Bitcoin fell below the 100-day sliding average at 98 thousand dollars. The United States, approaching the key level of support for $ 95 thousand. USA.

Nevertheless, low trading activities involve the lack of a strong impulse, which makes even more short -term consolidation.

Technical analysis

Shayan

Daily diagram

Bitcoin recently fell below the critical 100-day sliding average at 98 thousand dollars. The USA, which led to a slight increase in sales pressure. Nevertheless, the lack of a strong bear impulse implies a weak general participation in the market, and neither buyers nor sellers demonstrate dominance.

Despite this, the breakdown introduces bear bias, increasing the likelihood of further consolidation and potential repeated compensation to a significant level of support of 90 thousand dollars.

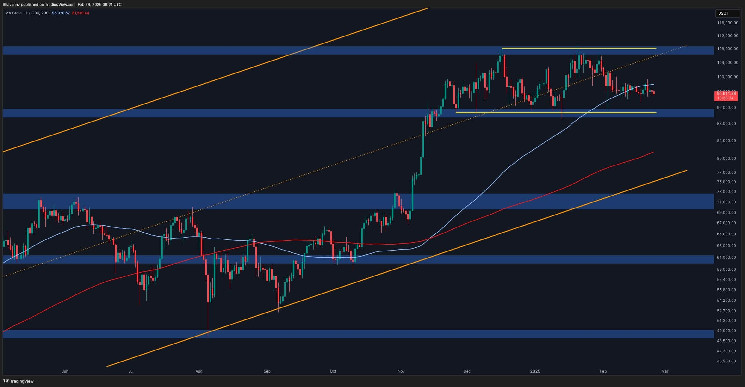

4-hour table

In the lower terms, the price effect of Bitcoin rests on the bear, gradually approaching the lower border of the ascending channel. The market remains in a state of indecision, with two contrasting scenarios in the game.

On the one hand, the BTC is approaching the critical area of support on the lower boundary of the channel and the range of 90 thousand dollars. The United States, which historically acted as a strong zone of demand. This can cause a change, which will lead to the update of the bull impulse.

And vice versa, Bitcoin, apparently, forms a double-riding pattern, with a neckline aligned with a key support zone $ 90 thousand dollars. USA, and also notes the previous minimum swings. The breakdown below this level can confirm a further continuation of the bear.

At the moment, the price of BTC about 90 thousand dollars will be crucial when determining the following main trend, and further consolidation to this level is expected in the short term.

Analysis on the chain

Shayan

The Bitcoin market is faced with growing problems, since the mood of investors continue to weaken. The recent rally was caused by optimism related to Trump’s victory and expectations of strategic assets distribution in the United States

Nevertheless, the escalation of geopolitical tension, especially in trading policy, caused risk-setting, damping the market impulse. Moving forward, a stable bull step will probably require the resolution of these uncertainty or the emergence of new catalysts.

The data in the chain additionally emphasize these problems. As shown on the schedule, the number of active addresses and transactions associated with the deposits of bitcoins and removal of funds was noticeably reduced. If this trend continues, this can signal the depletion of investors, similar to the peak market cycles of 2017 and 2021.

Given the current conditions, short -term prices remains difficult to predict. If market sentiments improve, and bitcoin is restored up the impulse, the trust of investors can strengthen by refueling another rally. However, if uncertainty is constantly preserved, the market can enter another long -term phase of consolidation, resembling stagnation observed at the beginning of 2024.