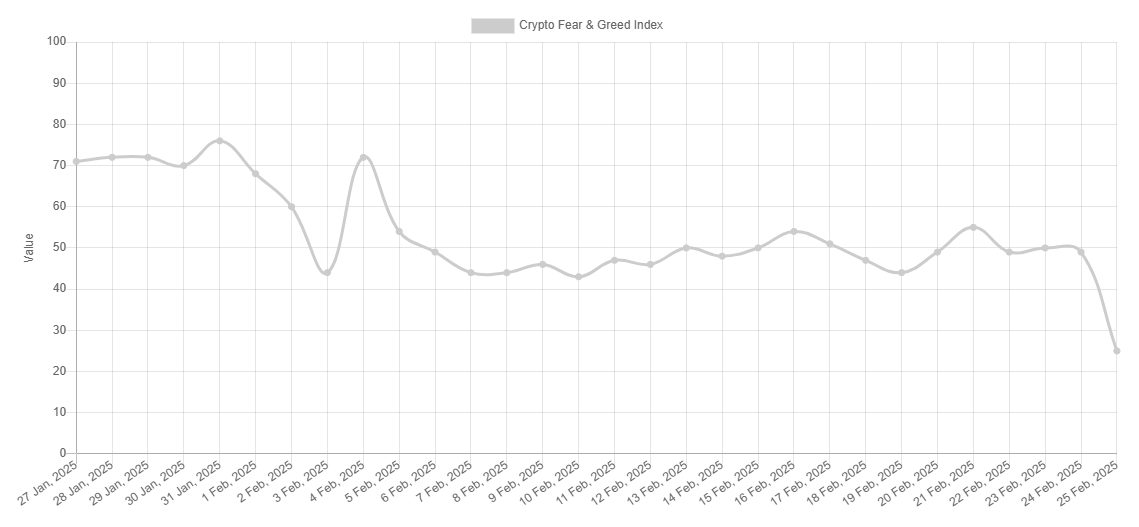

Although the market quickly recovered each time, Freukence concerns these liquidations. Nevertheless, this signals a clear trend that market moods are rapidly changing in the market, even more often than in previous cycles.

If we look at the index of fear and greed in the last three months, this volatility in the mood of the market is obvious. In addition, market moods are currently at the lowest level in 2025.

Despite these large crypto -ornaments, not everyone in the industries feel bearish. Binance General Director Richard Teng said these events are a tactical retreat, not a change.

“Pricing movements often overshadow what is happening under the surface, but the fundamental drivers of crypto -cutting remain firmly untouched. Market corrections can feel anxious, but they are also moments when experienced investors position themselves for the next tendency to the bull. For those who are focused on the overall picture, instability provides an opportunity, ”said the chief executive director of Binance CEO.

In other words, Ten urged pessimists to remember the cyclic nature of this industry. Mass accidents occurred before, and, indeed, they will happen again.

All leading crypto projects are faced with liquidation; The price of Solana is on a four -month minimum, and XRP is at the lowest level since December. However, the industry has strong foundations.

The political movement of the crypto industry is still in his dominance, and institutional investors have a huge level of interest. Teng could only speak for his own company, but Binance data show the constant growth of new users.

Whenever the dust settles after these liquidations, the crypto -community may be consolidated to achieve even greater success.