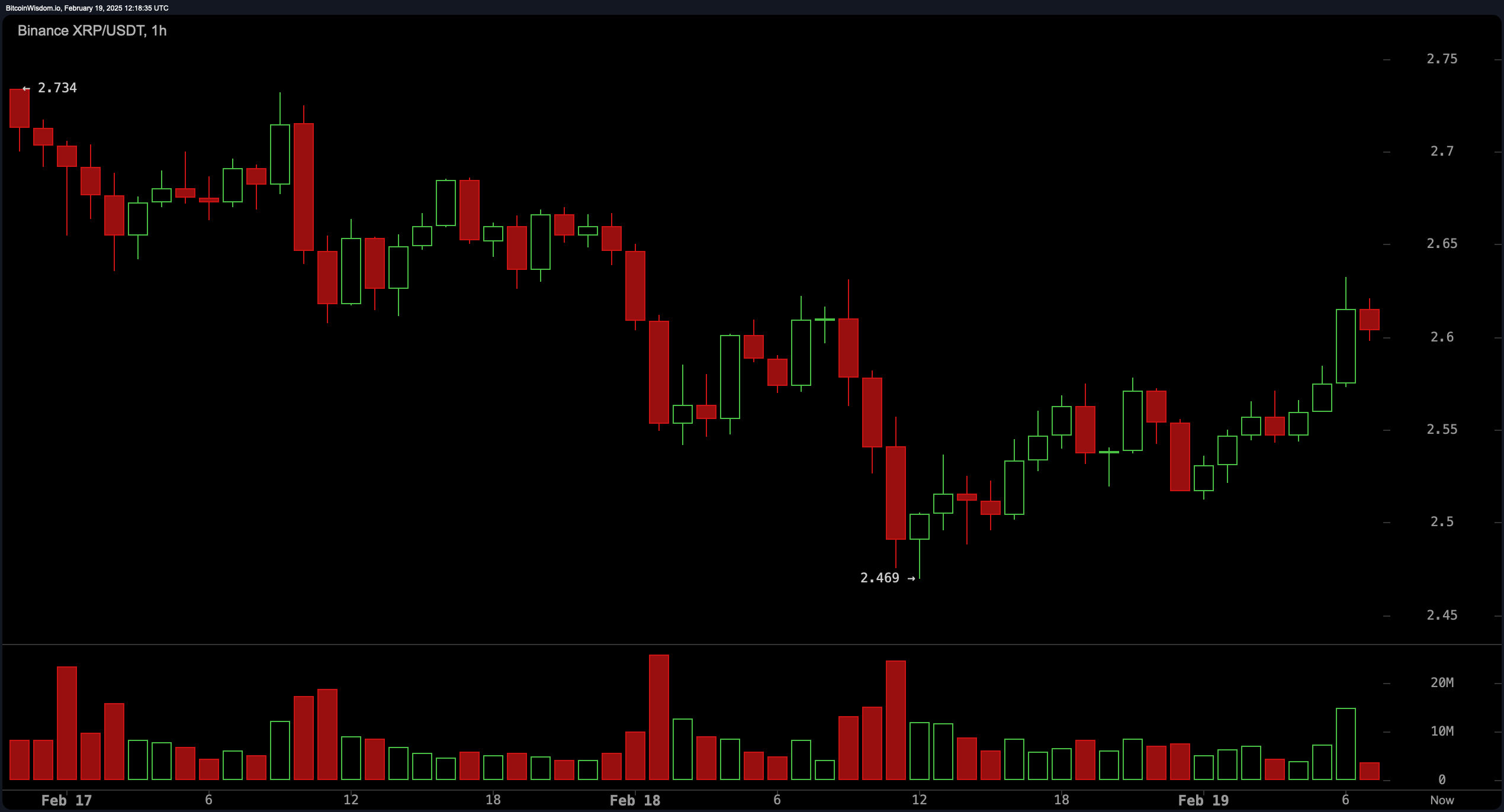

XRP traded from $ 2.58 to $ 2.61 for the last hour and within the narrow 24-hour range from $ 2.48 to $ 2.64. A digital asset boasts with a market capitalization of $ 150 billion, and a 24-hour trade volume of $ 4.44 billion, which emphasizes significant activity in a narrow corridor.

XRP

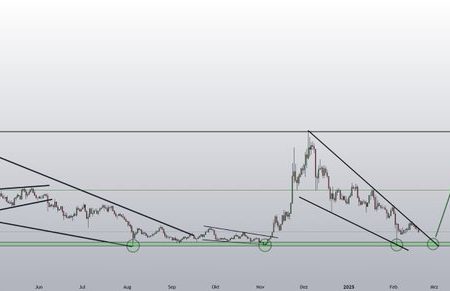

In the 1-hour XRP diagram, a rebound from a low level of $ 2.47 is displayed, and the price repeatedly protests the resistance zone 2.60–2.63 US dollars. An increase in the volume of purchase implies potential growth, although the inability to violate $ 2.65 can cause a restoration of up to $ 2.50–2.55. Scalpers can consider long -term positions of more than $ 2.60, aimed at $ 2.70, while bears can benefit from refusing $ 2.65 for a short -term fall. A direct impulse depends on holding $ 2.60 as local support.

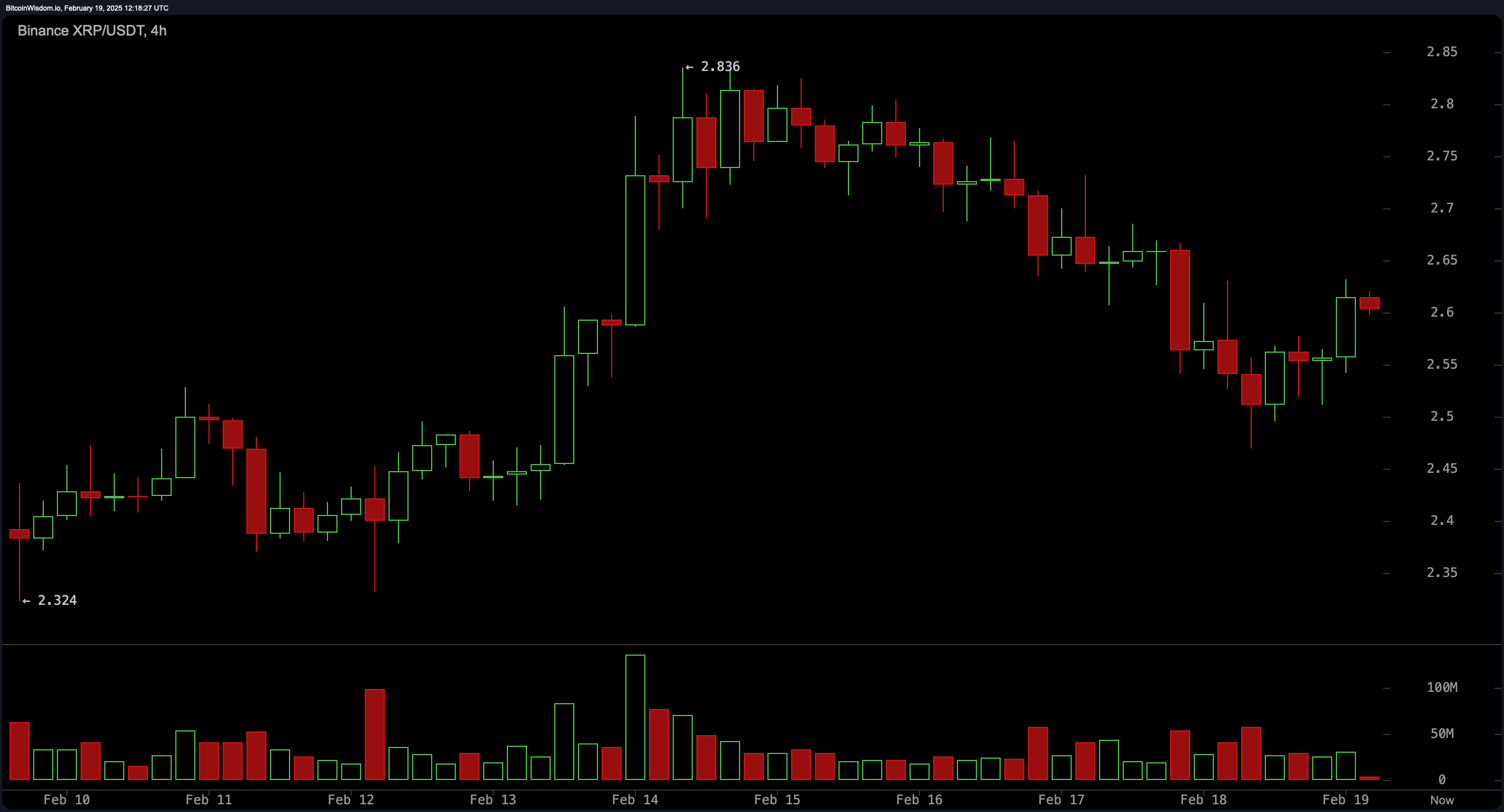

The 4-hour time is emphasized by a rally from $ 2.83, followed by consolidation from $ 2.50 and resistance $ 2.65–2.70. A high sales volume of XRP during recent falls contrasts with restoration candles indicating the percentage of the buyer. Merchants look at a breakthrough above $ 2.60 for an impetus to $ 2.75–2.80, while the refusal in this zone may resume the pressure down by $ 2.50. Close above $ 2.70 can signal the update of the bull impulse.

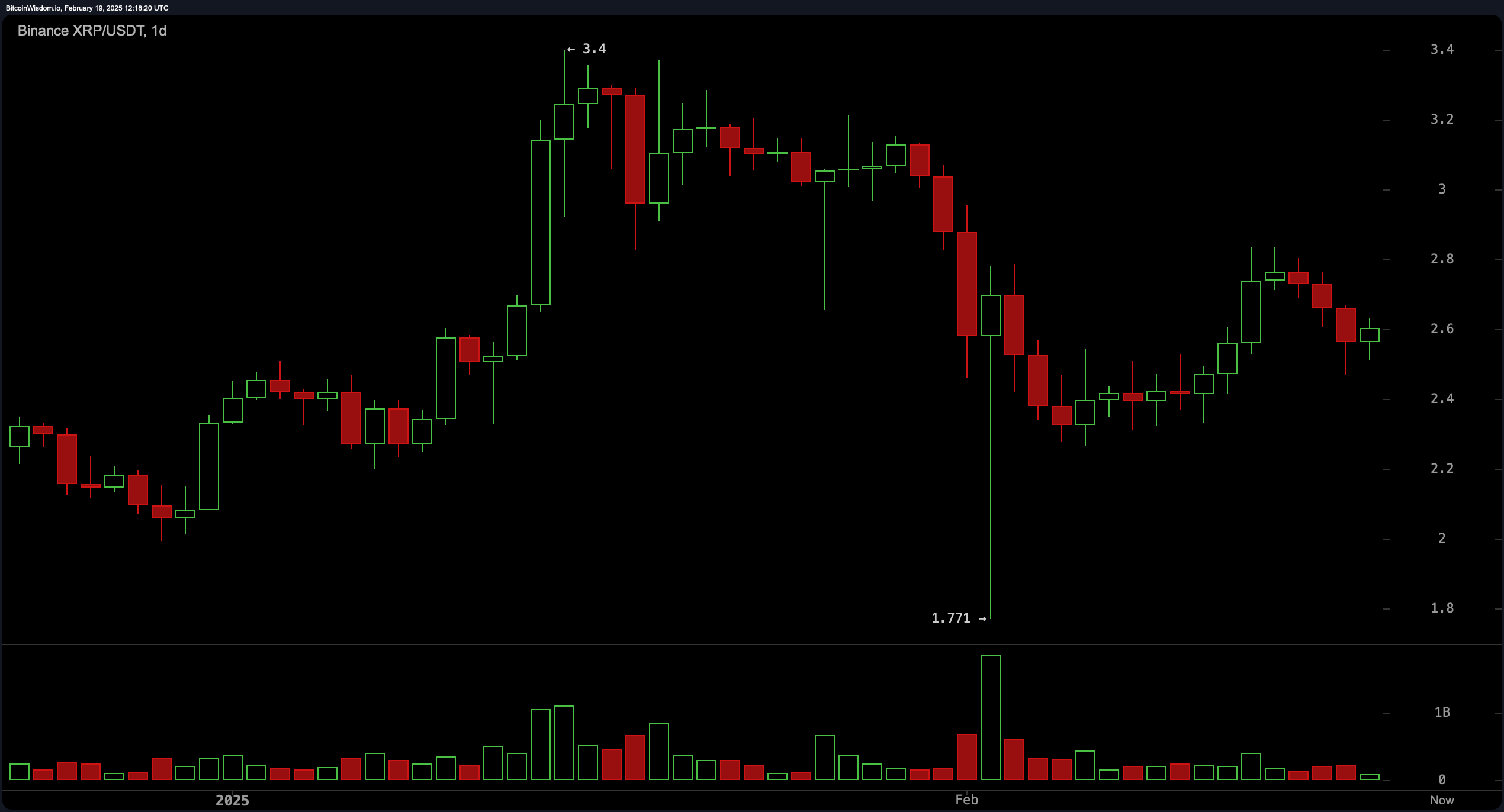

The XRP daily diagram shows unstable fluctuations, reaching a peak at $ 3.4 before falling to $ 1.77 and stabilizing about $ 2.50–2.60. The zone of $ 2.4–2.5 remains critical support, with a resistance of $ 2.8, $ 3.0 and $ 3.4. Sustainable deduction above $ 2.50 with strong bulls can check long records aimed at $ 2.80–3.00, while the refusal of $ 2.8–3.0 can reimburse bear bets. Volumetric bursts suggest accumulation, but macro is a control remains contested.

XRP oscillators on the daily caution diagram: the relative force index (RSI) at 47.65 and stochastic at 59.57 remains neutral. The commodity channels (CCI) at 2.64 and the average direction (ADX) at 30.68 also shows indecision. Nevertheless, an amazing generator (-0,12) offers a sales signal, while an impulse of 0.20 and a divergence of convergence of a sliding medium (MACD) at -0.03 Lean Pullish, creating conflicting short -term signals.

The actual graphic sliding averaging (MAS) draw a divided picture: the average exponential movements (EMA 10, 20, 30) at 2.61, 2.63 and 2.64 are sold, while simple brackets (SMA 10, 20, 50) at 2.59, 2.57 and 2.71 indicate purchases. Long -term EMA (50, 100, 200) and SMA (100, 200) from 1.43 to 2.71 generally contribute to accumulation. Traiders should reconcile conflicting signals, and shorter EMA calls for caution and SMA, supporting bull reversals if key levels are held.

Bull’s verdict:

Technical indicators suggest accumulation with long -term average values in favor of bull impulse. If the XRP retains above the key support levels, traders can see a rally in the direction of higher resistance zones.

Bear Verdict:

Conflicting signals from short-term indicators, including selling signals due to exponential sliding medium and amazing generator, a potential risk of reduction if the key resistance levels remain continuous.