According to the new poll of FTX creditors, 79% plan to reinvest their payments in Crypto. More than half of them plan to buy SOLANA, and Meme Coins and Tokens are also popular.

Nevertheless, a deeper look at the survey methodology implies a strong bias towards Solana’s enthusiasts. Although some participants may have a sincere interest in other assets, their preferences may not reflect the wider moods of all FTX creditors.

FTX creditors probably reinvest funds in crypto

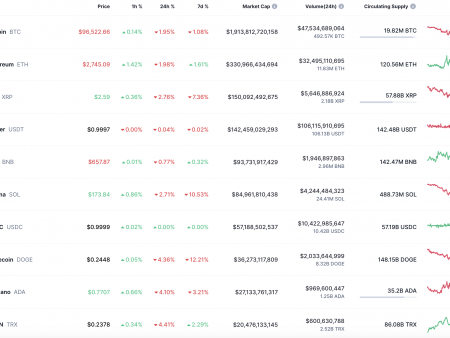

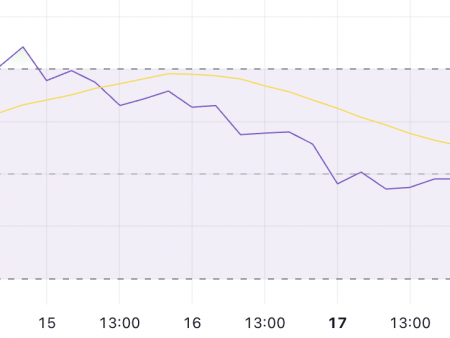

Since the collapse of the FTX in 2022, the residual loss has left deep traces in the crypto space. At the beginning of this month, liquidators announced that lenders would begin to reimburse on February 18. Although this would cause optical excitement in advance, the market hopes decreased when investors began to act scarecrow.

Nevertheless, the new survey claims that most FTX creditors will reinvest in Crypto:

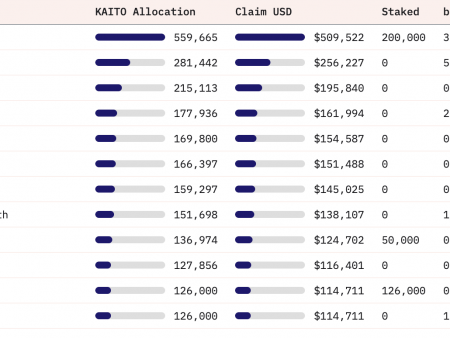

“79% of FTX creditors plan to reinvest their cryptocurrency payments, and on average 29% of their repayments are allocated for this purpose.

At first glance, this FTX poll looks very optimistic, especially for Solan. When compensation began, the exchange creditors demonstrated a strong tendency to immediately provide their funds.

However, if these results are accurate, this would be a shot in the hand for several assets. Solan, in particular, transferred a difficult month and could benefit from fresh investors.

Unfortunately, however, this bull vision may not materialize. In his methodology, the FTX survey admitted that “there is the possibility of prejudices.”

According to the visible, lenders had the right only if at least 10% of their portfolio consisted of SOLANA or if they kept SOL for $ 100 for more than a year. In other words, it seems obvious that suitable participants will be interested in Solan.

Even if in this regard the FTX survey was biased, its data can still be useful in other ways. For example, Meme Coins was hard in February, and the crypto -market of artificial intelligence does not look much better.

If some of these Solans enthusiasts conduct their compensation for these tokens, it may be a life buoy. Nevertheless, this is not a good barometer for a wide pool of FTX creditors.