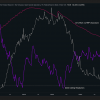

In the continuing restoration in the Tao market, the BitTensor native token, looks optimistic and is preparing for a mass midday with an increase in its strong price action. With two large green candles, Tao recently escaped from the strong line of the trend, which he encountered since the beginning of December 2024.

Tao price action and upcoming level

After the breakthrough of the Tao, in the visible one, goes from his long bear tendency in the bull phase. However, before this shift is completely occurred, the asset encounters a slight resistance of 200 exponential sliding average (EMA) and horizontal levels at $ 475.

Based on the historical price impulse, if Tao violates this obstacle and closes the daily candle above the level of $ 490, it can take off 46%to reach the level of $ 720 in the future.

Nevertheless, the average asset index (ADX) is currently 21 years and, according to the visible, decreases, which suggests that the Tao does not have enough strong impulse, which makes it difficult to support the asset.

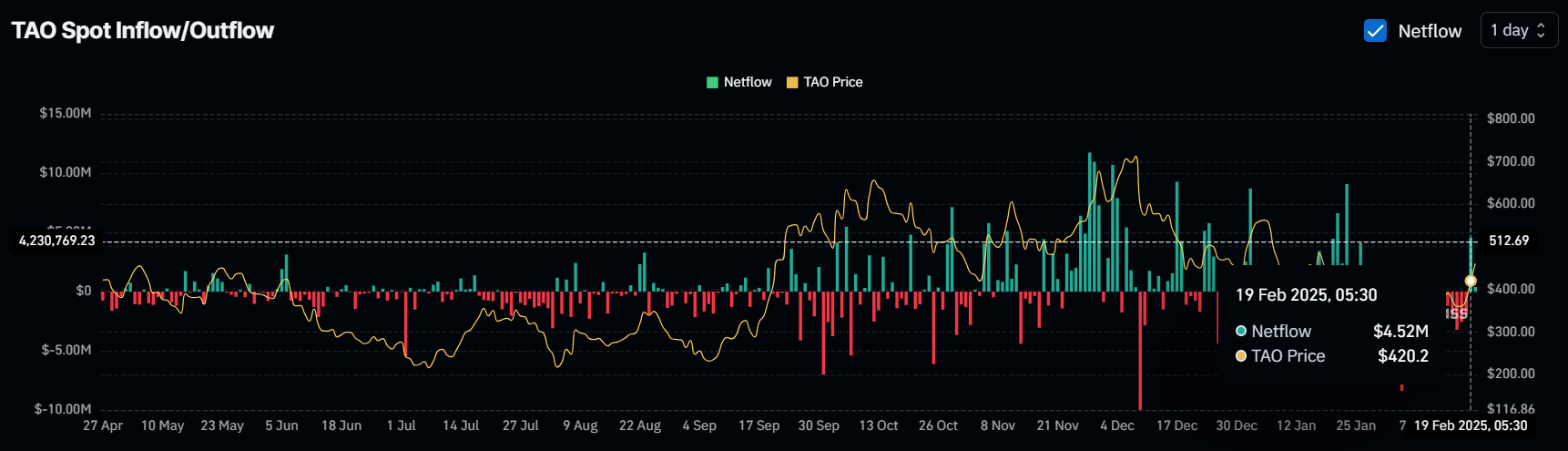

4.52 million dollars. USA Dusties of Tao on Exchanges

Despite these bull movements, long -term owners unload assets, as shown in the analytical company on the Coinglass network. Data from the point influx/outflow show that the exchanges have become witnesses of the influx in TAO-TOCEns in the amount of $ 4.52 million. The United States during a recent impulse, which indicates a potential sale.

Such an influx in the exchange can create a sales pressure and lead to a drop in prices. Nevertheless, in this case, the mood and structure of the market differ, which can be a problem for an asset in the coming days.

Growing open interest

Taking into account that the open percentage of TAO (OI) has increased by 27% over the past 24 hours, which indicates a strong share of traders and confidence in the assets.

During the press, the level of revaluation is $ 435.9 on the lower side, where the bulls occupied long positions in the amount of 7.71 million dollars. USA, and on the upper 473 US dollars, where the bears occupied short positions in the amount of $ 5.05 million. USA. This level of liquidation clearly determines that the bull is one who currently dominates the asset.