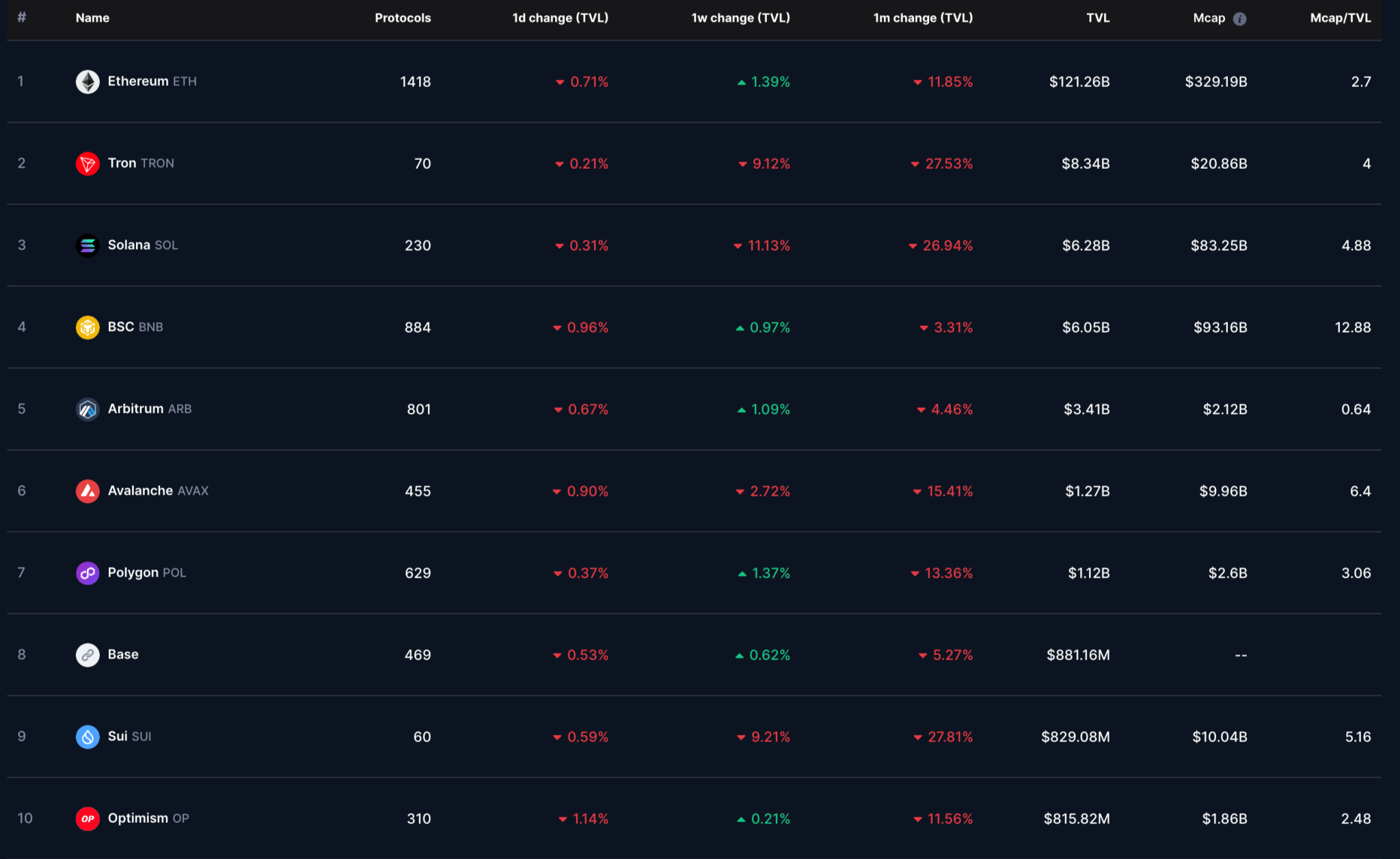

Ethereum remains the dominant network of blockchains with the highest total cost (TVL) of $ 121.26 billion, despite the fact that over the past month a decrease of 0.71% and a drop in 11.85%. The network supports 1418 protocols, much more than its competitors, and retains market capitalization of 329.19 billion dollars. USA, which leads to a market capitalization coefficient and TVL 2.7.

Tron (TRX) continues to hold the second largest TVL at 8.34 billion dollars, demonstrating relative stability with a decrease in only 0.21%. Nevertheless, the network witnessed the fall by 9.12% over the past week, and over the past month has decreased by 27.53%, which notes a significant trend towards a decrease. The market capitalization of the throne is $ 20.86 billion, which gives it the ratio of market capitalization to TVL 4.0.

Solana, undergraduate fluctuates as an arbiter, Avalanche Diverge

SOLANA (SOL) has a TVL in the amount of 6.28 billion dollars, which makes it the third largest blockchain from this metric. The network falls by 0.31% per day and a weekly decline by 11.13%, and by 26.94% decreased over the past month. SOLANA market capitalization is 83.25 billion dollars. USA, which brings relations with market capitalization to TVL 4.88.

Binance Smart Chain (BSC) should be carefully recorded by TVL in the amount of $ 6.05 billion. While the BSC was affected by 0.96% per day of decrease, it showed an increase of 0.97% in the last week, but still came across 3.31% in a monthly decrease. The network boasts with market capitalization in the amount of $ 93.16 billion. The United States, and the ratio with market capitalization and TVL is 12.88, which reflects its strong assessment of relatively blocked assets.

Among the levels of level-2, Arbitrum (ARB) registered TVL in the amount of $ 3.41 billion, and a daily decline by 0.67%, but by 1.09% weekly profit. Over the past month, he survived a decrease by 4.46%. ARBITRUM market capitalization is $ 2.12 billion. The United States, which leads to the ratio of market capitalization to TVL 0.64, which indicates that its assessment is relatively low compared to its blocked assets.

Avalanche (AVAX), on the other hand, observed 0.90% of the daily fall, a decrease in TVL by 2.72% and a monthly reduction of TVL by 15.41%, which increased its total amount to 1.27 billion dollars. USA. The market capitalization of the network is $ 9.96 billion, and the ratio with market capitalization and TVL-6.4.

Polygon, base, sui, optimism, see deflines tvl

Polygon (Pol) has a TVL of 1.12 billion dollars. USA, at the same time falling 0.37% per day, but 1.37% per week. Despite the short -term recovery, over the past month it decreases by 13.36%. Polygon market capitalization is $ 2.6 billion, with market capitalization to TVL 3.06. Base, the Coinbase Layer-2 network, currently has a TVL in the amount of $ 881.16 million. USA, with 0.53% daily decline and 0.62% per week. The platform continues to show a gradual implementation, but there is no registered market capitalization.

SUI (SUI) observed one of the coolest TVL, decreasing by 9.21% over the past week and 27.81% over the last month to 829.08 million dollars. The SUI market capitalization is $ 10.04 billion, which leads to market capitalization to TVL 5.16. Optimism (OP) by 1.14% of the daily decline, by 0.21% weekly increase and a monthly drop by 11.56%, which increased the total number to $ 815.82 million. USA. Its market capitalization is $ 1.86 billion, which leads to the fact that the market capitalization to TVL is 2.48.

The market remains in a state of stream when Ethereum supports dominance, while the Layer-1 and Layer-2 network experience various levels of influx and outflow of capital. Market ratios of capitalization and TVL imply differences in evaluation in different networks, and some blockchains that appear are overestimated compared to blocked assets, while others, such as arbitration, have lower grades compared to TVL. Investors and analysts will carefully monitor liquidity trends, the development of protocols and macroeconomic conditions in order to evaluate the future trajectory of these ecosystems of the blockchain.