This is a segment from a forwarding information ballot. To read full publications, SubscribeField

The FOMC meetings were published this week, providing a lot of food for monetary plumbing botanists to collect together that the Fed thinks about the reserves of banks and its current quantitative tightening campaign (QT).

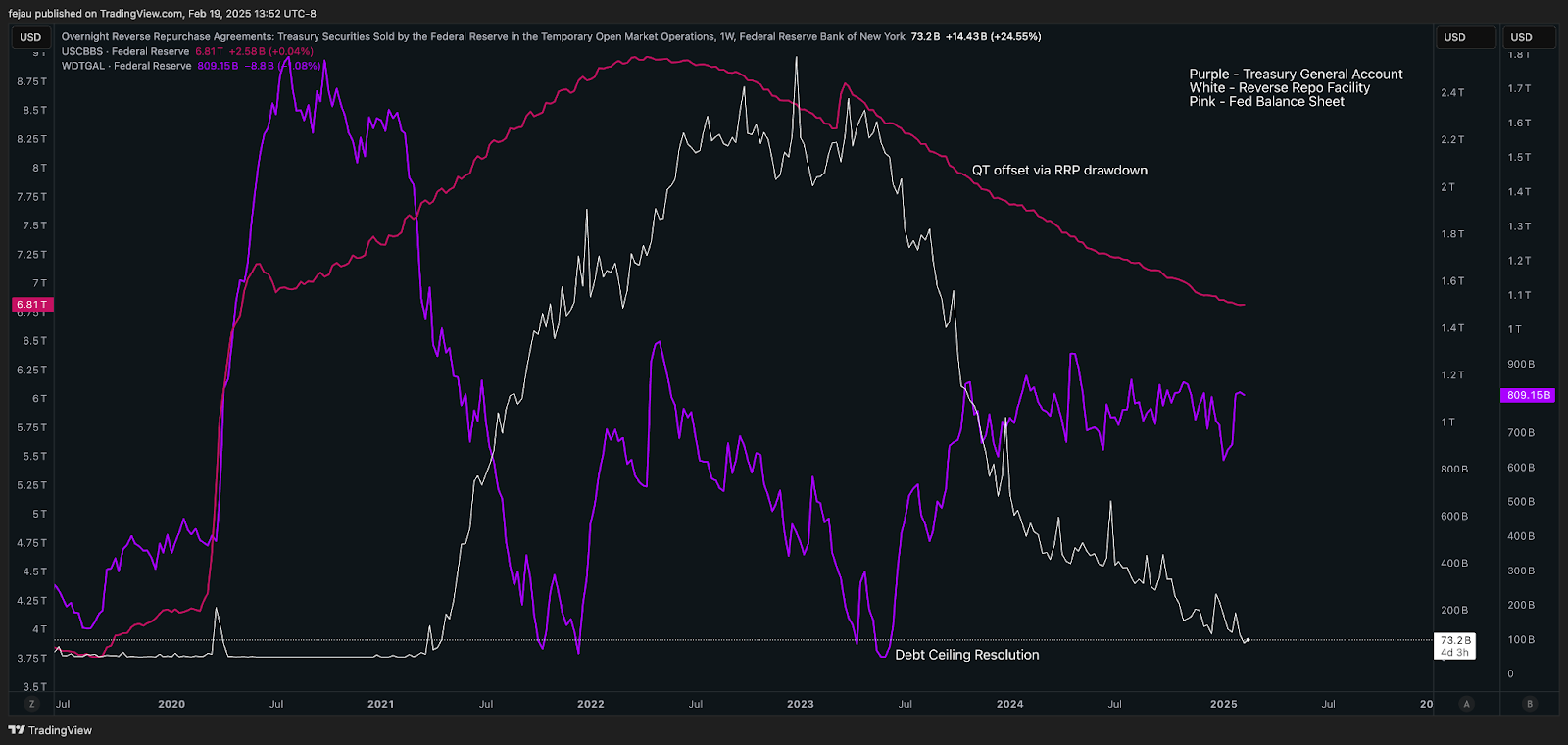

As can be seen on the table below, the QT campaign was fraught with nuance and unique compensation. As the QT occurred, the vast majority of them were compensated with the return of the reverse repo (RRP), as can be seen from the white line below.

In addition, this was due to the defeat of the 2023 debt ceiling and the SVB banking crisis, which led to the creation of a banking financing program.

Everything that is said, we are approaching the ultimate goal of QT from the point of view of the level of the bank, at which the Fed is aimed. There are many ways to measure this, but a simple reduction is that the Fed is aimed at an ideal reserve level of $ 3 trillion, which includes both bank reserves and RRP. Currently, it is a bit at the level of 3.27 trillion dollars.

Given this context, there was a lot of talk about when the Fed can completely end Qt. And with the release of the FOMC meeting protocols this week, we received our first hint:

Now there is something to unpack here, since it contains many nuances. Let’s run through them:

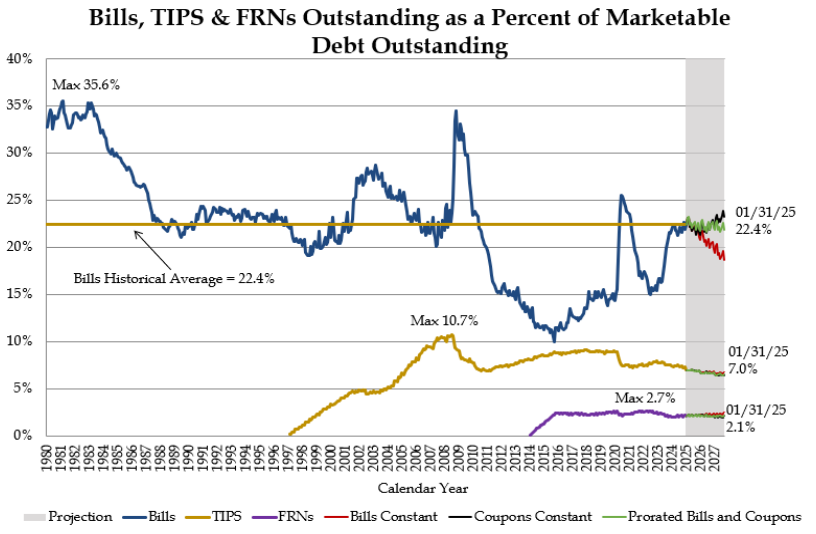

- The Fed rethifies the duration of the bonds that she holds. Ideally, he wants to return to the level of duration, which was until 2008 and Pre-QE. This is what they meant, saying that “it is appropriate to structure the purchase in such a way as to move the composition of the maturity of the portfolio somer closer to the unpaid action of the treasury debt …”

At the moment, this SOMA portfolio consists of 5% in T-Bills. However, the release of the Treasury is 22.4%.

- The Fed is concerned about the consequences of the ceiling of the debt and the followed by the general treasury account (TGA), as well as the next restoration of TGA after the resolution of the ceiling of the debt. Simply put, so that TGA is restored to the level that it was to the ceiling of the debt, the treasury must release a ton of T-on the Bill. In 2023, he was able to do this easily, because the RRP was filled to the edges and acted as a damption for him. Now, sitting at 73 million dollars, there is no buffer. Thus, the next statement was included in the protocol: “As for the potential of significant differences in reserves in the coming months associated with the dynamics of the ceiling of the debt, various participants noted that it may be advisable to consider the issue of a pause or slowing down the balance of balance before the resolution of this event …”

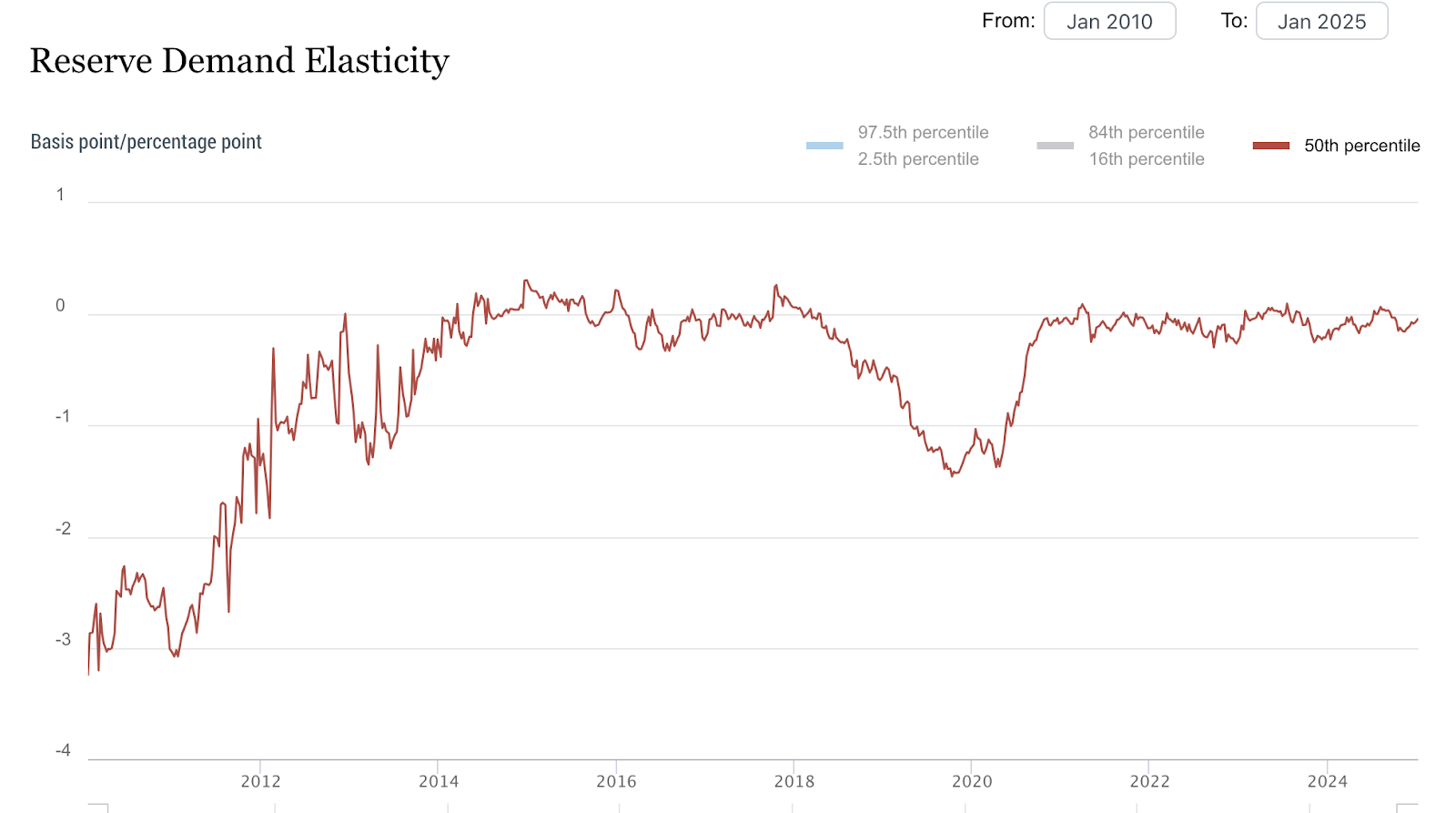

- Despite the fact that the Fed is not an emergency problem, the Fed becomes closer and closer to the reserve levels, where, as a rule, “liquid hiccles”, as a rule, occur. The last time this happened in September 2019, when the reserves were too scarce and caused a large replaces, stopping QT on their traces. Nevertheless, considering the current reserve elasticity panel below (one of the best indicators for measuring the risk of exposure of repo), if we are next to the fact that the zero level does not exist short -term problems. Nevertheless, the Fed is aware that the time is ticking, and it does not want a repetition of September 2019 – therefore, it is mentioned that “several participants also expressed support for future considerations of the desktop about possible ways to increase the efficiency of SRF …” SRF, or standing a repo, is a new constant tool that federal federal focus is focused on ensuring that all the right tools are fulfilled to continue to continue gradual balance.

In relation to the relatively short volume of text, we, of course, were able to consider a lot how the Fed thinks about its balance and reserves of banks in the coming months.