Unlike the long -awaited air frames, such as the Brachain and PI network, which have been waiting for years, Airdrop Kaito found many users by surprise. The token was launched by the Crypto Analytics platform with the same name.

Data on the chain show that leading claims quickly sold their tokens, which leads to a strong pressure of sales and a bear. However, if Kaito can restore the confidence of the community and use its plans for the tokenize content on social networks, it can recover from its recent minimums and challenge the key resistance levels.

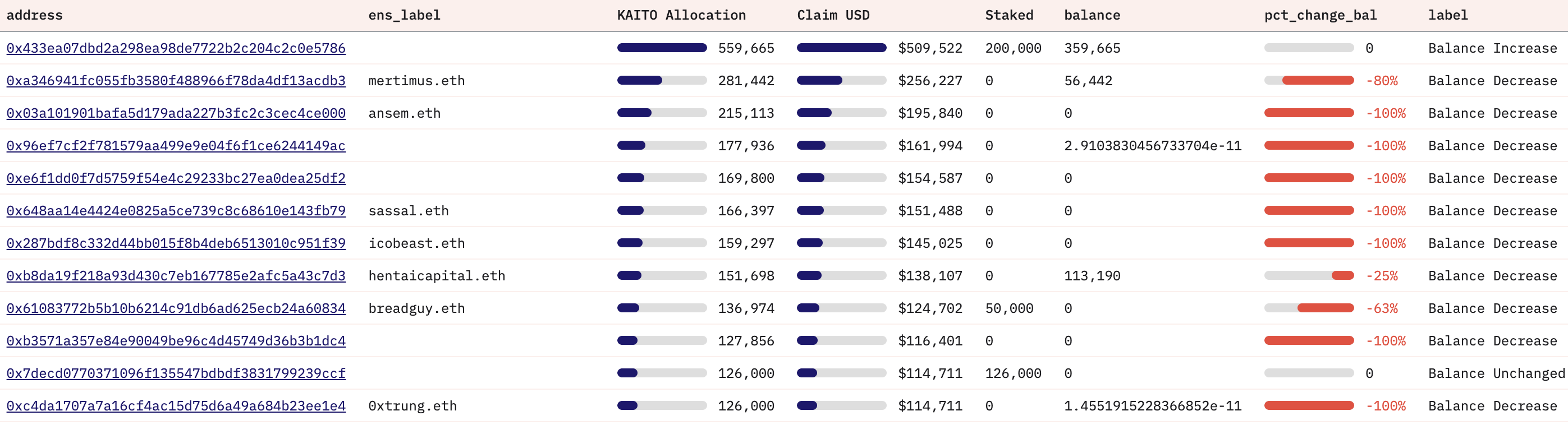

The upper addresses of Kaito have already sold almost all of their coins

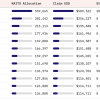

Data on the chain for Kaito show that users who declared the largest amounts of the coin are no longer holders, which indicates strong sales pressure shortly after air.

It is noteworthy that the 12 best applicants received Kaito in the amount of about 2.1 million dollars. The United States, but 10 of them have already sold at least part of their tokens, and 7 completely out of their positions.

Only 3 out of 12 decided to apply their coins, reflecting a cautious approach to long -term obligations.

This sales trend among the largest applicants implies the lack of confidence in the long -term cost of token or a strategic step to make a profit after the initial distribution.

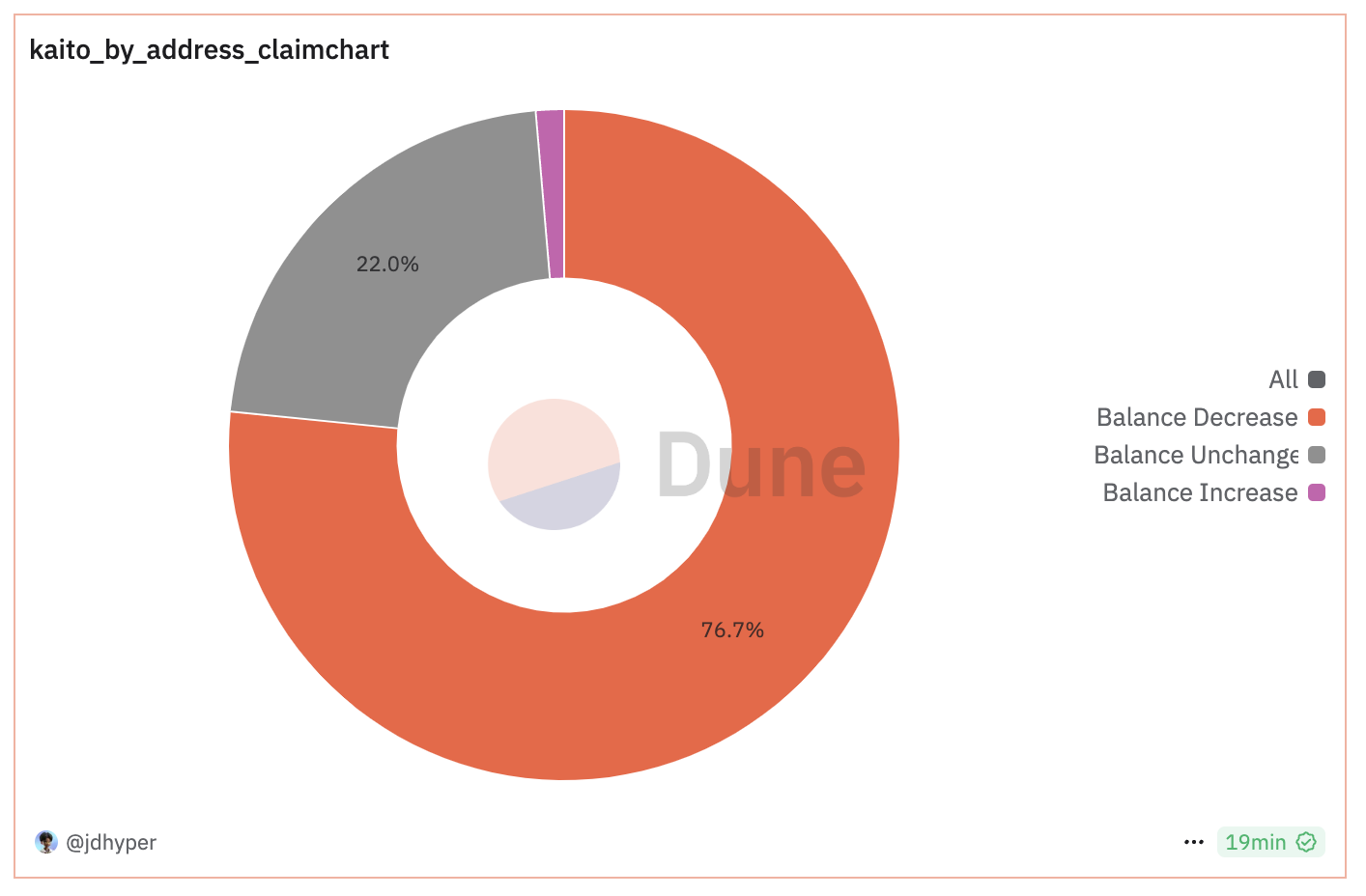

Checks do not take their positions

Wider activity in the chain shows a similar scheme: 76.7% of all users who claimed to have a reduction in balance.

Although not all of them sold all their assets, the majority reduced their effects, which indicates a careful or advantageous mood.

Conversely, 22% of applicants did not transfer their tokens, reflecting a strong condemnation for retention, while 1.3% increased their assets, demonstrating the minimum percentage of accumulation.

This distribution model assumes that criticism of the tokenomics community and the air approach can affect the behavior of users.

The low speed of accumulation in combination with high sales pressure indicates a bear. Market moods, apparently, are more focused on short-term profits, and not on a long-term assessment of value.

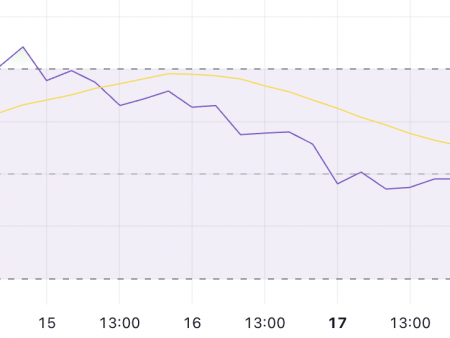

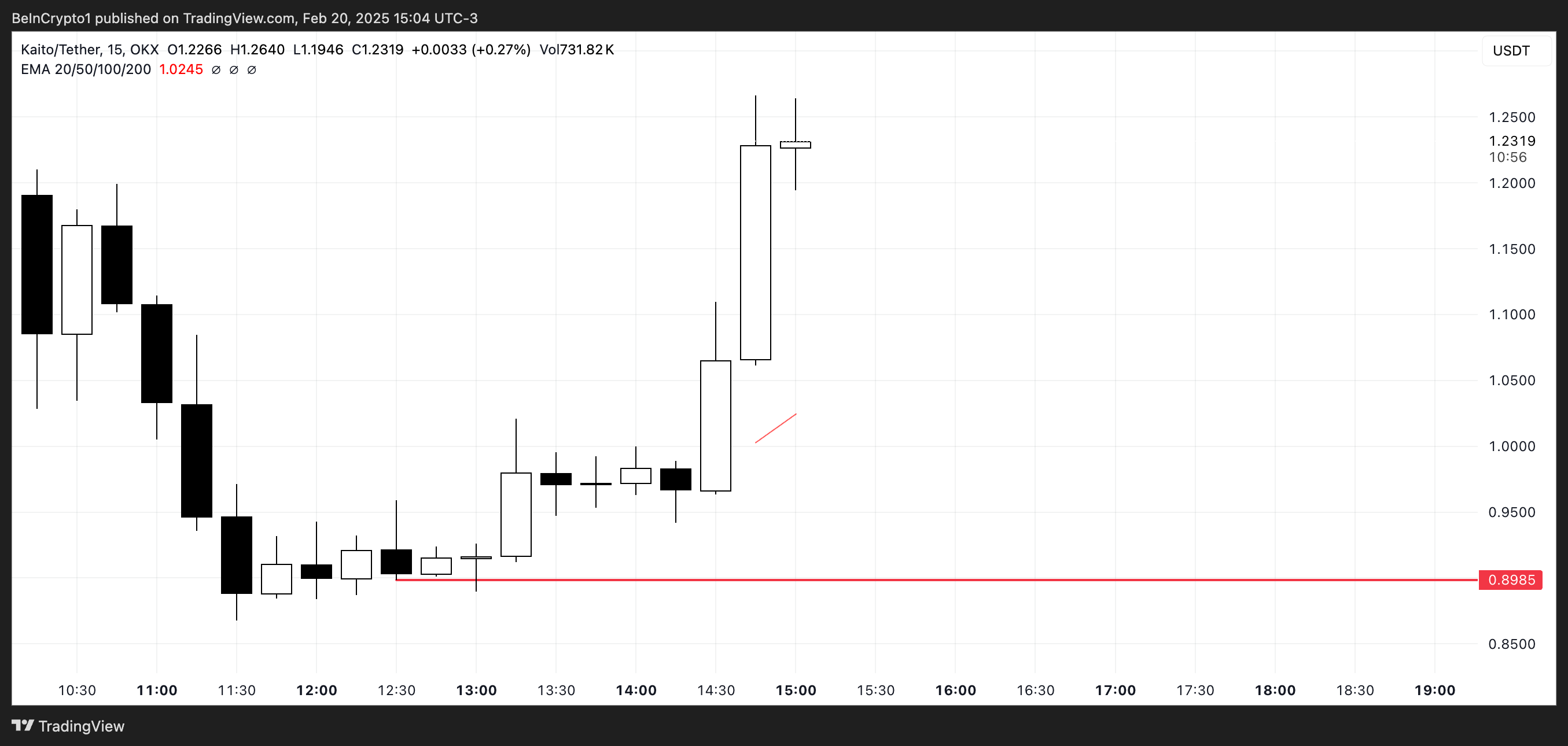

Kaito Price Forecast: Kaito will recover after the last minimum?

If Kaito can restore the confidence of the community and arouse interest using his plans aimed at navigating social networks using artificial intelligence, its price may continue to be restored after recent minimums.

Kaito was heavy in the first hours after its launch, as in the case of many recent air streams, such as Berahain. If he can recover after the recent strong pressure of sales, he can check $ 1.5 or even $ 2 very soon.

However, if the pressure on the sale remains, it may encounter a further decrease, especially if Dune data show that less than 30% of the total Kaito offer has been announced.

This indicates that a significant part of tokens can still enter the market. This can potentially increase sales pressure and reduce prices.

If this scenario occurs, Kaito can check the support of $ 0.89. If this level is violated, the price may fall below $ 0.8 or even $ 0.7.