-

Cardano (ADA) would seem optimistic and soon can take off 32% to 1.04 dollars.

-

Traiders built long positions for $ 20 million at 0.732 dollars, which indicates that the price is unlikely to fall below this support.

Despite the ongoing restoration of the market, ADA, the native token of the Cardano blockchain, it seems, is struggling to gain impulse. However, over the past 24 hours, the asset has grown by almost 4.5% and about $ 0.78 is currently being traded.

Technical analysis of ADA and upcoming level

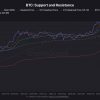

With this light growth impulse, the price of the ADA remains close to the decisive support level of $ 0.74 and 200 exponential sliding average (EMA) in the daily time. Meanwhile, the diagram apparently reflects the daily and four-hour XRP diagrams. In addition, the ADA seems to form a bull pattern with a cup and a neckline at a level of $ 0.85, as well as an ascending triangle.

Based on the recent price impulse and historical models, ADA looks bull. If the asset is held above the level of 0.73 US dollars, there is a strong probability that it can take off by 32%to reach $ 1.04 in the future. However, given the current market sentiments, the level of $ 0.85, in the same way, will rather be reached in the near future.

Bull metrics per chain

With this bull pricing and an ongoing change in market moods, traders and investors, apparently, accumulate and make bets on the bull side, as reported in an analytical company on the Coinglass network.

2.55 million dollars for ADA outflow

Data from a point inflow/outflow show that exchanges continue to indicate the outflow of ADA tokens by millions. Nevertheless, over the past 24 hours, ADA arises in the amount of 2.55 million dollars.

$ 20 million for long positions

In addition to the bull prospects of long-term holders, intra-day traders also, apparently, follow a similar strategy. The data show that the bulls currently dominate the assets and can significantly support the ADA in the coming days. According to Coinglass, $ 0.732 is a key level when traders who make bets on the long side are overestimated, occupying long positions in the amount of $ 20.37 million. USA.

This strong bull rate suggests that these traders believe that the price of the asset will not fall below this level, strengthening it as a strong support zone.